The artificial intelligence (AI) sector has dramatically boosted business for Nebius Group (NBIS +4.80%) and Astera Labs (ALAB +4.51%). The former is a tech infrastructure specialist operating data centers to house AI. The latter sells components to build data centers.

Both companies have enjoyed share price appreciation. Over the past 12 months through the week ending Nov. 28, Nebius stock has skyrocketed over 300%. Astera's shares rose 58% in that time, but that's still impressive performance.

This pair of AI stocks could see further growth as the industry expands in the coming years. Even so, one appears to be a better investment over the other. Here's a look at Nebius and Astera to find out which.

Image source: Getty Images.

A look at Nebius' AI infrastructure business

Artificial intelligence systems require tremendous computing power. This has led tech giants, such as Microsoft and Meta Platforms, to enter into multiyear contracts with Nebius.

The massive customer appetite for more compute has led to outsize sales growth. For instance, in the third quarter, Nebius' sales soared 355% year over year to $146.1 million. Demand was so strong, the company sold out of computing capacity in Q3.

Nebius is rushing to expand its infrastructure footprint. In November, it opened a new facility in the U.K. in support of the country's goal to grow computing capacity by a minimum of 20-fold by 2030.

While business expansion is a necessity to keep up with customer demand, it has come at a cost. Nebius racked up capital expenditures of $955.5 million in Q3. That's a huge jump up from its Q3 capex of $172.1 million in 2024.

To fund the construction of additional data centers, Nebius took on a ton of debt. It exited Q3 with over $4 billion in debt compared to just $6.1 million in 2024.

In addition, the company isn't profitable. In Q3, Nebius had a net loss of $119.6 million, up from a loss of $94.2 million in 2024.

NASDAQ: NBIS

Key Data Points

Digging into Astera Labs

Astera Labs is having a strong 2025 thanks to AI-related sales. Businesses building out data centers have gobbled up Astera's products, which are designed to deliver the kind of high-performance computing required for AI systems.

For example, the company achieved record Q3 revenue of $230.6 million, a 104% year-over-year increase. Astera expects its strong sales to continue into Q4, with revenue ranging between $245 million and $253 million. That would represent impressive growth over 2024's $141.1 million.

Not only is Astera enjoying sales growth, its business is profitable. Its Q3 net income was $91.1 million, which is a significant improvement over the prior year's net loss of $7.6 million.

Demand for the company's products is likely to remain robust. Industry forecasts predict AI infrastructure spending will grow from $59 billion in 2025 to $356 billion by 2032 as organizations, like Nebius, construct new data centers.

Adding to the tailwind of industry growth is Astera's acquisition of aiXscale Photonics. This strengthens the company's offerings by adding optical connectivity solutions to support the enormous bandwidth needs of AI systems.

NASDAQ: ALAB

Key Data Points

Choosing between Nebius and Astera Labs stock

While both Nebius and Astera are enjoying significant sales growth, the AI stock to invest in is Astera Labs. Not only does it possess stronger financials, Astera also sports a superior share price valuation.

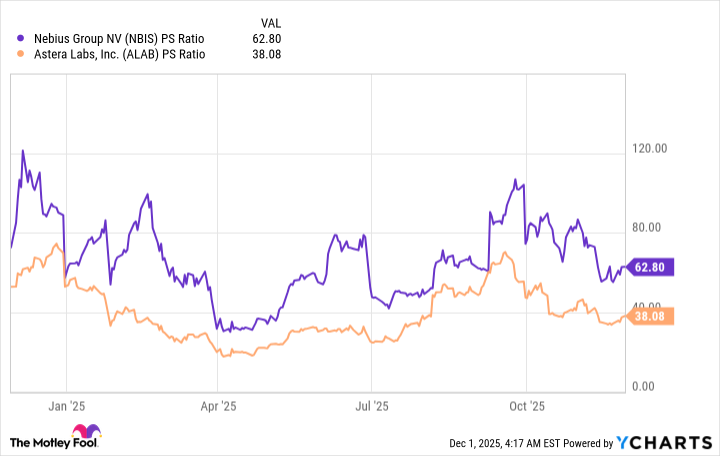

This can be assessed by looking at each stock's price-to-sales (P/S) ratio, which indicates how much investors are paying for every dollar of revenue generated over the past 12 months.

Data by YCharts.

The chart shows Astera's sales multiple has consistently remained below Nebius' over the past year, indicating Astera stock is a better value. Considering Nebius is unprofitable and it's accumulating a lot of debt very quickly, its higher valuation does not appear justified.

Moreover, to expand its business, Nebius must continue to pour funds into capex to add computing capacity. Astera does not have that kind of burden; its Q3 capex was $18.9 million, a slight increase from the prior year's $18.8 million.

Although both companies possess in-demand AI offerings, as a profitable business with superior financials and share price valuation, Astera Labs is a more attractive AI investment than Nebius.