Neocloud provider Nebius Group (NBIS +2.03%) delivered sizzling returns on the market in the past year, rising 475% as of this writing. This stunning surge in the stock is backed by the outstanding growth in the company's revenue in recent quarters, a result of the remarkable demand for its artificial intelligence (AI) data centers.

This phenomenal rally may lead investors to think that Nebius stock is in a bubble. A closer look at the company's valuation would also suggest the same. But is it really in a bubble? Let's find out.

Image source: Getty Images

It may seem that Nebius stock has gotten way ahead of itself...

Nebius currently has a price-to-sales ratio (P/S) of 114. That's extremely expensive when we consider that the U.S. technology sector index has an average sales multiple of 9.5. Meanwhile, Nebius peer CoreWeave (CRWV +1.26%) is trading at 19 times sales, and it has been growing at an incredible pace as well.

NASDAQ: NBIS

Key Data Points

CoreWeave reported a tripling of year-over-year revenue in the second quarter to $1.21 billion. Nebius' revenue, meanwhile, came in at $105 million, but it jumped much faster at 645% compared to the year-ago period. Nebius bulls may argue that the company's significantly faster growth than CoreWeave justifies its expensive valuation. Even then, its P/S seems like too much of a stretch.

The sky-high valuation explains why Nebius' 12-month median price target points toward a jump of just 25% from current levels. That's why anyone who's looking to buy this AI infrastructure stock may not be inclined to do so in light of its prohibitively expensive valuation and limited upside potential in the coming year.

That's because any signs of a slowdown in the company's growth could send the stock into a downward spiral considering its valuation, which suggests that it is in bubble territory right now. However, there's a simple reason this cloud infrastructure company isn't in a bubble.

...but its tremendous backlog suggests otherwise

Nebius is in the business of building dedicated AI data centers powered by the latest chips from the likes of Nvidia, Advanced Micro Devices, and Intel. It also provides a software stack that includes managed services and tools to train or fine-tune models, run AI inference applications, and develop custom AI applications, among other things.

Nebius gives its customers the flexibility to rent its infrastructure on an hourly basis or purchase tokens for running AI inference applications. This business model is in great demand. There is a shortage of AI computing infrastructure in the cloud, which is why companies are buying whatever capacity they can lay their hands on.

Microsoft, for instance, said in its latest earnings conference call that the demand for its Azure AI cloud services "again exceeded supply across workloads even as we brought more capacity online." The tech giant has been taking steps to get its hands on more AI capacity, and that was precisely why it offered Nebius a huge contract a couple of months ago.

Nebius will provide Microsoft with dedicated GPU infrastructure capacity over a five-year period in a contract valued at $19.4 billion.

The contract runs through 2031, and Nebius says that it will begin deploying infrastructure for Microsoft from 2025. This is a big deal for a company that was expecting to hit an annualized run-rate revenue (ARR) of $1 billion by the end of 2025 before this contract was announced.

The Microsoft contract alone has the potential to substantially boost Nebius' growth over the next five years, and analysts are expecting its top-line growth to simply take off.

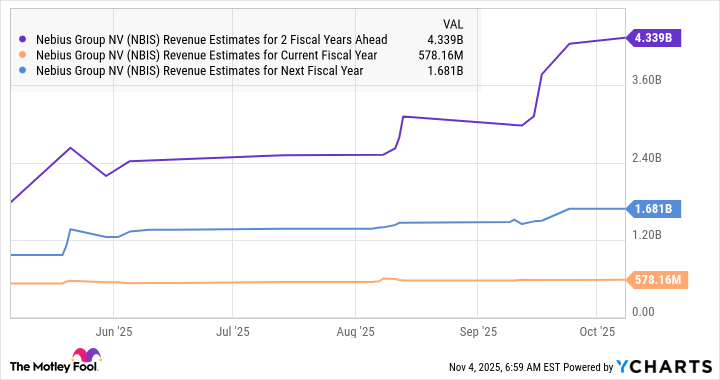

NBIS Revenue Estimates for 2 Fiscal Years Ahead; data by YCharts.

Nebius was growing at an incredible pace even before it landed the Microsoft deal, so the demand for its computing infrastructure was already strong. The company has been aggressively looking to bring more data center capacity online. It had 220 megawatts (MW) of connected capacity by the end of the second quarter. The company plans to increase its contracted data center capacity to more than 1 gigawatt (GW) by the end of 2026.

The added capacity brought online should sell out quickly thanks to the shortage of computing capacity. That should allow the company to achieve the remarkable revenue growth that analysts are anticipating. Assuming Nebius hits $4.4 billion in revenue in 2027 (as seen in the previous chart) and trades at a significantly discounted 19 times sales at that time (in line with industry peer CoreWeave's sales multiple), its market cap could jump to almost $84 billion.

That would mean a potential jump of 180% from current levels. So, investors looking to buy a fast-growing AI stock can still consider Nebius because the huge Microsoft contract and the hunger for AI computing infrastructure can ensure years of strong growth for the company.