Since 2022, when the index declined by more than 19%, the S&P 500 has been on an impressive run. As of the start of 2023, the index is up close to 77%, including nearly 15% gains this year through Oct. 23.

An S&P 500 exchange-traded fund (ETF) has consistently been a rewarding long-term investment, but there's another ETF that one Wall Street analyst thinks is poised to double the popular index's gains over the next few years: the Vanguard Russell 2000 ETF (VTWO 1.05%).

Of course, nobody can predict how indexes or stocks will perform in the short term, but some Wall Street analysts think the Russell 2000 index could begin to outperform the S&P 500 by almost double in the next year (20% to 11%). Let's take a look at why.

Image source: Getty Images.

What is the Russell 2000 index?

The Russell 2000 index is made up of roughly the smallest 2,000 stocks in the Russell index (which contains around 3,000 companies in total). It's like the S&P 500, but it's made up solely of small-cap stocks (those with a market cap between $250 million and $2 billion).

VTWO is a low-cost way to invest in the Russell, with a 0.07% expense ratio. It contains companies from all 11 major sectors, but it's less top-heavy and more diversified than the S&P 500:

- Industrials: 18.9%

- Financials: 17.5%

- Healthcare: 16%

- Technology: 13%

- Consumer discretionary: 11.7%

- Real estate: 6%

- Energy: 5.2%

- Basic materials: 3.9%

- Utilities: 3.8%

- Telecommunications: 2.3%

- Consumer staples: 1.8%

Being a small-cap company doesn't mean being a lesser company; there are plenty of thriving small-cap companies that have found their niche and operate beautifully in it. Notable names in VTWO include quantum computing company IonQ, Kratos Defense, Bloom Energy, and Hims & Hers Health.

That said, small-cap stocks are generally riskier than large-cap stocks because they tend to have fewer revenue streams and resources, and are more susceptible to broader economic conditions.

The S&P 500's high valuation brings on more risk

VTWO has underperformed the S&P 500 by a considerable margin over the past decade (116% gains vs. 228%), but it's the S&P 500's recent AI-fueled run that makes it susceptible to a pullback or correction.

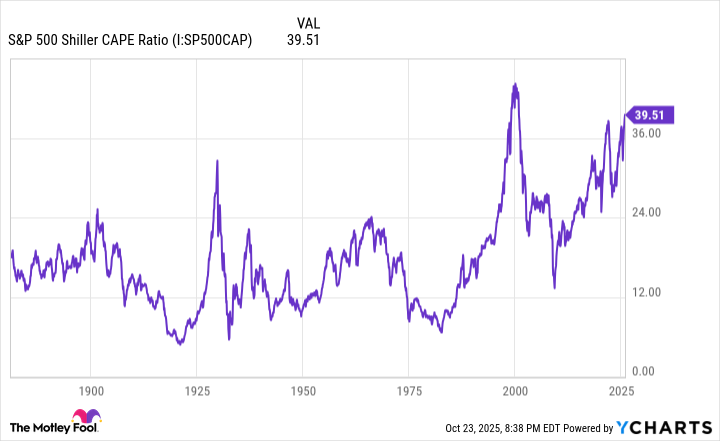

Looking at the Shiller price-to-earnings (P/E) ratio (sometimes known as the CAPE ratio) -- which measures the index's valuation based on inflation-adjusted earnings over the previous 10 years -- the S&P 500 is historically expensive. In fact, it's only ever been this expensive a couple of times since 1871, and each time before, the index experienced sharp declines.

S&P 500 Shiller CAPE Ratio data by YCharts

Now, just because it has happened in the past doesn't mean it'll happen this time, but it's worth keeping an eye on it and being well aware of what has historically happened.

Why VTWO could outperform the S&P 500 over the next year

Small-cap stocks currently have three things working in their favor: low valuations, interest rate cuts, and earnings growth. The Russell 2000's lower valuation relative to the S&P 500 theoretically gives it more upside because investors are paying less per dollar of a company's revenue and profits. The less you pay, the greater the potential upside as earnings grow.

NASDAQ: VTWO

Key Data Points

Interest rate cuts also tend to impact small-cap stocks more because smaller companies typically rely more on borrowing to fund their growth. Higher interest rates mean it's more expensive to borrow money, which cuts into profits or even deters borrowing altogether. The Federal Reserve made its first rate cut in a while in September, but expectations are that it will continue cutting rates into next year.

Again, nobody can predict how either the Russell 2000 or the S&P 500 will perform over the next year, including analysts who believe the Russell 2000 has a 20% upside compared to the S&P 500's 11%. However, these three factors do work out in the Russell 2000's favor in terms of positioning it to potentially outperform its larger peers.

In either case, you shouldn't invest solely in VTWO with the expectation that it will outperform the S&P 500. If anything, use it as a chance to diversify your portfolio a bit, giving yourself exposure to small-cap companies.