Just down the street from my home, a construction site has a sign out front, letting everyone know that my area will soon have its very first Dutch Bros (BROS +0.54%) location. And at the rate that this drive-thru coffee chain is growing, a lot of other people are seeing a Dutch Bros location for the first time as well.

Dutch Bros ended its second quarter of 2025 with just 831 locations. But it's opened an impressive 160 new locations in just the past year. This rapid nationwide expansion for this Oregon-based coffee stock is expected to continue for many years. It should lead to strong revenue growth. And this could be very important for investors.

Image source: Dutch Bros.

Dutch Bros' potential revenue growth is important for investors to note because revenue growth is one of the strongest drivers of a company's stock price over the long term. Yes, there is more to a winning stock investment. But it's hard to outperform the returns of the S&P 500 with below-average growth.

So just how good is Dutch Bros' growth? Allow me to show you one clear chart.

NYSE: BROS

Key Data Points

Dutch Bros' crystal clear growth chart

Before showing the chart, I want to explain why per-share metrics matter. Companies on the stock market issue shares to investors. Usually the share count is in the millions but for the sake of simplicity, imagine a company with just 10 shares. If you owned one share, you'd own 10% of the company -- one out of 10.

A company's share count isn't constant -- it can go up and down, changing how much of a company an investor owns. In the previous example, if the company issued 10 new shares, an investor with one share would only own 5% of the company -- one out of 20 -- instead of 10%. The amount of shares they owned didn't change, but the amount of company value they owned did change.

Hopefully this demonstrates why per-share metrics matter. Per-share metrics better show whether a company is creating (or destroying) individual shareholder value.

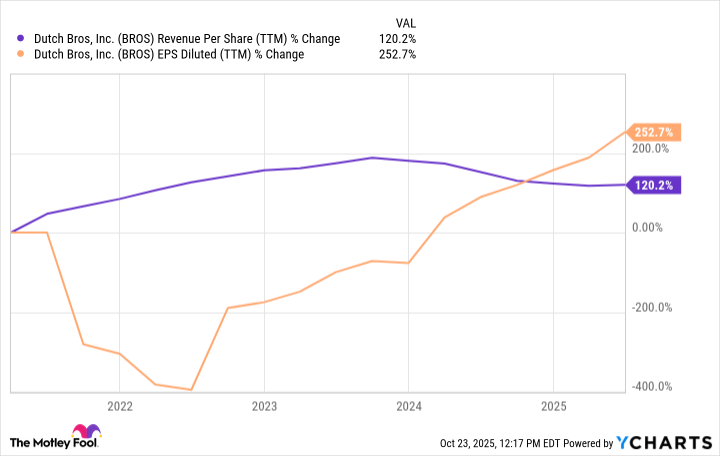

Now the chart: Dutch Bros is growing profitably at an impressive rate.

BROS Revenue Per Share (TTM) data by YCharts

When it went public, I complained about Dutch Bros' complicated structure -- its four classes of shares made it tricky to calculate the valuation of the company. But in 2024, many shares converted to Class A shares, which has significantly boosted the diluted share count used in many calculations.

That said, Dutch Bros has still more than doubled its revenue on a per-share basis over the last five years. Management has opened up hundreds of new locations, as mentioned, and same-store sales have increased as well.

Not only has Dutch Bros grown its revenue, but it's also grown its earnings on a per-share basis. And as the chart shows, its earnings per share are increasing at a much faster rate than its revenue, which is exactly what investors want to see.

In short, Dutch Bros is becoming a much more valuable company thanks to its profitable growth. And even when factoring in the changes to its share count, it's still creating value for its individual shareholders as well.

What does it mean for Dutch Bros stock from here?

I love that Dutch Bros' investment thesis is extremely simple. The company plans to open at least 4,000 locations long term -- almost 5 times as many as it had in Q2. If it can do this, and if these locations remain profitable, then the stock could outperform the S&P 500 for years to come.

A simple investment thesis doesn't mean that Dutch Bros can easily execute -- there are still plenty of risks. Other companies have failed to expand nationally, with locations outside of home markets producing lackluster financial results. Expansion also puts management to the test because operations become more complex and newer store managers may fail to uphold company culture.

However, Dutch Bros may have earned the benefit of the doubt. Its coffee shops average $2 million in annual sales, which is much higher than when the company went public. In short, it's opened hundreds of new locations in recent years and sales per location continue to rise nevertheless, suggesting there's an appetite for Dutch Bros outside of Oregon.

Moreover, the contribution margin for Dutch Bros' locations (a measure of individual store profitability) is sitting at 30%, which is strong and also higher than when it went public. In other words, management seems to be managing a more complex business just fine.

In conclusion, Dutch Bros is a great profitable growth story -- a story that could have many more chapters if things go right.