Companies selling artificial intelligence (AI) hardware such as chips, server systems, and semiconductor manufacturing equipment have been in the limelight of late, thanks to the hundreds of billions of dollars being spent in this space. But at the same time, investors shouldn't ignore the lucrative opportunity in AI software.

ABI Research projects that the AI software market could grow at an annual rate of 25% through the end of the decade, generating a whopping $467 billion in annual revenue in 2030. There are a few popular companies that are benefiting from this trend, such as Palantir Technologies, SoundHound AI, and Snowflake. However, all these names are trading at expensive valuations following a big jump in their share prices in recent months.

Data streaming platform provider Confluent (CFLT +0.13%), however, seems to have been left out of the AI-driven surge in software stocks. Shares of the company are down 16% in 2025 as of this writing. But it is worth noting that Confluent provides an important solution that could help companies get the most out of their generative AI software solutions.

Let's check out why this company could turn out to be a big beneficiary of the generative AI software boom.

Image source: Getty Images.

Confluent's platform is playing a key role in making AI software effective

Confluent's cloud-based data streaming platform enables its customers to process their data in real time, compared to the traditional way of storing data in silos and then processing it later on. Not surprisingly, the company's platform is now witnessing stronger adoption thanks to AI.

The real-time data processing that Confluent enables is powering event-based AI agents and is also providing large language models (LLMs) with context-driven data for providing accurate results. The company points out that its Confluent Intelligence platform "enables AI systems to continuously learn from historical data and act in real time."

On the latest earnings call, Confluent management pointed out that organizations and businesses are finding it challenging to move AI applications from the prototype to the production stage. That's because prototypes are trained using a particular set of data, but applications such as AI agents "must have an up-to-date comprehensive view of all the inputs needed to do its work."

NASDAQ: CFLT

Key Data Points

This is where Confluent's solutions that combine both historical and live data come into play. Not surprisingly, the company's solutions are finding success among customers looking to deploy AI applications. Confluent ended the third quarter of 2025 with more than 100 AI-native customers, 21 of which have more than $100,000 in annual recurring revenue.

Confluent management says that its AI customers include data analytics providers, cybersecurity companies, and AI automation companies. CEO Jay Kreps points out that "as AI evolves from innovation to utilization, context will define who wins, and we are committed to making Confluent the company enabling the shifts by turning data into continuously refreshed, trustworthy context for AI systems everywhere."

So, Confluent should ideally witness an acceleration in its AI customer count as the adoption of AI software grows. That could pave the way for stronger growth in the company's business.

Investors can expect stronger growth in the future

Confluent reported a year-over-year increase of 19% in its revenue last quarter to $298 million. Its non-GAAP earnings increased by 30% from the year-ago period to $0.13 per share. The numbers were well ahead of consensus expectations.

What's worth noting is that Confluent's revenue backlog increased at a much faster pace than its top line. Its remaining performance obligation (RPO), which refers to the total value of unfulfilled contracts at the end of a period, increased by 43% year over year. So, Confluent is receiving new business at a faster pace than it is fulfilling.

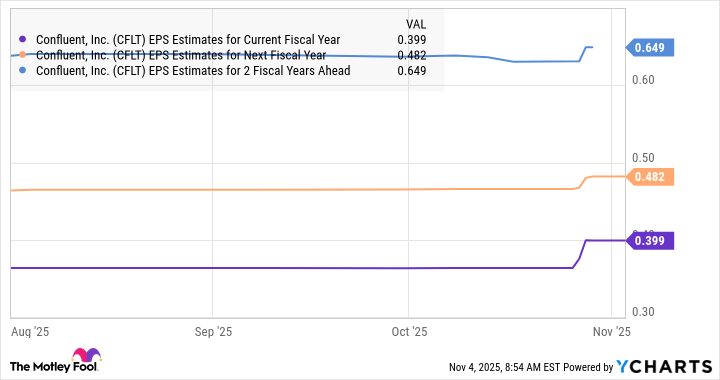

That's a positive sign, as it ideally points toward an acceleration in growth in the future. This explains why analysts are expecting Confluent's bottom-line growth to pick up momentum.

CFLT EPS Estimates for Current Fiscal Year data by YCharts.

That's why buying Confluent looks like a smart thing to do now. It is undervalued with respect to the growth that it could deliver, as evident from a price/earnings-to-growth ratio (PEG ratio) of just 0.34, as per Yahoo! Finance. The PEG ratio is a forward-looking valuation metric that takes a company's projected annual earnings-per-share growth for the next five years into account. A reading of less than 1 means that a stock is undervalued in light of its growth prospects.

Confluent's PEG ratio indicates that it is indeed worth buying right now. That's why investors looking to buy an AI stock capable of flying higher in the long run should take a closer look at it before it steps on the gas.