Over the past three years, Nvidia (NVDA +6.84%) and Palantir Technologies (PLTR +3.85%) have become two of the most recognizable names in artificial intelligence (AI).

Nvidia powers the infrastructure layer of the AI revolution, while Palantir dominates the software side of data integration and analytics. Yet as investors look toward the future, another company may quietly surpass them both: Taiwan Semiconductor Manufacturing (TSM +4.40%). As the world's largest chip foundry, TSMC is the true backbone of AI computing -- fabricating nearly every advanced processor that drives today's most demanding workloads.

While Palantir and Nvidia built remarkable businesses, the next five years could mark a turning point where TSMC's strategic position and scale advantage propel it toward becoming the most valuable technology company in the world.

NYSE: TSM

Key Data Points

Why Palantir's valuation could normalize over the next five years

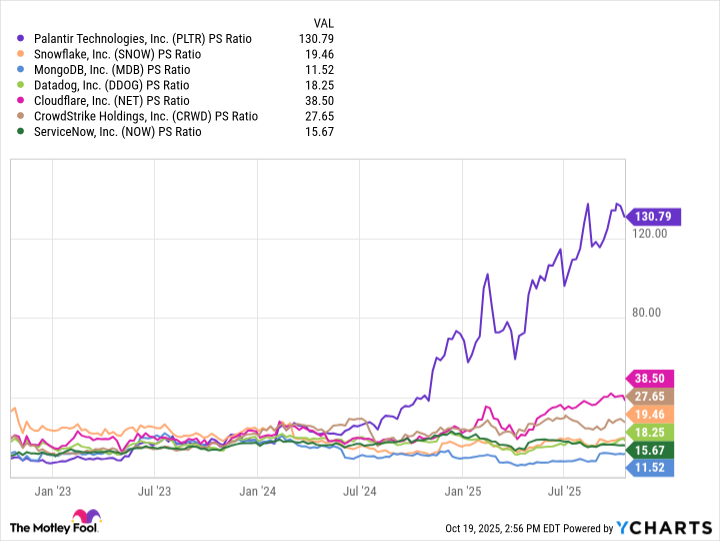

Palantir captivated investors with its vision of AI-powered decision intelligence. Its platforms -- Foundry, Gotham, and Apollo -- enable organizations to analyze vast data sets and automate complex workflows. Yet the AI software landscape is becoming increasingly crowded. Enterprise giants like Salesforce, ServiceNow, Snowflake, and Databricks are embedding generative AI directly into their ecosystems, offering comparable capabilities with broader integrations.

At the same time, the rise of open-source large language models (LLMs) is lowering barriers to entry. Companies no longer need to depend exclusively on proprietary stacks to build and deploy AI applications. Moreover, the economics of software differ markedly from hardware: While software can scale more efficiently, intensifying competition often compresses pricing and contract values over time.

As a result, the AI software market may continue to grow steadily -- but likely not at the blistering pace of semiconductors, where physical capacity and manufacturing expertise remain scarce.

Palantir's current valuation already bakes in lofty expectations, leaving limited margin for error. As AI capabilities become more commoditized and rivals gain traction, a valuation normalization toward traditional software multiples wouldn't be surprising.

PLTR PS Ratio data by YCharts

Palantir may still grow revenue and profits, but its market capitalization could stagnate -- or even decline -- relative to the broader AI ecosystem.

Image source: Taiwan Semiconductor Manufacturing.

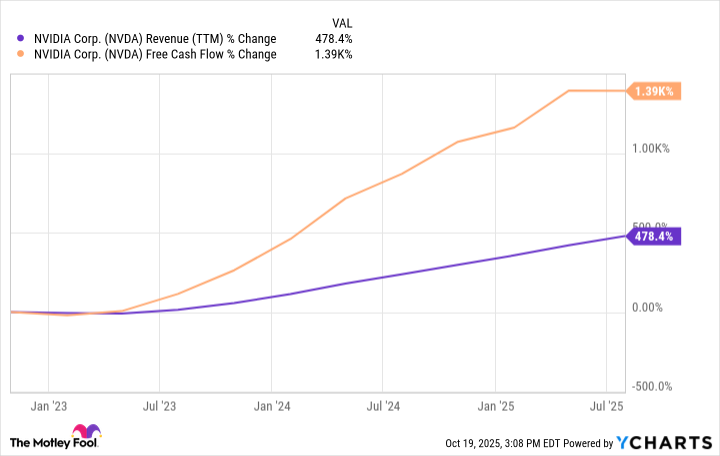

Nvidia's growth engine is still roaring, but deceleration could be inevitable

Nvidia's dominance in AI chips is unquestioned. Its GPUs remain the industry's gold standard for both training and inference, while its proprietary CUDA software ecosystem provides a formidable competitive moat. These advantages have propelled Nvidia to become the world's most valuable company, surpassing Apple and Microsoft in recent years.

