Artificial intelligence (AI) is slowly getting embedded into all types of enterprise software. Based on its promise to automate tasks, generate code faster than humans, and elevate its users' general capabilities, companies are rushing to deploy large language models (LLMs) in conjunction with their existing software.

One AI software stock that is attracting a great deal of attention is Palantir Technologies (PLTR +2.23%). It is now the largest pure-play software company in the world by market capitalization, valued at $400 billion.

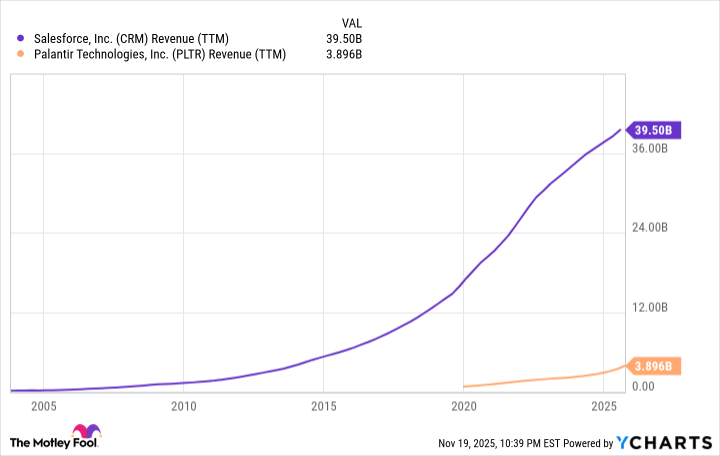

However, it is not the largest in its space by revenue and earnings. That title belongs to Salesforce (CRM 0.02%). The customer relationship management, marketing, and analytics platform provider is embracing AI across its software programs, which is leading to steady revenue growth. And, despite its much smaller market cap, Salesforce generated 10 times as much revenue as Palantir over the last 12 months.

Here's why I expect it to join the $1 trillion market cap club by 2035, leaving Palantir in the dust.

NYSE: CRM

Key Data Points

Durable growth in CRM software

Salesforce was one of the first software-as-a-service (SaaS) companies ever, and has grown to become the dominant player in customer relationship management, helping its customers' sales teams manage their clients efficiently from a single platform. On top of sales software, it has a ton of other products that support such functions as marketing, commerce, team messaging (through its Slack acquisition), and analytics (via its Tableau subsidiary).

With its comprehensive suite of tools, Salesforce has steadily ridden the transition to cloud-based systems and SaaS for enterprise clients, growing revenue every year since it went public in 2003. That year, it generated just over $50 million in revenue. Over the last four reported quarters, its revenue was $39.5 billion, making it one of the fastest-growing companies of the last two decades.

As its scale has increased, so has its operating leverage. Its operating margin was a record 21% over the last 12 months, and with a gross profit margin of 70%, I think there is plenty of room for it to keep expanding those bottom-line margins over the next decade.

Image source: Getty Images.

An AI opportunity to expand among existing customers

It looks like the next growth tailwind for Salesforce will involve its new AI integrations across its software, specifically with its Agentforce automation tools and Agentic Enterprise. Large companies are adopting Salesforce AI tools in rapid fashion, with the segment's annual recurring revenue reaching $1.2 billion last quarter and growing by more than 100% year over year.

While we are still in the early innings of AI deployment, it looks like Agentforce has real potential to help Salesforce keep compounding its revenue and earnings for years to come. In its fiscal 2026 (which will end in January 2026), the company is guiding for over $41 billion in revenue, and expects to grow its revenue by 8% on a constant-currency basis. A lot of this growth is coming from Agentforce AI deployments.

CRM Revenue (TTM) data by YCharts.

Why Salesforce can reach a $1 trillion valuation by 2035

Salesforce generated $39.5 billion in revenue over the last four reported quarters, compared to Palantir's $3.9 billion. As it keeps upselling its AI tools and riding the secular tailwind of cloud CRM adoption around the globe, I believe Salesforce can keep growing its revenue at its existing 8% annual rate -- or close to it -- for the next decade. That would bring annual revenue to approximately $88 billion in 2035.

Over the next 10 years, it is likely that Salesforce will keep expanding its profit margin. An operating margin of 35% on a generally accepted accounting principles (GAAP) basis is well within reach due to the company's high gross margins. That would bring Salesforce's operating earnings up to $31 billion by 2035.

With that volume of operating income, a market cap of $1 trillion would give the company a price-to-earnings ratio of 32. That's a reasonable valuation for a wide-moat software company like Salesforce, which is why I think it has a strong chance to hit $1 trillion before 2035, and likely well before Palantir ever does.