The past five years have been challenging for Exact Sciences (EXAS +0.02%) and Roku (ROKU 0.19%), with both companies significantly lagging broader equities over this period. Though they faced severe headwinds, both corporations are slowly righting the ship and have rebounded this year. Exact Sciences and Roku now look like excellent long-term bets. Here's why.

Image source: Getty Images.

1. Exact Sciences

Exact Sciences develops cancer diagnostic tests, the most famous in its arsenal being Cologuard, an at-home, stool-based, non-invasive test for colorectal cancer (CRC). The company has faced some challenges in recent years, due to two factors.

First, it remains unprofitable, which, as interest rates rose, became a bigger problem for investors. Second, Exact Sciences is facing increasing competition, including from Guardant Health, which launched a blood-based CRC test. That said, Exact Sciences has catalysts that could drive the stock higher in the mid- to long-term.

NASDAQ: EXAS

Key Data Points

It recently launched a new, better, more accurate version of its crown jewel, called Cologuard Plus. It should help Exact Sciences get even more patients and physicians on board, which is a big deal. The company estimates that 55 million people in the U.S. aged between 45 and 85 have yet to be screened. Screenings are supposed to start at 45 for average-risk people.

Exact Sciences' Cologuard has been used in over 20 million tests (screenings, not patients) since its 2014 launch, so there is plenty of room to grow. Meanwhile, Cologuard Plus has higher sensitivity (rate of true positive diagnosis) and specificity (true negatives) than Guardant Health's Shield. Exact Sciences also recently acquired the rights to an up-and-coming blood-based CRC test, which should allow it to make even more headway in the field.

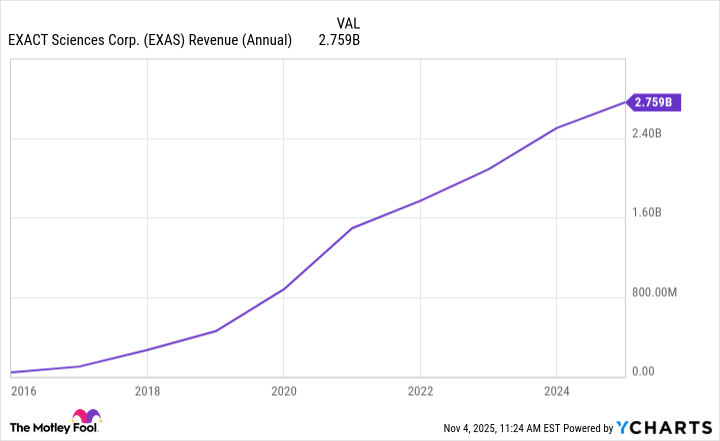

There are other important products in the company's arsenal, including Cancerguard, a test to help detect multiple cancers early. These opportunities should help maintain solid revenue growth, as the company has been doing for a while.

EXAS Revenue (Annual) data by YCharts.

Although the bottom line is a problem, Exact Sciences should improve on that front as Cologuard Plus gains traction, since its manufacturing cost is at least 5% lower than the previous version. Even before this important launch, the company's marketing and advertising expenses as a percentage of revenue were declining as it gained more brand recognition.

Exact Sciences has already helped advance cancer screening, but there is more work to be done. The company could benefit from its innovative efforts in the long run, making it an attractive option for investors.

2. Roku

Roku failed to maintain the strong sales growth momentum it had during the early pandemic years. Meanwhile, the company posted consistent net losses for a while, as its average revenue per user barely increased or even declined.

However, the streaming specialist is slowly improving. Roku reported strong results in the third quarter. Revenue increased 14% year over year to $1.2 billion. Importantly, the company reported its first net profit in a long time, with earnings per share of $0.16, compared with a loss per share of $0.06 in the year-ago period.

Roku owes that performance to its strong ad business, which it continues to improve through new launches like Ads Manager -- a DIY ads platform it introduced last year -- and its partnership with Amazon, among other initiatives.

NASDAQ: ROKU

Key Data Points

Here's why this is important. Roku is the leading connected TV platform and boasts a deep ecosystem of households with improving engagement. This is shown by its streaming hours increasing 14% year over year to 36.5 billion hours in the third quarter. The company's efforts to better its ad platform enable it to monetize its audience further, leading to higher sales.

At the same time, the company is strengthening its network effect, as advertisers will increasingly use the platform as they earn a greater return on ad investment.

Here's the best part: Streaming is still on a long-term growth path even in the most penetrated markets, like the U.S., where it accounts for 50% or less of television viewing time. Roku is ideally positioned to profit from the switch away from cable and into streaming over the long run, making it a top stock to buy and hold.