Nvidia's data center revenue and free cash flow have expanded at an unprecedented pace -- but growth of this magnitude is difficult to sustain.

NVDA Revenue (TTM) data by YCharts

As the AI infrastructure cycle matures, spending is likely to shift from large-scale buildouts toward efficiency and optimization -- favoring incremental upgrades over massive new deployments.

Competition is also heating up. Advanced Micro Devices is securing high-profile wins for its upcoming MI400 series accelerators, while hyperscalers such as Amazon, Alphabet, Microsoft, and Meta Platforms are developing custom silicon tailored for their own workloads. Over time, these alternatives should gradually reduce industry dependence on Nvidia's GPUs, introducing more balance -- and perhaps more volatility -- into the AI hardware landscape.

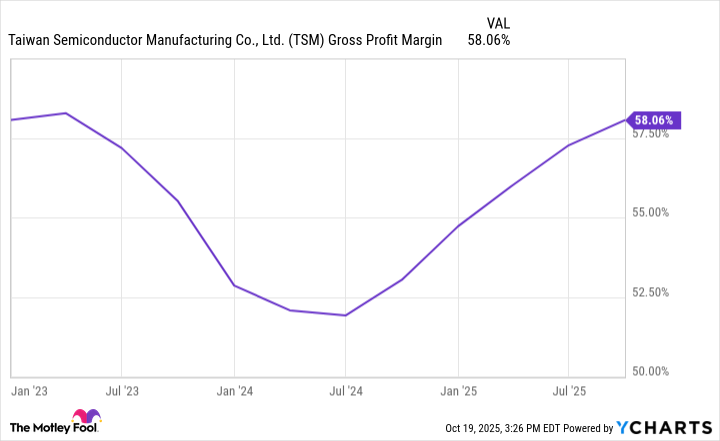

Why Taiwan Semiconductor could become the world's most valuable AI stock

While Nvidia designs the chips that power AI, TSMC builds them -- and that distinction is critical. TSMC controls nearly 90% of the world's advanced processor market, manufacturing the most sophisticated nodes available today. Major AI players -- Nvidia, AMD, Apple, and Tesla -- rely on its unparalleled precision and manufacturing expertise.

What makes TSMC especially compelling is its enduring position at the center of global AI supply chains. The company is expanding its footprint with new fabrication plants in the U.S., Japan, and Germany -- reducing reliance on Taiwan while aligning more closely with Western industrial policy. This geographic diversification not only mitigates geopolitical risk, but also strengthens TSMC's strategic importance to the global economy.

Even as Intel works to reestablish itself as a foundry contender, matching TSMC's scale, efficiency, and customer trust will take years. Large customers are unlikely to migrate quickly, as switching fabrication partners introduces massive design, cost, and performance risks.

TSM Gross Profit Margin data by YCharts

As AI demand accelerates, the most constrained resource in the industry is fabrication capacity -- precisely where TSMC sits. With a gross margin above 50%, unmatched technology leadership, and a robust customer pipeline, TSMC is positioned to see its earnings and valuation multiply as global AI adoption continues to compound.

Can TSMC realistically surpass Nvidia and Palantir combined?

Let's be clear: The ideas explored in this article are theoretical -- but far from implausible. Nvidia currently commands a market capitalization of about $4.5 trillion, while Palantir's stands near $420 billion. For TSMC -- which is valued around $1.5 trillion -- to be on par with their combined worth, it would need to compound at roughly 27% annually for the next five years -- ambitious, but not inconceivable.

The caveat, of course, is that the math above assumes both Palantir and Nvidia maintain their current valuations. In reality, that's unlikely. As noted earlier, there's a strong case that Palantir's valuation could contract by 2030. Nvidia, on the other hand, has multiple catalysts -- from next-generation GPU launches to expanding data center demand -- that could continue to propel its market value higher.

This is where nuance enters the picture. Nvidia depends heavily on TSMC for chip manufacturing, and that relationship cuts both ways. If Nvidia's explosive growth does begin to normalize, Taiwan Semiconductor remains positioned to benefit from the broader secular theme of semiconductor growth from other designers -- meaning it's conceivable that TSMC could see its own valuation rerate upward at a faster pace relative to Nvidia.

Predicting that TSMC will be worth more than Nvidia and Palantir combined by the end of the decade is undeniably bold -- some may even say that it's unrealistic. To me, the scenario isn't entirely a fantasy.

The subtlety is that a lot must go right: Global AI infrastructure buildouts must stay on track, supply chains must remain resilient, and China-Taiwan tensions must avoid escalation.

If those conditions hold -- and AI continues to redefine computing at a foundational level -- TSMC's near-monopoly on the world's most advanced chips could give it unmatched strategic leverage over the entire AI ecosystem. Under that scenario, a valuation rivaling -- or even exceeding -- today's market leaders may be entirely within reach.