For much of the last three years, just about anything that touches the very idea of artificial intelligence (AI) has witnessed some form of price appreciation -- be it fleeting price jolts or sustained valuation increases. Some beneficiaries of the AI boom so far include semiconductor stocks, cloud computing companies, nuclear energy, and even the cryptocurrency sector.

Now, as the AI theme accelerates, investors are becoming captivated by a new frontier: Quantum computing.

What's interesting, though, is that many of the hottest quantum AI stocks have been found beyond the usual tech titans of Nvidia, Microsoft, Amazon, Alphabet, or Palantir Technologies.

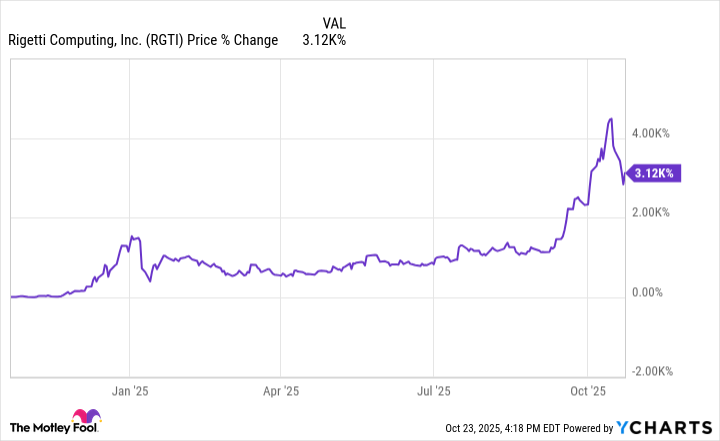

Shares of one player, Rigetti Computing (RGTI 6.05%), have gained roughly 3,000% over the last year as of this writing (Oct. 23).

With such impressive returns, Rigetti's management must be more bullish than ever, right? Well, not so fast.

Below, I've provided an overview of Rigetti Computing's origins, as well as a breakdown of what its CEO has been doing with his stock. Spoiler alert: He's cashing out. The question is, should you follow his lead before it's too late?

Corporate overview: A brief history of Rigetti Computing

Rigetti Computing was founded in 2013 by a physicist and former IBM employee, Chad Rigetti. For almost a decade, Rigetti remained a private company, raising money from venture capital (VC) funds, most notably Andreessen Horowitz.

In late 2021, Rigetti disclosed its intention to go public via a special purpose acquisition company (SPAC). Throughout 2020 and 2021, SPAC offerings experienced an uptick compared to prior periods -- primarily due to their endorsement by the so-called "SPAC King," Chamath Palihapitiya. The company eventually made its debut on the Nasdaq in March 2022.

Image source: Getty Images.

Who is Subodh Kulkarni, and how much stock did he just cash out?

Subodh Kulkarni spent the early days of his career in research roles at IBM and 3M. Throughout his career, he went on to serve in a number of leadership positions at various hardware and software operations, including a company called CyberOptics, which was acquired by Nordstrom in November 2022. Just a month later, Kulkarni took the reins at Rigetti following the resignation of its prior founder-CEO.

Like many highly compensated employees, Kulkarni's payment structure is comprised of both a salary and awards in the form of options.

Rigetti's share price at the start of the year hovered around $6. By May, the stock had climbed within the range of $12 to $15.

Here is where things get interesting. According to a Form 4 filing with the Securities and Exchange Commission (SEC) on May 21, Kulkarni exercised 1 million stock options at a strike price of $0.96 per share, and then immediately sold those shares at an average price of about $12 -- netting a cool $11 million in just one trading day.

Now, sometimes when corporate executives sell stock, it's part of a pre-planned trading program known as a Rule 10b5-1(c). These guardrails are designed to prevent insiders from liquidating their equity -- and profiting -- from material, non-public information. That would be known as insider trading.

This is not the case for Kulkarni. Per the Form 4, the Rule 10b5-1(c) box was not checked off. This implies that Kulkarni's sale was discretionary and not an automatic function of a previously agreed-upon structure.

Kulkarni isn't the only one taking profits, either. My fellow Fool, Sean Williams, astutely pointed out that insiders at Rigetti have collected more than $50 million in proceeds over the last five years.

Is Rigetti Computing stock a buy right now?

While Kulkarni will likely continue to earn additional stock incentives as long as he remains CEO, it's curious that someone in his position would dump their equity just as shares began to experience some momentum -- fueled by the broader optimism of the AI revolution.

NASDAQ: RGTI

Key Data Points

Since Kulkarni's sales, shares of Rigetti have gone even more parabolic. They're now trading for about $40. In terms of valuation, Rigetti is trading at a price-to-sales (P/S) multiple of 1,267. This reflects more than optimism; it's completely detached from reality and far surpasses what internet darlings witnessed during the dot-com bubble.

In my eyes, it's pretty clear what's going on here. Talking heads on financial news programs are collectively echoing the once-in-a-generation opportunity that is AI. By extension, meme traders on forums such as Reddit's r/wallstreetbets are creating hype-driven narratives suggesting that quantum computing stocks are the next big thing.

Behind the scenes, however, insiders and executives at these same quantum AI businesses are capitalizing on the volatility -- selling their shares to unsuspecting retail investors who will be left holding the bag.

If you were lucky enough to buy Rigetti stock earlier this year, the prudent move is to use the current surge as an opportunity to sell and lock in some gains. On the other hand, if you bought shares near the top, it might be best to cut your losses now. History has shown with prior bubbles that many companies become falling knives at the flick of a switch, never recapturing their prior peaks.