The arrival of artificial intelligence (AI) has been a boon for ASML Holding (ASML +1.68%) and Nebius Group (NBIS +2.25%). Both are seeing sales growth as customers seek out their AI-related offerings.

ASML provides the extreme ultraviolet (EUV) lithography equipment necessary to manufacture the most advanced semiconductor chips, which are used in AI tech. Nebius operates data centers delivering the computing capacity needed to run AI systems.

While both businesses enable AI behind the scenes, one looks like the better investment in the artificial intelligence field. Let's examine ASML and Nebius to understand which one and why.

Image source: Getty Images.

Digging into ASML

Dutch company ASML is the only manufacturer in the world to offer EUV lithography. As a result, it possesses a monopoly legally. This position makes it an essential player in the AI ecosystem, and contributes to the company's forecasted 2025 full-year sales growth of 15% over 2024's 28.3 billion euros.

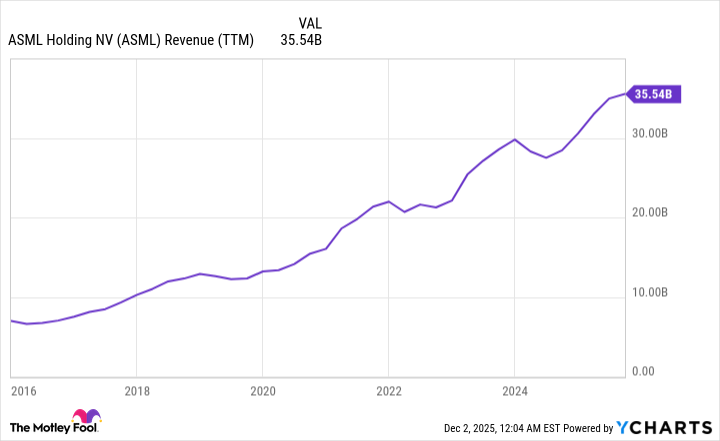

ASML's advantageous situation makes it a great company to invest in for a few reasons. While it's not immune to the cyclical nature of the semiconductor industry, it's been resilient, as demonstrated by progressively rising revenue over the years.

Data by YCharts.

This steady sales increase has resulted in a boon for shareholders in the form of robust diluted earnings per share (EPS) growth, especially over the last couple of years in the wake of artificial intelligence.

Data by YCharts.

The good news is that this EPS trend looks like it will continue in 2025. For example, in the third quarter, diluted EPS was 5.48 euros, up from 5.28 in the prior year. Moreover, ASML has reliably paid a dividend for years, and has stated it intends to grow the payout over time. For instance, back in 2021, the company's dividend totaled 5.50 euros per share, and that reached 6.40 euros in 2024.

As organizations around the globe ramp up AI adoption, demand for ASML's tech should remain strong. That said, management anticipates sales to China, one of the largest AI markets in the world, will slow down next year. However, overall AI demand is expected to offset the decline, meaning 2026 revenue should see growth over 2025.

NASDAQ: ASML

Key Data Points

Unpacking Nebius' pros and cons

Nebius offered data center computing capacity at just the right time to catch the AI tsunami. The company's facilities differ from typical cloud computing environments in that they are optimized for AI. This means tech specialized for massive data processing, high-speed networking components, and advanced cooling systems.

Because the company's data centers are optimized for AI, customers have flocked to its services. In fact, demand was so great, Nebius sold out of capacity in the third quarter.

The situation propelled the company's Q3 revenue to $146.1 million, a 355% year-over-year increase. Nebius estimates its 2025 full-year sales will reach between $500 million to $550 million, a substantial jump up from 2024's $117.5 million.

The company's challenge is spinning up more facilities fast enough to capture the current customer clamor for AI computing capacity. To do so, Nebius issued stock and took on debt. Both funding options hold negative consequences for shareholders. Equity offerings create share dilution, and the company executed two of these in the last three months.

Nebius' reliance on debt is concerning because the company's debt load has ballooned to over $4 billion in Q3, compared to about $6 million a year ago. And Nebius is pursuing more debt financing, which eventually could put it in serious financial trouble, as a growing portion of its income is diverted toward making debt payments rather than investing in the business.

Compounding this issue is the fact Nebius isn't profitable. It exited the third quarter with a net loss of $119.6 million, versus a loss of $94.2 million in 2024.

NASDAQ: NBIS

Key Data Points

Choosing between ASML and Nebius stocks

ASML's business performance this year helped its shares rise about 50% in the past 12 months through the week ended Nov. 28. Over that same time frame, Nebius saw its stock price skyrocket about 300%. This fact alone can make Nebius seem like a compelling investment.

But between this pair of AI tech businesses, ASML wins out as the better stock choice. It offers investors a stable, profitable tech company with consistent sales and EPS growth.

Another factor in ASML's favor is share price valuation. This can be assessed by looking at each stock's price-to-sales (P/S) ratio, which indicates how much investors are paying for every dollar of revenue generated over the past 12 months. Nebius' P/S multiple of 63 is nearly six times higher than ASML's 11, making it far more expensive. As an unprofitable business racking up enormous debt, Nebius' stock valuation is hard to justify.

ASML's stronger financials, better valuation, and key position in the AI ecosystem are among the factors making it the superior stock over Nebius to buy and hold for the long term.