The S&P 500 is undoubtedly the stock market's most important index because it tracks the performance of around 500 of America's largest and most influential companies. After a disappointing 2022 when the index declined by over 19%, it has been on a strong bull run, up more than 78% since the start of 2023.

This recent run is great news for investors who've been along for the ride, but it has also had another cautionary effect: The S&P 500 is now trading at historically high levels. One key metric that shows this is the Shiller price-to-earnings (P/E) ratio, sometimes known as the CAPE ratio.

The Shiller P/E ratio examines the S&P 500's inflation-adjusted earnings per share (EPS) over the previous 10 years, aiming to provide insight into the index's valuation without being influenced by one-off booms or slumps that could be misleading. The current Shiller P/E ratio is above 40 -- a mark only hit three times in over 150 years.

Image source: Getty Images.

Unfortunately, the past couple of times the S&P 500 has hit this mark, bad times eventually followed (the dot-com bubble crash and the 2022 slump mentioned above). Now, past events don't guarantee future events, but it's well worth pointing this out to encourage investors to begin preparing for a potential market correction.

The S&P 500 is as top-heavy as we've seen it

The S&P 500 is weighted by market capitalization, meaning larger companies account for more of the index than smaller companies. This setup is largely responsible for the index's surge in the past couple of years.

Megacap tech stocks (like those in the "Magnificent Seven") have exploded in valuations due to the current AI boom. As they've grown in valuation, they've accounted for a larger portion of the S&P 500, making their performance more influential on the index's overall performance. It has worked in the S&P 500's favor, but now the index is a little too concentrated in a handful of stocks, in my opinion.

The Magnificent Seven stocks -- Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta, and Tesla -- now account for around 34% of the S&P 500. Its top 10 holdings account for over 38%.

An alternate way to invest in the S&P 500

One way to invest in the S&P 500 while avoiding the overconcentration problem and the risks that come with it is to invest in an equal-weight S&P 500 ETF, such as the Invesco Equal Weight S&P 500 ETF (RSP +0.52%).

NYSEMKT: RSP

Key Data Points

Instead of being weighted by market cap, RSP spreads investments roughly evenly between all S&P 500 companies. This brings a lower risk than investing in the standard S&P 500 because you're not relying on a handful of stocks to perform well for the investment to be successful. Here is how the weight of the standard S&P 500's top holdings compares in RSP:

| Company | Percentage of Standard S&P 500 | Percentage of Equal-Weight S&P 500 |

|---|---|---|

| Nvidia | 7.95% | 0.23% |

| Microsoft | 6.73% | 0.21% |

| Apple | 6.60% | 0.24% |

| Amazon | 3.72% | 0.21% |

| Meta (Class A) | 2.78% | 0.17% |

| Broadcom | 2.71% | 0.20% |

| Alphabet (Class A) | 2.47% | 0.13% |

| Tesla | 2.18% | 0.26% |

| Alphabet (Class C) | 1.99% | 0.10% |

| Berkshire Hathaway (Class B) | 1.61% | 0.19% |

Source: Vanguard and Invesco. Vanguard percentages as of Sept. 30; Invesco as of Oct. 31.

If AI hype cools down and investors turn away from these top holdings, it's much better for only around 2% of your portfolio to be exposed to them than for it to be over 38%.

The equal-weight S&P 500 still has good long-term returns

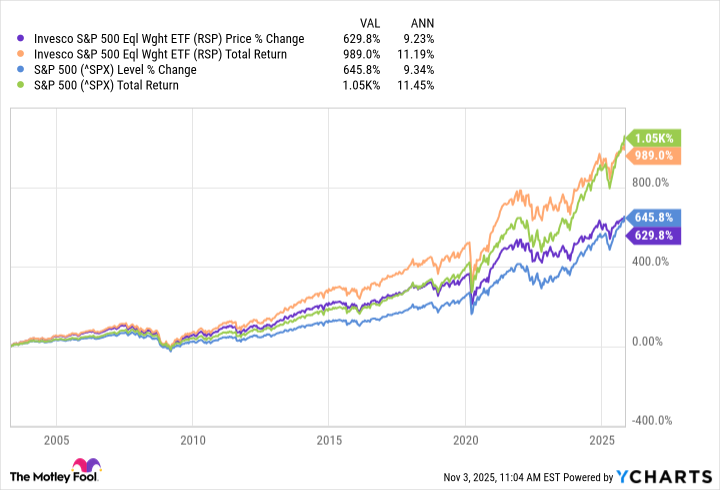

With the S&P 500's top holdings being some of the best-performing stocks on the market, the standard S&P 500 has noticeably outperformed RSP over the past decade. The index is up 225% in that span, compared to RSP's 134%. However, when you zoom out, RSP has performed in line with the standard index since its April 2003 inception.

This shows that going the equal-weight route doesn't have to mean sacrificing gains. S&P 500 companies are some of the best in the world; investing in RSP gives you exposure to these companies without putting too much of your portfolio's fate in the hands of big tech.