It's one thing to work for your income, but the real beauty comes when you can earn money without lifting a finger -- otherwise known as passive income. There are many forms of passive income, but one of the most straightforward forms in the stock market comes via dividends.

Dividends are a way for companies to reward their investors for simply owning their stock. And regardless of the stock's price movement, you can expect your dividend payments to keep flowing (in most cases).

If the idea of earning $10,000 in passive income sounds enticing, there is one dividend exchange-traded fund (ETF) well-equipped to make it happen. It likely won't be overnight, but with a little patience, it's absolutely attainable.

Image source: Getty Images.

A high-quality dividend ETF that has stood the test of time

The Schwab U.S. Dividend Equity ETF (SCHD 0.45%) is one of the top dividend exchange-traded funds (ETFs) on the market. It has been around since October 2011 and is known for holding high-quality companies. This is largely because of the criteria companies must meet to be included.

A company must have 10 consecutive years of dividend payouts, strong cash flow, and a healthy balance sheet to be eligible. That eliminates many companies that may seem attractive strictly because of a high dividend yield or an unsustainable dividend.

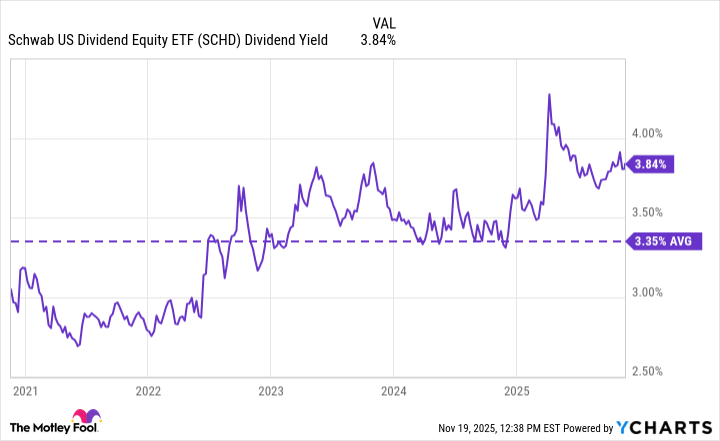

In the past five years, SCHD's average dividend yield has been 3.35%. If we assume this continues (though it will inevitably fluctuate because dividend yields move inversely to stock prices), you would need to have $298,508 invested in SCHD to generate $10,000 in annual passive income.

Data by YCharts.

At the time of this writing, SCHD's price is around $27, meaning you'd need to purchase 11,056 shares if you were starting from scratch.

It all comes down to consistency

In reality, few people have close to $300,000 in cash lying around that they can instantly invest to make the above scenario happen. However, with time, consistency, and the power of compound earnings, it's much easier to accomplish than one may initially believe.

NYSEMKT: SCHD

Key Data Points

Over the past decade, SCHD has averaged 11.2% annual total returns. Past performance doesn't guarantee future performance, but if we assume this continues for the sake of illustration, you could cross the $300,000 mark in 20 years by investing $400 monthly into the ETF. If you upped the monthly contributions to $750, you could hit the mark in 15 years.

In either case, you would have personally invested much less than the actual $300,000. The key is to start early and let time do a lot of the heavy lifting.