The 500 companies represented in the S&P 500 (^GSPC +0.03%) index are spread across 11 economic sectors, but information technology is the largest by far with a weighting of 35.1%. That's because the sector is home to the world's three largest companies: Nvidia (NVDA +1.60%), Microsoft (MSFT +3.45%), and Apple (AAPL 0.07%), which have a combined market capitalization of $12 trillion.

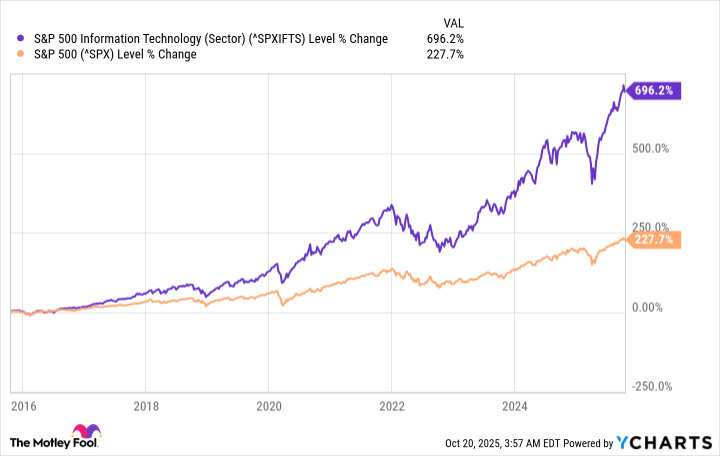

Those three stocks have contributed to a near-700% gain in the S&P 500 information technology sector over the past decade, more than tripling the gain of the S&P 500 overall.

In fact, investors who invested in the entire S&P 500 over the past 10 years, but excluded the information technology sector, would have earned a return of just 81%. Suffice it to say, it has been essential to own a slice of companies like Nvidia, Microsoft, and Apple in order to keep pace with the broader market.

Here's the good news: Buying a slice of the entire information technology sector has never been simpler thanks to the Vanguard Information Technology ETF (VGT +0.10%). It's an exchange-traded fund (ETF) that invests in 314 stocks under the information technology umbrella, including many outside the S&P 500, and 43.6% of the entire value of its portfolio is parked in Nvidia, Microsoft, and Apple. Read on.

Image source: Getty Images.

The ultimate technology ETF

The Vanguard Information Technology ETF invests across 12 sub-segments of the information technology sector. The semiconductor segment is the largest with a weighting of 31.3%, which isn't a surprise considering Nvidia's valuation has ballooned from $360 billion to $4.4 trillion since the start of 2023.

The semiconductor segment is also home to Broadcom, Advanced Micro Devices, and Micron Technology, which are some of the other top suppliers of the data center chips and components fueling the artificial intelligence (AI) boom.

AI is a prevalent theme across the entire tech space right now. Each of the top 10 holdings in the Vanguard ETF is contributing to the AI industry in some capacity, whether it be through data center infrastructure, software, or cloud services:

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

17.16% |

|

2. Apple |

13.35% |

|

3. Microsoft |

13.09% |

|

4. Broadcom |

4.47% |

|

5. Oracle |

2.34% |

|

6. Palantir Technologies |

2.02% |

|

7. Cisco Systems |

1.39% |

|

8. Advanced Micro Devices |

1.33% |

|

9. International Business Machines |

1.33% |

|

10. Salesforce |

1.14% |

Data source: Vanguard. Portfolio weightings are accurate as of Sept. 30, 2025, and are subject to change.

Apple launched Apple Intelligence in partnership with OpenAI last year, which is a suite of AI-powered apps and features for its iPhones, iPads, and Mac computers. Apple Intelligence can summarize text messages and emails, create images on command, and prioritize notifications based on the preferences of each user. Apple has over 2.35 billion active devices worldwide, so it could become the most dominant consumer AI company in the world.

Microsoft and Oracle are two of the biggest buyers of data center chips and components which they use to develop their own AI software, but they also make money by renting the computing capacity to businesses. In fact, both companies are experiencing more demand for data center capacity than they can possibly supply, as businesses across all industries race to adopt AI.

Palantir is one of the best-performing stocks in the AI space, with a 300% gain over the past year alone. It developed two platforms called Gotham and Foundry, which use AI to help organizations extract value from their data. It also offers a third platform called AIP (Artificial Intelligence Platform), which allows organizations to connect their internal data to large language models (LLMs) so they can create AI applications.

Outside of its top 10 holdings, the Vanguard ETF holds many other powerhouse AI stocks. They include Adobe, Snowflake, Datadog, and cybersecurity giants Palo Alto Networks and CrowdStrike.

NYSEMKT: VGT

Key Data Points

The Vanguard ETF has a great track record against the S&P 500

The Vanguard Information Technology ETF has delivered a compound annual return of 14.2% since it was established in 2004, comfortably outperforming the S&P 500, which climbed by 10.4% per year over the same period. However, given the ETF's high degree of exposure to volatile themes like AI, investors should avoid putting all of their eggs in one basket.

Instead, this Vanguard ETF is ideal for investors who might be overly exposed to more defensive areas of the market, like the financials, consumer staples, and real estate sectors which are known for paying high dividends, but tend to generate slower growth.

As I highlighted earlier, excluding the information technology sector from any portfolio tends to result in sluggish returns. Since AI is likely to remain a significant value creator in the coming years, investors who have minimal or no exposure to stocks like Nvidia, Apple, and Microsoft might want to buy the Vanguard Information Technology ETF right now.