For quite some time, tech companies have been the most sought-after investments on the stock market because of their performance and return potential. It's largely why 8 of the world's 10 most valuable public companies are tech companies.

And of those eight companies, seven are part of the "Magnificent Seven" group: NVIDIA, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla. Each of these companies has its own growth outlook and risk, but one effective way to invest in them while not being fully reliant on them is via the Vanguard Growth ETF (VUG +0.52%).

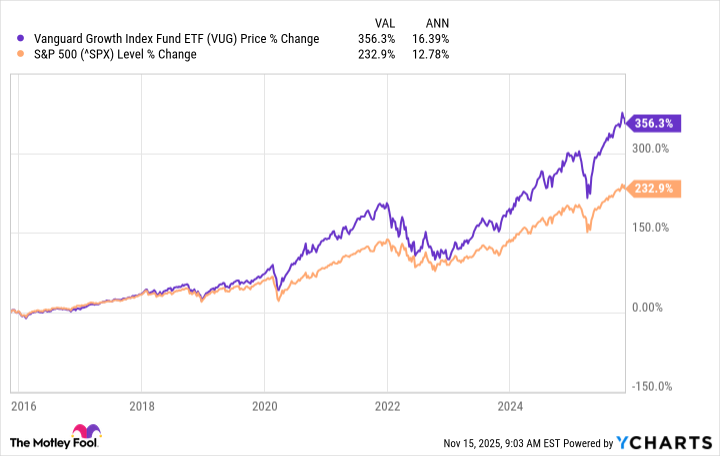

VUG is a low-cost ETF that has consistently demonstrated its ability to be a reliable market outperformer (compared to the S&P 500's performance).

Image source: Getty Images.

An ETF led by big tech's most prominent companies

Although the Vanguard Growth ETF isn't purely a tech ETF, its growth-focused nature means that many of its companies are tech companies. The tech sector accounts for 62.1% of the ETF, primarily due to the ETF's structure. VUG is weighted by market cap, so larger companies account for more of the fund than smaller companies.

As I mentioned earlier, 8 of the world's 10 most valuable public companies are tech companies, so they're also a large part of Vanguard Growth. Below is how much the Magnificent Seven stocks account for in the ETF:

| Company | Percentage of the ETF |

|---|---|

| NVIDIA | 12.01% |

| Microsoft | 10.70% |

| Apple | 10.47% |

| Alphabet | 6.77% |

| Amazon | 5.55% |

| Meta Platforms | 4.22% |

| Tesla | 3.70% |

Source: Vanguard. Percentages as of Sept. 30.

The performance of these companies will have a noticeable impact on VUG's performance, but it isn't the only factor influencing its performance. It still contains companies from all major sectors, with the four rounding out the top five being consumer discretionary (18.2%), industrials (8.2%), healthcare (5%), and financials (2.9%).

NYSEMKT: VUG

Key Data Points

A history of outperforming the market

One of the main reasons to invest in a growth ETF is to aim for outperforming the market. From its January 2004 inception, the Vanguard Growth ETF has done exactly that. Since then, the fund is up 875% compared to the S&P 500's 482%. Over the past decade, VUG's performance has been even more impressive, averaging 16.4% annual returns, compared to the S&P 500's 12.8%.

Past performance doesn't mean it'll keep happening, especially considering the Magnificent Seven stocks' performances have carried a lot of weight for Vanguard Growth. However, these are companies that should continue thriving for the foreseeable future, which is good news for the ETF.

VUG has a low fee you can't beat

Vanguard Growth's expense ratio is 0.04%, meaning you'll only pay $0.40 per $1,000 you have invested in the ETF. That's not only one of the lowest expense ratios you'll find from a growth-focused ETF, but also any ETF in general. In the first few years, a slight difference in fees may not seem significant, but over time, it can add up to noticeable differences in total fees paid.

To see it in action, let's imagine you had invest $500 monthly in Vanguard Growth and two other ETFs with expense ratios of 0.25% and 0.50%. Below is how the different investment totals would stack up over a different number of years, averaging 10% annual returns:

| Expense Ratio | Investment Total After 10 Years | Investment Total After 15 Years | Investment Total After 20 Years |

|---|---|---|---|

| 0.04% | $95,400 | $190,000 | $342,000 |

| 0.25% | $94,400 | $186,800 | $334,000 |

| 0.50% | $93,300 | $183,200 | $324,700 |

Table by author. Values rounded down to the nearest hundred.

Earning a good return on your investment is great; earning a good return on your investment and being able to keep more of the gains to yourself is much better. A low-cost ETF like Vanguard Growth allows you to do the latter.

The concentration in Magnificent Seven stocks should caution investors about making the ETF the bulk of their portfolio, but it can be a key staple piece when complemented with other ETFs and stocks in sectors where VUG lacks.