On the surface, the investment case for Airbnb (ABNB 0.07%) seems excellent. The short-term home rental platform is disrupting the travel market, providing an alternative to traditional hotels, and the business model is easily scalable.

It's not just asset-light, but asset-free, meaning the company owns none of the rooms at which its guests stay. In fact, Airbnb has more rooms than any single hotel chain, with more than 8 million active listings worldwide, and an unmatched global reach with rooms in more than 220 countries and 150,000 cities and towns.

By some measurements, Airbnb has been an overwhelming success. The business is highly profitable and it's worth roughly $75 billion. It's made plenty of early investors and insiders wealthy, and it continues to outgrow the overall travel market.

Image source: Airbnb.

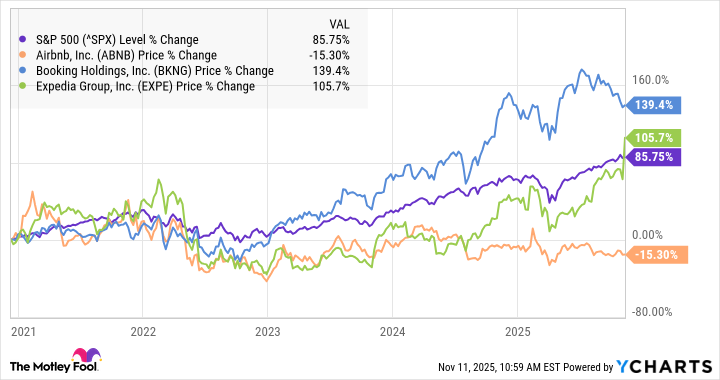

However, nearly five years after the company went public, what's also become clear is that the stock has been a huge disappointment, and a gulf has formed between expectations and reality for the disruptive travel marketplace. Airbnb stock closed Dec. 10, 2020, its initial public offering (IPO) day, at $144.71 a share. Nearly five years later, the stock is trading around $120, down 15%, compared with an 86% gain in the S&P 500.

It's true that Airbnb debuted during a heady time for tech stocks as the pandemic-era boom was in full effect then, but many of the other high-priced tech stocks that went public then have recovered from the 2022 sell-off and gone on to set new highs. DoorDash, for example, was up more than 50% from its IPO closing level before a recent sell-off, and Palantir Technologies has skyrocketed in the artificial intelligence (AI) boom. Even Snowflake is now trading above its IPO closing price.

Not only has Airbnb badly underperformed the S&P 500 during that time, but it's also been left in the dust by its chief rivals, Booking Holdings and Expedia, as the chart below shows.

The brand is increasingly toxic

There's no single factor that's led to Airbnb's underperformance, but there are some notable reasons for the company's struggles. By now, the downside of staying in Airbnb is well known. Complaints on social media are rife about chore lists, hidden fees, bad hosts and check-in experiences, and soaring prices.

Airbnb has pushed back on these complaints and made changes, including listing the total price up front, rather than hiding extra fees for things like cleaning. However, those issues have led to bad faith among users. Airbnb began as a small community, and its corporatization as it's grown, though inevitable, seems to have contributed to a lack of trust in the brand.

That's also become more visible on a larger scale as it's been the focus of anti-tourism measures and protests in places like Barcelona, Lisbon, and Venice, and local governments have cracked down on Airbnb. For example, the Spanish government called for the removal of roughly 66,000 listings in the country, and New York City banned most Airbnb listings two years ago.

Airbnb regularly defends itself by arguing that it provides an economic benefit to local neighborhoods rather than tourist districts and that it allows local hosts to earn supplemental income. However, the company seems to be losing that debate based on the broader pushback in some of the world's biggest tourist markets.

NASDAQ: ABNB

Key Data Points

The market has matured faster than expected

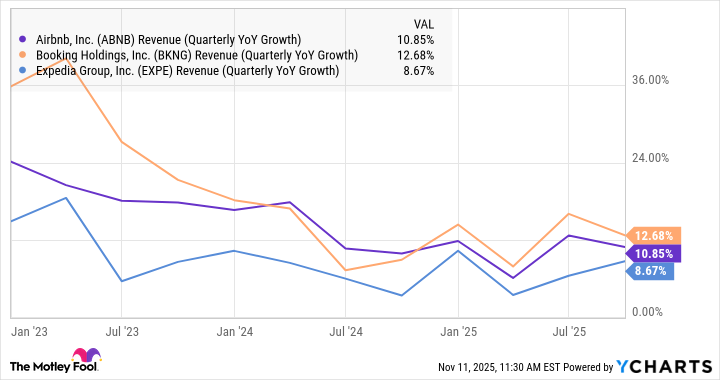

Airbnb has long been priced like a disruptive growth stock due to the nature of its business model and the opportunity in front of it, but it now seems like the days of the home-sharing marketplace's outsize growth are over.

It's been six quarters since Airbnb reported revenue growth above 13%, and its growth rate now looks downright pedestrian for the hotel and accommodations industry. As you can see from the chart below, it's trailed Booking Holdings, which makes most of its revenue from hotel bookings, for the last four quarters.

ABNB Revenue (Quarterly YoY Growth) data by YCharts

What's notable about Airbnb's recent sluggish growth is that it has come even as the company launched its services marketplace and an enhanced experiences marketplace in May, though gross booking value increased 14% in the third quarter, outpacing revenue growth.

Still, fourth-quarter guidance calls for revenue growth of just 7% to 10%. At this point, it seems unlikely that Airbnb's revenue growth will reaccelerate to the 20% or beyond that investors typically expect from a growth stock.

While the valuation has become more reasonable as its returns have underwhelmed, the upside potential in the stock also seems to be gone, despite CEO Brian Chesky's talk about expanding beyond the core.nAt this point, growth stock investors may want to move on from Airbnb.