The danger of investing in meme stocks is their valuations can fluctuate wildly from one day to the next. And they can move significantly even if there aren't any big news events. This is where it can be incredibly difficult to predict the path of these types of stocks.

Opendoor Technologies (OPEN +5.87%) is a prime example of a meme stock that has taken off this year. Even though its financials don't look great and the home-flipping business that it's in is far from ideal, the stock has surged 365% as of Oct. 17 this year.

There has, however, been a bit of a slowdown in the stock of late. It hit a high of $10.87 in September, but it's nowhere near those levels today; in the past month, it has declined by around 20%. Could this be a sign that Opendoor's stock has peaked, and that more of a decline could be coming? Or is this a good time to invest in the company, while its price is lower?

Image source: Getty Images.

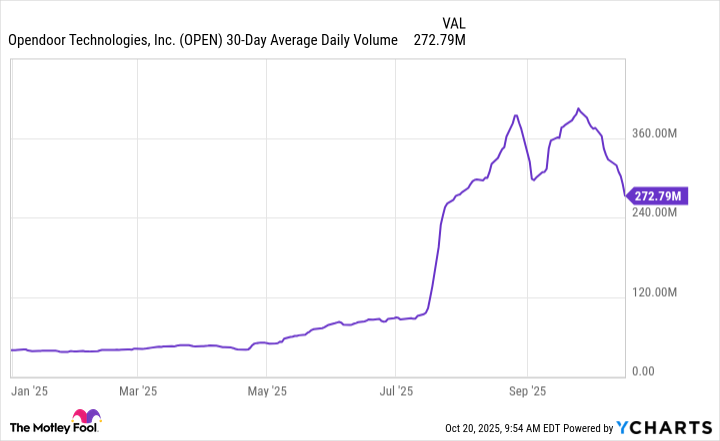

Trading volumes are also trending lower

It's not just Opendoor's stock price has been sluggish of late, so too have trading volumes. This can indeed be a sign that interest in the stock from retail investors may be diminishing. For meme stocks that are dependent on hype, this can be a concerning development.

OPEN 30-Day Average Daily Volume data by YCharts

Opendoor's volumes remain high when compared to the start of the year, but if this downward trend continues and there's less interest in the stock, that could lead to a further decline in its value.

This comes at a time when investors appear to be growing concerned with inflated valuations in the stock market. Opendoor, whose market cap is $5.5 billion, may not seem terribly expensive, but it is not a cheap buy given its poor financials.

Opendoor is an unprofitable business with a challenging road ahead

In each of the past four quarters, Opendoor has posted a net loss. The company, however, hopes that under its new CEO, Kaz Nejatian, who came over from e-commerce giant Shopify, it can leverage artificial intelligence (AI) to enhance the company's operations, leading to greater efficiencies. AI tools can potentially speed up and simplify the buying and selling process for Opendoor.

However, Nejatian took over just last month and it can take a while to see if there's any payoff from AI efforts for the business down the road. While AI can likely trim some costs and improve margins, whether it'll be enough for the business to get into the black is the big question. Opendoor's gross profit margin is usually in just the single digits, and that can make it incredibly difficult for even the leanest of businesses to stay out of the red.

NASDAQ: OPEN

Key Data Points

The stock still doesn't look cheap

You might be tempted to believe that Opendoor is a good buy because of its falling share price, but it's still up big this year. And with a high valuation, there isn't any buffer in the event that its business continues to face challenges. Economic conditions aren't all that strong these days, and simply focusing on AI may not be enough to turn the business around.

Buying and selling houses makes for a capital-intensive business, and Opendoor hasn't shown that it can be successful in that realm. And until that changes, the safest option would be to avoid this stock, as this is the type of investment that can put your portfolio on a roller-coaster ride. There are many other growth stocks that can be safer and better buys to hang on to, for both the short and long term.