Though artificial intelligence (AI) has been the hottest game-changing innovation on Wall Street since the advent and proliferation of the internet in the mid-1990s, it's not the only next-big-thing trend fueling investor excitement at the moment. The evolution of quantum computing is playing a close second fiddle to AI.

Investors need only look at the trailing-12-month returns of quantum computing pure-play stocks to gauge the level of excitement for this innovation. Shares of IonQ (IONQ +4.89%), Rigetti Computing (RGTI +2.53%), D-Wave Quantum (QBTS +3.96%), and Quantum Computing Inc. (QUBT +4.34%) have respectively soared by 284%, 3,140%, 2,760%, and 1,310%.

Quantum computers have the potential to tackle complex problems that today's classical computers wouldn't be able to solve in our lifetime, or flat-out can't do. This includes running molecular simulations to help drug developers target treatments, assisting cybersecurity companies to make their platforms more secure, and speeding up the learning process of AI algorithms. It's a technology with high-ceiling potential.

President Trump at the United Nations headquarters in New York City. Image source: Official White House Photo by Daniel Torok.

It's also an innovation that may be piquing the interest of President Donald Trump's administration. Based on a report from The Wall Street Journal last week, the Trump administration is tinkering with idea of taking equity stakes in IonQ, Rigetti Computing, and D-Wave Quantum. While this might sound great on paper, it would very likely be terrible news for investors.

Government stakes in quantum computing stocks would be troublesome

Let me preface the following discussion by making clear that the WSJ report is a rumor, with a U.S. Commerce Department official telling CNBC last week that it's not in discussion with quantum computing pure-play stocks to take equity stakes. Nevertheless, IonQ, Rigetti, D-Wave, and Quantum Computing Inc. all rallied significantly following the report.

With all four of these companies actively looking to expand the reach of their quantum computing infrastructure and maintain a healthy level of research and development spending to improve the efficacy and speed of their computing solutions, investments from the federal government would certainly help. These are businesses that, by Wall Street's consensus expectations, will lose money and burn cash through 2028, if not considerably longer.

NYSE: IONQ

Key Data Points

We've also witnessed the willingness of the Trump administration to take equity stakes in public businesses to ensure everything from domestic chip fabrication to access to rare-earth metals. Thus far, federal government equity stakes have been taken in chipmaker Intel, along with MP Materials, Lithium Americas, and Trilogy Metals.

But even if the Trump administration did take equity stakes in one or more of Wall Street's quantum computing darlings, it would come at a price.

Firstly, there would be an expected issuance of shares to the federal government. Common stock offerings are dilutive to existing shareholders, which would possibly put near-term pressure on the share price of IonQ, Rigetti Computing, and/or D-Wave Quantum.

Perhaps the bigger issue is that government equity stakes in public companies may put the interests of the government ahead of what's best for these companies over the long run. Although the Trump administration's stakes are designed to be passive, elected officials in Washington, D.C., ultimately establish the laws that impact these businesses.

We've witnessed instances during President Trump's second term where he's used American businesses as bargaining chips when negotiating tariff and trade deals. Government stakes wouldn't be ideal for IonQ, Rigetti Computing, D-Wave Quantum, or their investors.

