A concern sweeping the stock market right now is that artificial intelligence (AI) will render numerous software products obsolete.

Software company Adobe (ADBE 7.31%) is one of the largest and most successful growth stocks. However, it has become controversial because many fear that generative AI will replace the company's creative software.

The company has insisted that artificial intelligence is more of an opportunity than a threat and is doubling down with massive share repurchases.

What does it all mean for you? Here is why it may be worth buying into Adobe's massive decline.

Image source: Getty Images.

Is the AI threat an existential crisis for Adobe?

At the surface, AI looks like a threat. The newest AI apps can create images and videos from text prompts. The technology has also progressed rapidly. I remember seeing an AI-generated video a few years ago of a celebrity eating spaghetti, and it looked awful. Today, that same video, redone with the latest AI models, is almost indistinguishable from real footage.

Adobe has four distinct business units:

- Creative Cloud -- photo and video editing software.

- Document Cloud -- securely storing, editing, and signing documents.

- Experience Cloud -- customer marketing and engagement software for business.

- Adobe Express -- a generative app for making social media content or other quick projects.

AI could disrupt some of these products and services, but Adobe's software goes so deep into the finer details of media editing that it's tough to see AI rendering Adobe useless anytime soon. Additionally, AI apps have had to increasingly put up guardrails on the content they produce due to copyright and safety concerns.

NASDAQ: ADBE

Key Data Points

It seems most likely that Adobe may face pressure in some of its apps, something the company could address by incorporating AI features into its existing software. By the way, Adobe is already doing that. Lastly, Adobe has a massive user and content base that has become a competitive moat that won't erode overnight.

If anything, Adobe faces more direct competition from Figma, another AI-infused creative software app. The company went public earlier this year and has posted impressive growth as a potential disruptor. Adobe once tried to acquire Figma but abandoned the merger amid regulatory scrutiny.

Fact: Adobe has leaned into gobbling up its own stock

Adobe has enjoyed dominance in its space for a long time. It's only natural that competition will come for it. Adobe can and must respond to any threats from AI and/or Figma. That's a legitimate risk. That said, it's also fair to say that Wall Street has baked that risk into Adobe's share price, considering that the stock is down over 50% from its high.

Management is confident that Adobe can successfully adopt and embrace the risks, going so far as to call AI the company's biggest opportunity in decades at the start of its recent third-quarter earnings call.

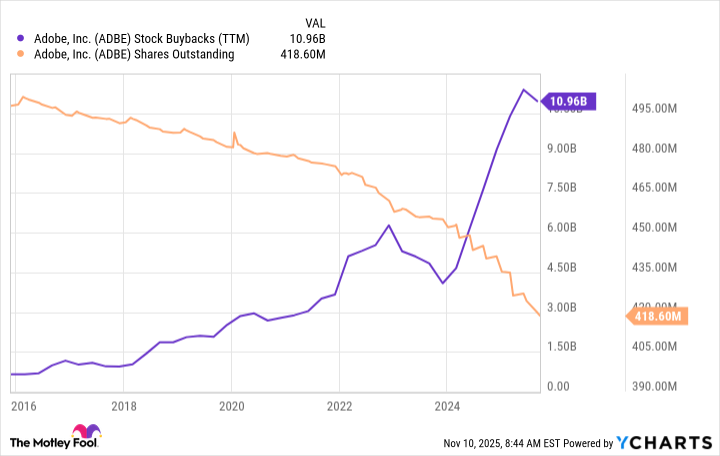

Through share repurchases, Adobe is showing investors that management sees compelling value in the stock. The company has consistently repurchased shares over the years, but management aggressively increased its buybacks at the start of 2024.

ADBE Stock Buybacks (TTM) data by YCharts

Importantly, Adobe is maintaining a stellar balance sheet. The company still has less than $1 billion in net debt, and it generated $9.4 billion in free cash flow over the past four quarters, an all-time high. Adobe may not grow as rapidly as it once did, but that also reflects its increasingly massive size.

What's clear is that this isn't a struggling company, at least as far as the financials indicate.

A depressed valuation could generate outsized returns

The market's doubts have depressed Adobe's share price and its valuation.

Adobe's stock now trades at less than 16 times the company's estimated 2025 earnings, and analysts estimate that Adobe will grow its earnings by an average of 13% annually over the next three to five years. Assuming Adobe delivers growth anywhere near that, the stock is a bargain today. Remember, all those share repurchases will also help drive earnings growth.

The stock's average price-to-earnings ratio over the past decade is 48. Any future uptick in market sentiment could catapult the stock to impressive gains as it reverts toward its long-term averages. Adobe isn't without risks, but this looks like a classic contrarian investment with a potentially massive payoff if the AI buzz ultimately proves to be little more than noise.