Alphabet (GOOG +1.05%) stock continued its strong run with the shares up as much as 3.2% in early morning trading. The move today comes as news broke that Meta is reportedly in talks with Alphabet's Google to buy AI chips from it.

Alphabet is the highest quality AI play

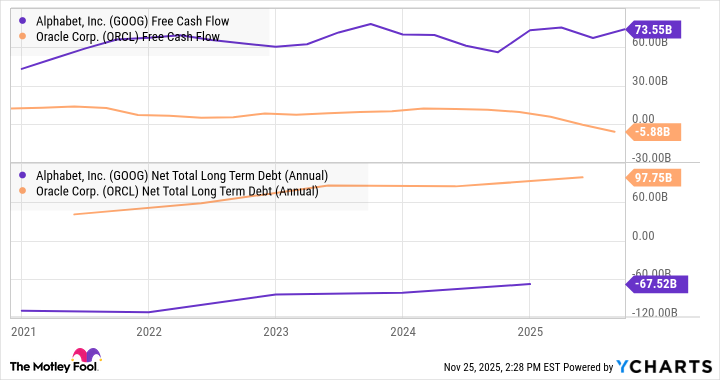

The news highlights the attractiveness of Alphabet stock as a means to capitalize on the AI boom. A quick look at its cash flow and remarkable cash levels, compared to one of its peers, demonstrates the ease with which it can finance the substantial investment required to grow its AI capabilities.

GOOG Free Cash Flow data by YCharts

Moreover, it's already demonstrating its ability to grow its cloud computing services with Google Cloud revenue up 34% year over year in the third quarter, and operating income up 85% to $3.6 billion – a figure now more than 10% of what it earned from Google Services (search, advertising, and subscriptions).

Speaking on the earnings call, CEO Sundar Pichai noted that Google Cloud's "product portfolio is accelerating growth" and it had "signed more deals over $1 billion through" the first nine months of 2025 "than we did in the previous two years combined."According to Pichai, more than 70% of Google Cloud customers utilize its AI products, and it's clear that Alphabet has the financial firepower to prevail in a fiercely competitive market.

Image source: Getty Images.

Where next for Alphabet?

Whether Alphabet sells its AI chips to Meta or not, the speculation highlights the potential to do so and its multifaceted approach to winning in the AI market. The company generates cash flow from search, advertising, and now Google Cloud as well, and it remains the highest-quality way to invest in an AI hyperscaler.