Robinhood Markets (HOOD +0.67%) runs a popular commission-free investing platform where its clients buy and sell stocks, options, cryptocurrencies, and more. It made a name for itself at the height of the pandemic in 2020 and 2021, when troves of young investors used it to trade speculative meme stocks like GameStop, which sent the platform's revenue soaring.

But Robinhood stock has exploded higher by 240% in 2025 for a different reason. In August, the company signed a deal with Kalshi to bring NFL and college football prediction markets to its platform, which could unlock an entirely new revenue stream from new and existing clients.

This could be a big opportunity in the long run, but early reports suggest prediction markets are still a very small part of the company's overall business.

If that's true, Robinhood stock could suffer a sharp correction after Nov. 5, which is the date the company is scheduled to release its operating results for the third quarter of 2025.

Image source: Getty Images.

Robinhood's prediction business is still very small

Gamblers can use traditional sports betting platforms to wager on binary outcomes, like the winner of a football game, whereas prediction markets like Kalshi allow customers to trade in and out of contracts (like shares) that represent the likelihood of a specific event, such as political, economic, and cultural outcomes. That means they can cash out at any time with a small profit or a small loss, before the game is over.

According to Grand View Research, the U.S. sports betting industry is worth about $20 billion annually, and it could grow to $33 billion by 2030, so there is a sizable opportunity up for grabs. Robinhood's clients have a median age of 35, and since many of them are drawn to risky cryptocurrencies and financial derivatives like options contracts, the company thinks they will jump at the chance to wager on football and other sports.

NASDAQ: HOOD

Key Data Points

However, according to Wall Street firm Piper Sandler, Robinhood's prediction markets generate revenue at an annualized rate of around $200 million right now. Chief Executive Officer Vlad Tenev cited this estimate in an interview with Bloomberg a few weeks ago, so we can consider it fairly accurate.

But since the company is on track to report $4.2 billion in total revenue this year, prediction markets are a small fraction of its overall business, which makes the blistering rally in its stock this year a little hard to justify.

Robinhood's core revenue shrank during the last two quarters

Total quarterly revenue hit a record high of $1 billion in the final three months of 2024. Transaction revenue, which is the money the company generates from processing stock, options, futures, and cryptocurrency trades on behalf of clients, accounted for $672 million of that total.

Zooming in even further, cryptocurrency trading revenue was $358 million of that total transaction revenue. However, it has since plunged by 55%, coming in at just $160 million in the second quarter of 2025. This caused Robinhood's overall transaction revenue to shrink for two consecutive quarters:

Image source: Robinhood Markets.

The crypto market ended 2024 with a powerful rally following Donald Trump's presidential election win, but its momentum is fading this year. Dogecoin, for instance, is down 59% from its 52-week high, while Shiba Inu is down 70%. Ripple's XRP token has plunged 34% from its recent peak, and even industry leader Bitcoin recently shed 13% of its value.

These losses have pushed many investors to the sidelines, and it isn't the first time. In the second quarter of 2021, Robinhood's crypto revenue surged by 4,560% and accounted for half of its total transaction revenue, before plunging by 75% just one year later in the second quarter of 2022.

That looks awfully similar to the scenario playing out right now, and it suggests there could be more pain to come for Robinhood's crypto business. This is a key trend to monitor when the company reports third-quarter results.

Beware of the sky-high valuation ahead of Nov. 5

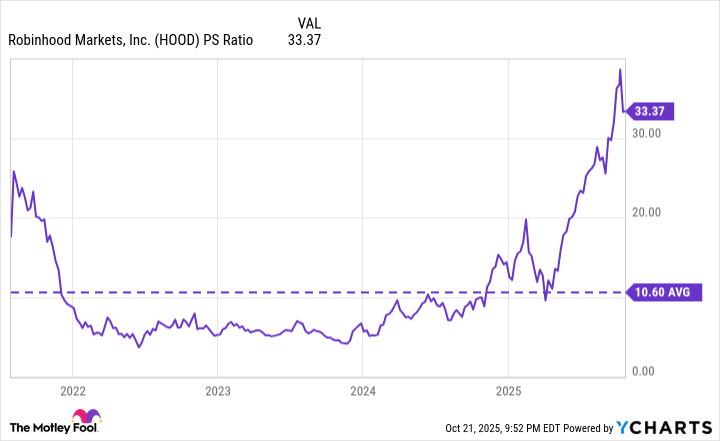

In my opinion, the 240% surge in Robinhood stock this year doesn't really make sense, with its main source of revenue shrinking on a sequential basis at the very same time. In fact, these diverging trends have pushed its price-to-sales ratio (P/S) to 33, which is more than triple its average of 10.6 dating back to the company's initial public offering in 2021.

HOOD PS Ratio data by YCharts.

Unless Robinhood finds significantly more revenue in a very short period of time, its stock would have to plummet by 68% from here just to bring its P/S in line with its long-term average. The prediction markets segment doesn't appear to be the silver bullet investors are looking for, given what we know about its revenue so far.

Plus, Kalshi was recently valued at just $5 billion during a private funding round. Since Robinhood's market capitalization is about $113 billion, it's hard to imagine this partnership making a serious impact on the company's financial results in the near term.

In summary, when you combine Robinhood's sky-high valuation with its declining transaction revenue, investors face the risk of a sharp correction in its stock. I think the third-quarter report on Nov. 5 could be the trigger, especially if prediction markets revenue underwhelms, and its crypto revenue declines even further.