Upstart Holdings (UPST 2.64%) developed an artificial intelligence (AI) algorithm to perform credit assessments on potential borrowers. It can analyze more data and deliver faster approvals than traditional assessment methods, so a growing number of banks are using it to originate their consumer loans.

However, Upstart stock has plummeted by 27% during the past 30 days, as some U.S. regional banks have flagged potential credit losses from bad loans and even fraud over the last few weeks, which is dragging the entire consumer credit sector down. There is no suggestion Upstart contributed to any of the purported issues -- in fact, loans originated using its algorithm typically outperform those originated through traditional assessment methods.

As a result, this might be a buying opportunity for investors. Upstart is scheduled to release its results for the third quarter of 2025 on Nov. 4. Here's why the report could be a bullish catalyst.

Image source: Getty Images.

AI-powered lending could be a trillion-dollar opportunity

Banks have relied on Fair Isaac's FICO credit scoring system for more than three decades, but it only takes a handful of factors into account, like a person's existing debt and their repayment history. Therefore, Upstart believes it's outdated. It has designed its AI algorithm to analyze over 2,500 data points instead, to get a more accurate sense of a potential borrower's ability to repay their loan.

Upstart says 92% of its approvals are fully automated and instant, whereas it would take a human assessor days or even weeks to analyze a similar amount of data. This creates a convenient customer experience, which is why banks and credit unions are eager to adopt the technology.

Most of Upstart's originations are unsecured personal loans, but it has a growing presence in the automotive and home equity line of credit (HELOC) segments. During the second quarter of 2025, the company originated 372,599 loans across all categories, which was up by an eye-popping 159% from the year-ago period. They had a dollar value of $2.8 billion, which was a three-year high.

Granted, the past few years have been difficult for Upstart, as elevated interest rates drove down demand for consumer loans. The Federal Reserve cut rates three times in the closing months of 2024, which contributed to Upstart's strong second-quarter result. However, the company also cited an improvement in its AI algorithm, which converted more applicants into borrowers.

This momentum could have serious legs in the long run. At Upstart's "AI Day 2025" event earlier this year, Chief Executive Officer Dave Girouard said he expects all human loan assessment methods will be replaced by AI during the next 10 years. That leaves $25 trillion in annual loan originations up for grabs worldwide, and a whopping $1 trillion per year in fee revenue.

NASDAQ: UPST

Key Data Points

Upstart is on track for record revenue this year

As a result of its surging originations, Upstart's second-quarter revenue jumped by 102% year over year to $257 million. It was the fourth-consecutive quarter in which revenue growth accelerated.

The strong result prompted management to raise the company's full-year revenue forecast to $1.055 billion for 2025, which would be the first time it crosses the billion-dollar milestone. If Upstart's third-quarter result comes in above management's estimate of $280 million on Nov. 4, investors should look for a further upward revision to the full-year forecast.

Upstart's bottom line is also benefiting from the surge in revenue. The company reported $5.6 million in net income on a generally accepted accounting principles (GAAP) basis during the second quarter, and it's now on track for its first profitable year since 2021.

Upstart stock trades at an attractive valuation

As I mentioned, there hasn't been any indication that Upstart's algorithm is driving the recent issues with bad loans at regional banks. In fact, Upstart won a regional bank client as recently as Oct. 15, which is now using its algorithm to originate personal loans, car loans, and HELOCs.

Plus, Upstart's algorithm was battle-tested during the difficult 2022 and 2023 period, and it performed well. The company wouldn't be growing so quickly right now if that weren't the case.

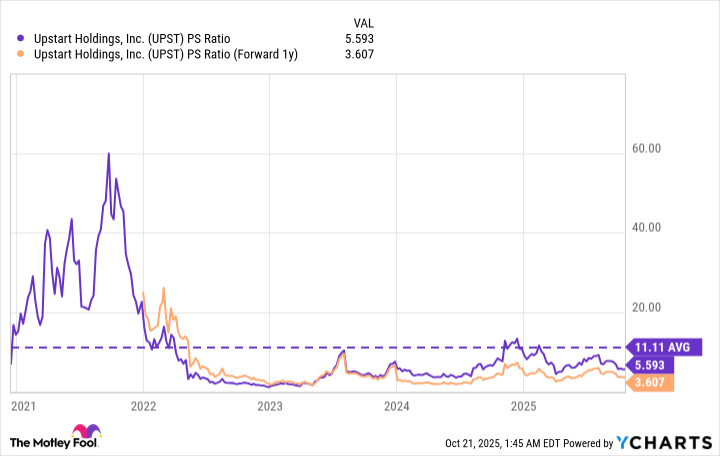

With all of that in mind, Upstart stock could be a great buy on the dip ahead of its Nov. 4 earnings report. It's trading at a price-to-sales (P/S) ratio of just 5.6 as I write this, which is a 50% discount to its average of 11.1 dating back to its initial public offering (IPO) in 2020.

It looks even more attractive on a forward basis, if we measure its P/S ratio using Wall Street's 2026 revenue forecast of $1.34 billion:

UPST PS Ratio data by YCharts

In other words, Upstart stock would have to rise by 55% by the end of next year just to maintain its current P/S ratio of 5.6, and it would have to rocket by 208% in order for its P/S ratio to match its long-term average of 11.1.

As a result, the risk-reward picture looks very compelling right now, so Upstart stock could be a solid buy, especially for investors willing to hold on to it for at least the next 12 months (and beyond).