The Nasdaq stock exchange is typically the destination of choice for technology companies looking to go public. It offers lower listing fees than the New York Stock Exchange, in addition to a smoother listing process with fewer barriers, so it's ideal for rapidly growing, early-stage companies.

The Nasdaq-100 is an index of 100 of the largest non-financial companies listed on the Nasdaq, and given the nature of the exchange, it features a very high concentration of technology names. Many of them operate at the forefront of high-growth industries like artificial intelligence (AI), cloud computing, digital advertising, and more, driving the Nasdaq-100 to much higher annual returns than the more diversified S&P 500 (^GSPC 0.84%).

The Invesco QQQ Trust (QQQ 1.54%) is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 by holding the same stocks and maintaining similar weightings. Should investors buy the ETF with the index currently at an all-time high? History offers a clear answer.

Image source: Getty Images.

A high-growth index fund packed with tech titans

The Nasdaq-100 and the S&P 500 share many of the same top holdings, but the Nasdaq assigns them much higher weightings. In fact, the top five positions in the Invesco QQQ ETF represent 39.5% of the value of its entire portfolio, whereas those same stocks have a combined weighting of 30.2% in the S&P:

|

Stock |

Invesco ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Nvidia |

10.29% |

8.51% |

|

2. Apple |

8.40% |

6.92% |

|

3. Microsoft |

8.15% |

6.72% |

|

4. Alphabet |

6.61% |

5.07% |

|

5. Broadcom |

6.11% |

3.04% |

Data source: Invesco, State Street. Portfolio weightings are accurate as of Oct. 30, 2025, and are subject to change.

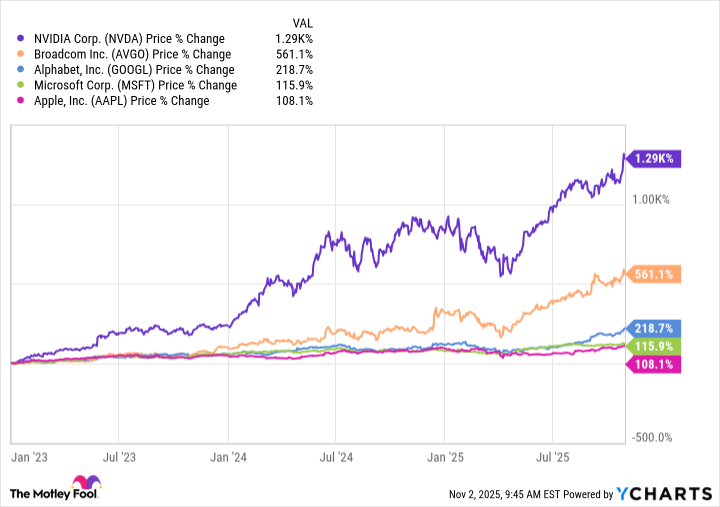

Since the AI boom started gathering momentum at the beginning of 2023, those five stocks have delivered a median return of 218%. They have propelled the Nasdaq-100 to a return of 136% over that period, which is far better than the 78% gain in the S&P 500:

Data by YCharts.

Nvidia and Broadcom supply some of the best data center chips and components for developing AI software. Microsoft and Alphabet are two of the biggest buyers of that hardware, and they have used it to build their own large language models (LLMs) and AI chatbots. They also rent computing capacity to businesses for profit through their respective cloud platforms, Microsoft Azure and Google Cloud.

Apple, on the other hand, could become one of the biggest AI touchpoints for consumers. There are more than 2.35 billion iPhones, iPads, Macs, and other devices active worldwide, and the company is slowly weaving its Apple Intelligence software into its operating systems.

Investors will also find other leading AI stocks like Amazon, Tesla, Meta Platforms, Palantir Technologies, and Advanced Micro Devices among the top 20 holdings in the Invesco QQQ ETF.

However, despite being extremely tech-heavy, the ETF does offer a splash of diversification with positions in retail and consumer products companies like Costco Wholesale, Starbucks, PepsiCo, and Monster Beverage.

NASDAQ: QQQ

Key Data Points

History suggests it's always a good time to invest

The Invesco QQQ ETF has delivered a compound annual return of 10.6% since it was established in 1999, even after accounting for every sell-off, correction, and bear market along the way.

On that note, volatility is a normal part of the investing journey. The Nasdaq-100 has experienced three bear markets (defined by peak-to-trough declines of 20% or more) over the last five years alone, triggered by the COVID-19 pandemic in 2020, the surge in interest rates in 2022, and President Trump's "Liberation Day" tariffs announced in April of this year.

Each of those events felt like a dramatic turning point for the stock market, but here we are today with the Nasdaq-100 at an all-time high. In fact, the average bear market in stocks typically lasts just 289 days, or nine and a half months (according to Hartford Funds), so as long as investors focus on the long term, history suggests they will almost certainly earn a positive return.

Although AI stocks are unquestionably driving the Nasdaq-100 higher right now, other technologies like personal computers, smartphones, the internet, enterprise software, cloud computing, and electric vehicles have contributed to its strong returns dating back to its inception in the 1980s.

Technology is constantly evolving, so even if the AI tailwind tapers off in a few years' time, other up-and-coming industries could pick up the slack. Autonomous vehicles, robotics, and quantum computing are just a few of the promising areas of the tech sector to watch in the future. Therefore, long-term investors shouldn't be deterred from buying the Invesco QQQ ETF with the Nasdaq-100 at an all-time high.