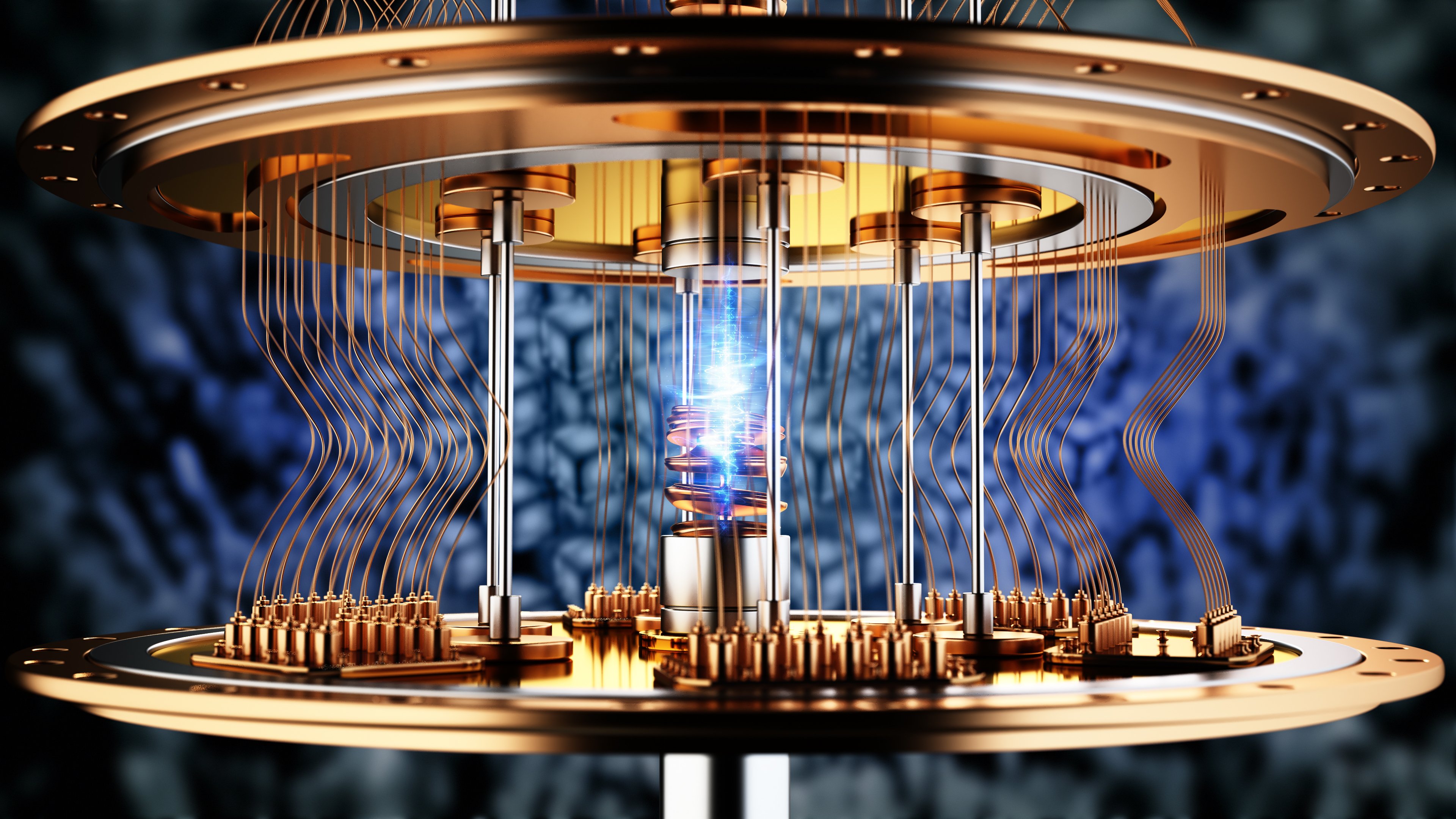

Image source: Getty Images.

But wait -- there's more

Unfortunately, rumors of the Trump administration wanting stakes in quantum computing pure-plays is just the tip of the iceberg of potential red flags and headwinds with these stocks.

Arguably the top headwind for companies like IonQ, Rigetti, D-Wave, and Quantum Computing Inc. is history. While history has paved the way for numerous next-big-thing technologies to positively alter the growth arc for corporate America, there's no mistaking that early stage bubbles have been a given for every game-changing technology since the mid-1990s.

Including the internet, we've watched numerous hyped innovations fail to live up to expectations in the early going, including nanotechnology, 3D printing, blockchain technology, and the metaverse, to name a few. Investors have a habit of overestimating how quickly a hyped technology will be used on a mainstream basis, which eventually results in lofty growth projections not being met.

Quantum computing remains a nascent technology that has plenty of potential on paper, but isn't being commercialized on a broad scale, as of yet. It's probably going to need multiple years to evolve and mature.

NASDAQ: RGTI

Key Data Points

The other headwind that investors simply won't be able to sweep under the rug has to do with the valuation of quantum computing pure-play stocks.

The dot-com era led to the most expensive stock market in history, spanning more than 150 years, according to the Shiller price-to-earnings ratio. In the months leading up to the internet bubble bursting, market-leading stocks like Cisco Systems and Microsoft were consistently peaking at trailing-12-month (TTM) price-to-sales (P/S) ratios of 30 to 40.

As of the closing bell on Oct. 24, the respective TTM P/S ratios for Wall Street's four hottest quantum computing stocks are:

- IonQ: 263

- Rigetti Computing: 1,243

- D-Wave Quantum: 375

- Quantum Computing Inc.: 7,322

Not even a high-double-digit or triple-digit annual sales growth rate can sustain or justify P/S ratios tipping the scales between 263 and 7,322!

Though it's possible these quantum computing stocks will be long-term success stories, historical precedent points to eventual significant drawdowns for all four companies in the quarters and years to come.