The S&P 500 (^GSPC 0.05%) has climbed by 16% so far in 2025, but investors who bought shares of music streaming giant Spotify (SPOT 1.66%) at the start of the year would have earned an eye-popping 40% return instead.

Investors have rewarded the company's strong revenue growth and soaring earnings, and all signs suggest its momentum will continue into 2026. However, there is one big reason to be cautious about piling into Spotify stock as we head into the new year. Read on.

Image source: Getty Images,

The global leader in music streaming

Spotify is the world's largest music streaming platform by a wide margin. According to Statista, it has a global market share of 31.7%, with Tencent Music in a distant second place with a market share of 14.4%. Most music streaming services offer a similar content catalog, so Spotify competes by offering users the most advanced technology to enhance their listening experience, and by delivering other content formats like podcasts and audiobooks.

Artificial intelligence (AI) is a huge part of Spotify's tech strategy right now. It's embedded in the platform's recommendation engine, where it learns what music each user likes so it can feed them more of it. AI is also at the foundation of new features like AI Playlist, which can create an entire playlist of music based on a simple prompt from the user.

Spotify also announced an integration with OpenAI's ChatGPT in October. Users can now ask the chatbot to find an artist, song, or playlist in their Spotify app, or request a recommendation.

On the content side, Spotify is already a top destination for podcasts, but the company is specifically focusing on building its video podcast library right now because this format drives more engagement. For example, during the third quarter of 2025 (ended Sept. 30), the amount of time users spent watching video content on Spotify more than doubled year over year. The majority of the platform's active users are monetized through advertising, so the more time they spend online, the more ads they see, and the more money the company makes.

NYSE: SPOT

Key Data Points

Solid revenue growth and a surging bottom line

At the end of the third quarter, Spotify had 281 million users paying for a Premium subscription, and 446 million free users who were monetized through advertising. The Premium subscriber base grew by 12% year over year, which was slightly faster than the growth in its free users. That was good news, because paying members represent around 90% of the company's total revenue.

Speaking of which, Spotify generated $4.9 billion in total revenue during the third quarter, which was up 7% year over year (or 12% after adjusting for global currency headwinds). With 2025 drawing to a close, Wall Street thinks the company is on track to deliver a record $19.9 billion in revenue for the year (according to Yahoo! Finance), representing growth of 9.5% compared to 2024.

However, the Street is forecasting accelerated growth of 14.5% in 2026, suggesting Spotify's business could gain momentum in the new year.

Turning to the bottom line, Spotify is carefully managing costs to boost its profitability. The company's operating expenses declined by 2% year over year during the third quarter, which contributed to a whopping 200% jump in its net income, to $1.04 billion.

On an adjusted basis, which strips out one-off and noncash expenses, Spotify has now generated a record $3.4 billion in free cash flow over the last four quarters.

The big reason investors should be cautious heading into 2026

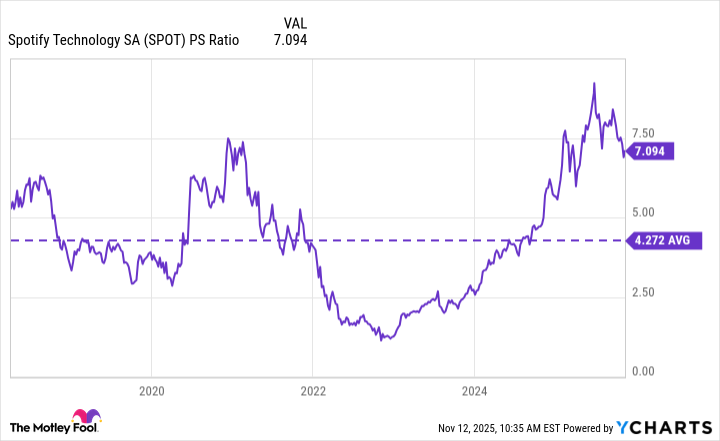

Spotify's business is unquestionably strong right now, but investors need to carefully consider its valuation before buying its stock, especially if they are looking for gains in the next 12 months. It's trading at a price-to-sales (P/S) ratio of 7.1 as I write this, which is a whopping 69% premium to its average of 4.2 since the stock went public in 2018:

SPOT PS Ratio data by YCharts

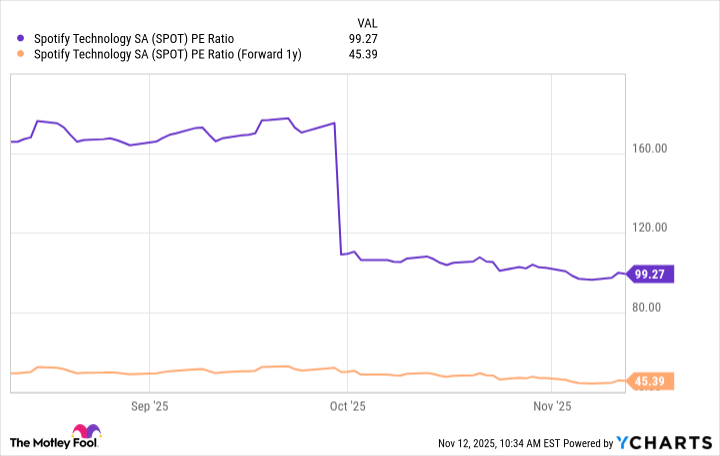

Moreover, based on Spotify's trailing-12-month earnings per share, its stock trades at a price-to-earnings (P/E) ratio of 99.2, which is almost four times higher than the 25.7 P/E ratio of the S&P 500. In other words, Spotify is substantially more expensive than the rest of the market.

Even if we value Spotify stock based on Wall Street's consensus earnings estimate for 2026, its stock is still trading at a forward P/E ratio of 45.3. Therefore, if investors buy Spotify stock today and its financial results come in exactly as Wall Street expects, it will still be significantly more expensive than the S&P 500 in a year from now. That doesn't leave much room for upside.

SPOT PE Ratio data by YCharts

Simply put, Spotify stock doesn't look like a great buy right now for investors who are looking for gains in 2026. However, longer-term investors can still do quite well, because outgoing CEO Daniel Ek previously issued a forecast suggesting the company's revenue could reach $100 billion by 2032. That would be a fivefold increase from its expected 2025 result, leaving plenty of room for upside in Spotify stock over the next seven or eight years.