Cybersecurity specialist Zscaler (ZS +1.13%) had been performing impressively on the stock market -- at least, until Nov. 25 when it released results for its fiscal 2026 first quarter (ended Oct. 31). The stock fell 13% the following day, and it has pulled back 25% since hitting a 52-week high on Nov. 3.

However, Zscaler's drop doesn't seem justified, since it not only beat Wall Street's revenue and earnings expectations, but also raised its full-year guidance. Let's take a closer look at the company's business, and check why it may be a good idea to buy it following its recent pullback.

Image source: Getty Images.

Zscaler's growth trajectory is set to get better

Zscaler provides cloud-based cybersecurity solutions such as zero trust security and secure access service edge (SASE), two fast-growing niches within the industry. Zero trust security, for instance, is expected to grow from $34 billion last year to $161 billion in 2034, according to Precedence Research. The SASE market, on the other hand, is forecast to clock annual growth of 29% and generate $25 billion in revenue in 2027, according to Gartner.

Both these cybersecurity niches are growing at a healthy pace thanks to the increasingly complex nature of cyber threats. According to a survey by the World Economic Forum earlier this year, 72% of businesses pointed out that cybersecurity risks are rising, with new technologies such as generative AI turning out to be an asset for malicious actors.

So, it is easy to see why demand for Zscaler's offerings is increasing. Its revenue jumped by 28% year over year in the previous quarter to $788 million, while non-GAAP (generally accepted accounting principles) earnings per share increased by 25% to $0.96 per share. Consensus estimates would have settled for $774 million in revenue and $0.86 per share in earnings.

Zscaler's growth was driven by its zero trust security solutions, data security offerings, and AI security tools. The company has made a smart move by offering cybersecurity features for securing public AI apps such as ChatGPT, large language models (LLMs), and internal AI apps used within an organization.

Annual recurring revenue (ARR) from Zscaler's AI security solutions hit $400 million in Q1, three quarters ahead of the company's original expectation. Zscaler is now expecting its AI security solutions to generate over $500 million in ARR by the end of the year.

It has also introduced a contract program called Z-Flex. This allows "customers to commit to a spend and provide flexibility to swap or activate additional modules without undergoing new procurement cycles." The company points out that the flexibility provided by this model is "driving meaningful upsells and reduced sales cycle." Zscaler management added that it witnessed a 70% sequential increase in Z-Flex bookings last quarter to $175 million.

NASDAQ: ZS

Key Data Points

All this explains why Zscaler is now expecting slightly stronger revenue growth of 23% in the current fiscal year to $3.29 billion. It was earlier forecasting its revenue to land between $3.27 billion and $3.28 billion.

However, there is a possibility of Zscaler further raising its guidance as the year progresses. That's because the company ended the previous quarter with a 35% year-over-year increase in remaining performance obligations (RPO) to $5.9 billion. This metric refers to the total value of a company's contracts that are yet to be fulfilled.

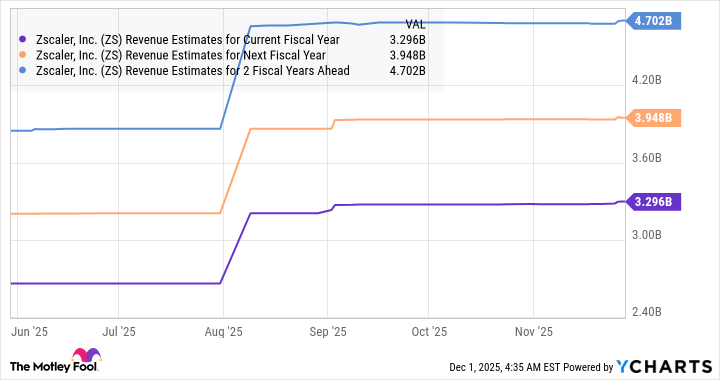

So, the faster increase in this metric as compared to Zscaler's actual revenue growth suggests that it is getting new contracts at a faster pace than it is fulfilling. This probably explains why Zscaler's revenue growth estimates have been revised slightly upward.

ZS Revenue Estimates for Current Fiscal Year data by YCharts

The stock can step on the gas once again

The improving growth prospects of Zscaler are likely to result in more upside ahead. The stock has a 12-month median price target of $334, per 50 analysts covering the stock, suggesting a jump of 33% from current levels. That seems achievable, considering that its top-line growth is likely to be better than anticipated, owing to its fast-improving pipeline.

Importantly, Zscaler could fly higher than analysts' expectations in the long run. The previous chart shows that its revenue is expected to jump to $4.7 billion after a couple of fiscal years. But given that it is reaching its revenue targets at a faster-than-anticipated rate, don't be surprised to see it hit $5 billion in revenue after a couple of years.

If Zscaler indeed achieves $5 billion in revenue in fiscal 2028 and maintains its price-to-sales ratio of 14 at that time, its market cap could hit $70 billion. That would be a potential jump of 75% from current levels in three years. So, investors can consider buying this growth stock as it has the potential to overcome its recent slide and deliver healthy long-term gains.