Artificial intelligence (AI) isn't going away. In fact, it's just going to get better -- improved chatbots and generative AI, banking and shopping experiences optimized by AI, and even autonomous vehicles and robotics. A report by UN Trade and Development projects that the global AI market will see a 25x increase in just a decade, jumping from $189 billion in 2023 to $4.8 trillion in 2033.

And for investors, there are lots of interesting ways to approach AI. You could look for frontier innovation, putting money into companies that are on the cutting edge of AI growth. You could seek companies that are using AI to create all-new revenue streams, or you could invest in those that are using AI to monetize their products and grow even larger. These three companies each represent one of those paths: Rigetti Computing (RGTI +0.76%), Palantir Technologies (PLTR 0.63%), and Meta Platforms (META 0.77%).

Let's look at each and how they can help investors make a fortune.

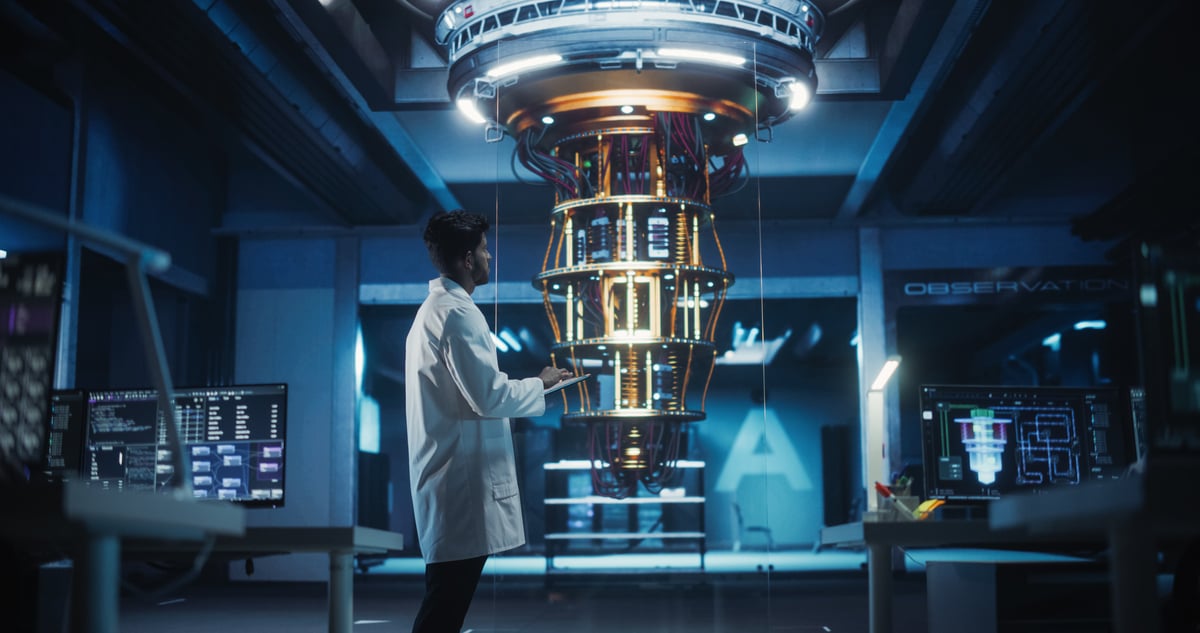

Image source: Getty Images.

Rigetti Computing

Rigetti Computing's stock has been on a huge run, with its price jumping 154% so far this year. Rigetti works in quantum computing, which is considered by many to be the next evolution of computing. Quantum is different from classical computing because it uses quantum bits, or qubits, that can exist in multiple states and perform complex calculations. Traditional computers tackle problems one step at a time, but quantum computers can do many things at once, so they can be much faster.

Rigetti uses AI to automate and improve the calibration of quantum computers, but the technology also has tremendous potential to operate the next generation of AI programs.

NASDAQ: RGTI

Key Data Points

Rigetti isn't profitable yet -- revenues in the second quarter were $1.8 million versus a net loss of $39.7 million. But the next quarter will likely be much better as Rigetti recently announced it sold two quantum computing systems for $5.7 million.

Quantum computing stocks are speculative right now, but there are opportunities for massive rewards, and Rigetti is one of the leading names in the space.

Palantir Technologies

Palantir is using AI to create something new -- the company's massively powerful AI systems mine thousands of sources to pull information to provide real-time actionable insights to companies, the military, government agencies, and intelligence agencies. It launched its Artificial Intelligence Platform (AIP) in 2022, and since then, the company has exploded in value, with the market cap rising to nearly $440 billion.

Palantir's AIP platform is a game-changer for both government and commercial clients. The company brought in $1 billion in quarterly revenue for the first time in its most recent earnings report. U.S. commercial revenue jumped 93% to $306 million, and U.S. government revenue was up 53% from a year ago to $426 million.

NASDAQ: PLTR

Key Data Points

Palantir also reported closing 42 deals worth at least $10 million each, as well as 66 deals worth at least $5 million and 157 deals valued at $1 million-plus.

While the company's valuation is likely not sustainable, Palantir's momentum continues, and the stock is up 151% in 2025.

Meta Platforms

The operator of top social media platforms Facebook, Instagram, Messenger, and WhatApp, Meta Platforms has been an incredibly successful company for a long time. Now it's using AI to make it better -- and to bring in even more revenue.

The company's Meta AI product is built on the company's own large language model platform, Llama, which is incredibly versatile. It can create AI photos and videos, help users create their own AI-powered characters, and allow content creators to use their AI characters to engage with their audiences. And it uses AI to personalize ads on its platforms and to allow advertisers to optimize their campaigns in real time.

NASDAQ: META

Key Data Points

The effort is paying off. Meta's second quarter showed revenue of $47.5 billion, up 22% from a year ago. Advertising impressions improved 11% from last year, and the average price per ad increased 9% from last year.

Meta stock is up 26% so far this year -- not as explosive as Rigetti or Palantir, but it's also a much more established company with less risk.