When it comes to stock market performance, tech stocks have been leading the way for quite some time. This isn't a new phenomenon, but the recent artificial intelligence (AI) boom has sent many tech companies' valuations skyrocketing. As it stands, nine of the 11 public stocks with a market cap of at least $1 trillion are tech companies.

If you have $1,000 available to invest -- after having an emergency fund saved and high-interest debt paid down -- the following tech stocks are good investments to consider. They have businesses built to last and aren't solely reliant on AI hype for their success, unlike many other tech stocks that seem to meet that description.

Image source: Getty Images.

1. Microsoft

There's a strong case to be made that Microsoft (MSFT +2.23%) is the most well-rounded tech company in the world. It has its hands in industries spanning from enterprise and consumer software, hardware, cloud computing, gaming, and even social media.

NASDAQ: MSFT

Key Data Points

Microsoft doesn't have a single product or service that carries the business like Apple with the iPhone, Alphabet with Google Search, or Nvidia with GPUs. However, this has worked out in its favor when it comes to consistency, because the company isn't as affected by cycles tied to a particular product or trend.

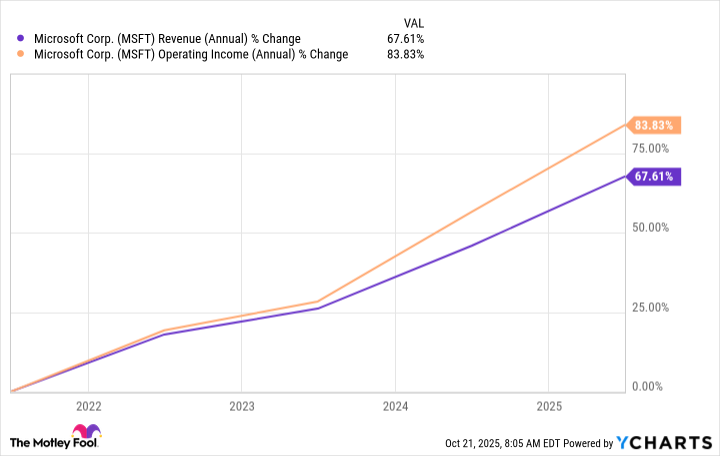

In its fiscal year 2025 (ended June 30), Microsoft's revenue increased 15% year over year to $281.7 billion (up 67% in five years). More impressive was the growth of its cloud platform, Azure, which increased revenue 34% year over year to $75 billion.

MSFT Revenue (Annual) data by YCharts

Unsurprisingly, much of Azure's growth can be attributed to AI demand. As companies increasingly integrate AI into their businesses, many rely on Azure's infrastructure and services to build, train, and deploy their own AI models. Azure powers operations at major companies such as Walmart, Coca-Cola, and Adobe.

One of the keys to Microsoft's longevity is the number of corporate customers it has. Thousands of companies rely on Microsoft's products and services for their daily operations, whether it's Azure, Microsoft 365, LinkedIn, or others. These corporate customers keep Microsoft's business fairly predictable because they're more likely to stay on during tough economic times than consumers.

That's why Microsoft is routinely one of the best tech stocks you can invest in. It's trading at a premium, but this shouldn't deter long-term investors.

2. Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Company (TSM +1.69%) (TSMC) is the backbone of the tech world, as the No. 1 semiconductor (chip) manufacturer globally. It manufactures chips for many of the tech products we use daily, like smartphones, tablets, computers, smart TVs, and even cars. You don't see these chips, but they're the brains that power many of these devices.

NYSE: TSM

Key Data Points

TSMC's manufacturing ability is by far the most advanced of all semiconductor companies. It has industry-leading precision and efficiency, routinely producing the highest yields (percentage of chips that function properly after manufacturing). That's why it's the go-to for many of the world's top tech companies. They design their respective chips, but TSMC brings them to life.

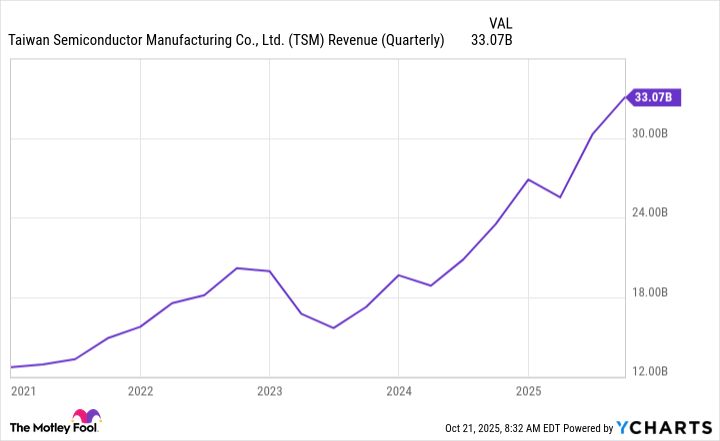

For a while, smartphones were TSMC's biggest segment, but AI developments have made advanced AI chips a large part of their current business. Its high-power computing (HPC) segment, which includes AI chips, accounted for 57% of its $33.1 billion in revenue in its fiscal third quarter (ended Sept. 30).

TSM Revenue (Quarterly) data by YCharts

As companies continue to invest in AI infrastructure (especially data centers), TSMC should continue to see demand for its advanced chips and play a pivotal role in the AI pipeline. Still, its diversified business ensures it's not completely reliant on this demand for success.

The barriers to entry and the huge capital requirements needed for semiconductor manufacturing provide TSMC with a sustainable competitive moat that should ensure its dominance for years to come.