What if I told you that there's a straightforward way to get $680,000? Most people would probably be all ears and open to hearing me out. Now, what if I told you that hitting that mark would cost "only" $500 per month? Most people with the means would likely consider and embrace the strategy.

There are no guarantees in the stock market, and nobody can predict how stocks will move. But there's an exchange-traded fund (ETF) that has historically delivered results that could help you hit the $680,000 mark. It's the Schwab U.S. Dividend Equity ETF (SCHD 1.07%). To top it off, having $680,000 could pay out around $21,000 annually in dividends.

Image source: Getty Images.

Why invest in the Schwab U.S. Dividend Equity ETF?

SCHD is one of the most reliable dividend ETFs in the stock market. It has been around since October 2011 and has maintained a selection of high-quality dividend-paying companies.

It tracks the Dow Jones U.S. Dividend 100 Index, which has criteria for companies to be included, such as a minimum of 10 consecutive years of dividend payouts, strong financials and cash flow, and market cap minimums to help with stability.

NYSEMKT: SCHD

Key Data Points

The vetting process required to be included in SCHD helps keep investors away from financially unstable companies and yield traps that only look good on the surface.

How $500 monthly can turn into $680,000

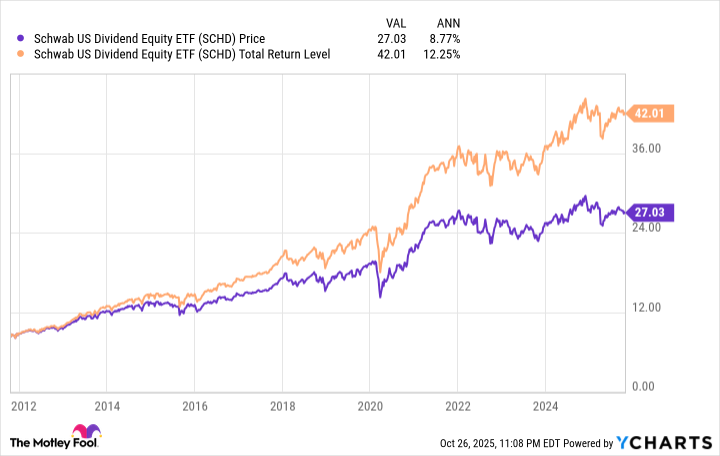

In the past 10 years, SCHD averaged around 11% total returns. Since its October 2011 inception, its annual average has been a bit higher, at just above 12%. When you're investing in a dividend ETF, it's important to focus on total returns because dividends contribute a lot to the value you receive from an ETF or stock.

You should never use past results to predict future performance, but for the sake of illustrating how powerful the compounding effect can be, let's imagine you invest $500 monthly into SCHD. Here's how much it could grow to at different annual averages and years invested:

| Years Invested | 10% Annual Returns | 11% Annual Returns | 12% Annual Returns |

|---|---|---|---|

| 10 | $95,300 | $100,000 | $104,900 |

| 15 | $189,700 | $205,400 | $222,600 |

| 20 | $341,300 | $382,500 | $429,300 |

| 25 | $584,700 | $680,200 | $792,600 |

| 30 | $975,800 | $1.18 million | $1.43 million |

Table by author. Values include SCHD's 0.06% expense ratio and are rounded down to the nearest hundred.

Let's assume you averaged 11% returns over 25 years. In this case, your investment would grow to just over $680,000, while you only personally contribute $150,000 in those years. That's a testament to the power of compound earnings and how time adds to the phenomenon.

It pays to have dividend-paying stocks in your portfolio

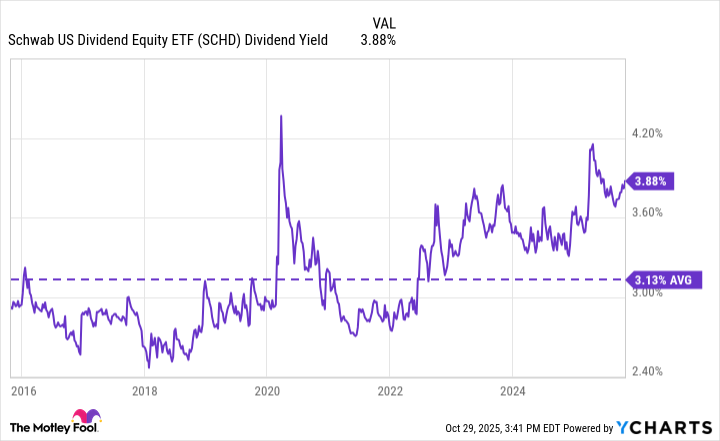

At the time of this writing, SCHD's dividend yield is around 3.8%. That's close to three times more than the S&P 500 average and higher than its 3.1% average over the past decade. A stock or ETF's dividend yield will inevitably fluctuate with its stock price, but we're going to assume SCHD will maintain a 3.1% average dividend yield over the long term.

SCHD Dividend Yield data by YCharts.

With a 3.1% dividend yield, having $680,000 invested in SCHD would mean annual payouts of $21,080. That's a substantial amount of passive income that could work wonders for someone, especially in retirement.

Sure, the exact amount of the dividend payouts will fluctuate with the dividend yield, but the bigger picture is how focusing on building a nest egg in a dividend ETF like SCHD can become a reliable (and lucrative) source of income. That's money coming in without having to lift a finger.