When Peloton (PTON +3.41%) had its initial public offering (IPO) in September 2019, it had no idea just how good the timing would prove around six months later. When the COVID-19 pandemic forced a global shutdown, Peloton was in the right place at the right time to capitalize on fitness enthusiasts who could no longer go to a physical gym.

From its IPO through December 2020, Peloton's stock price rose by more than 540%, making it one of the hottest stocks on the market. Unfortunately, its stock is now down close to 95% from those highs. And, even more unfortunate for me, my (regretful) stake in Peloton is down more than 90% as I write this article.

There has been some semi-encouraging news coming from Peloton recently, but I can honestly say that it's a stock I wouldn't touch with a 10-foot pole, regardless of what positives it seems to be showing right now.

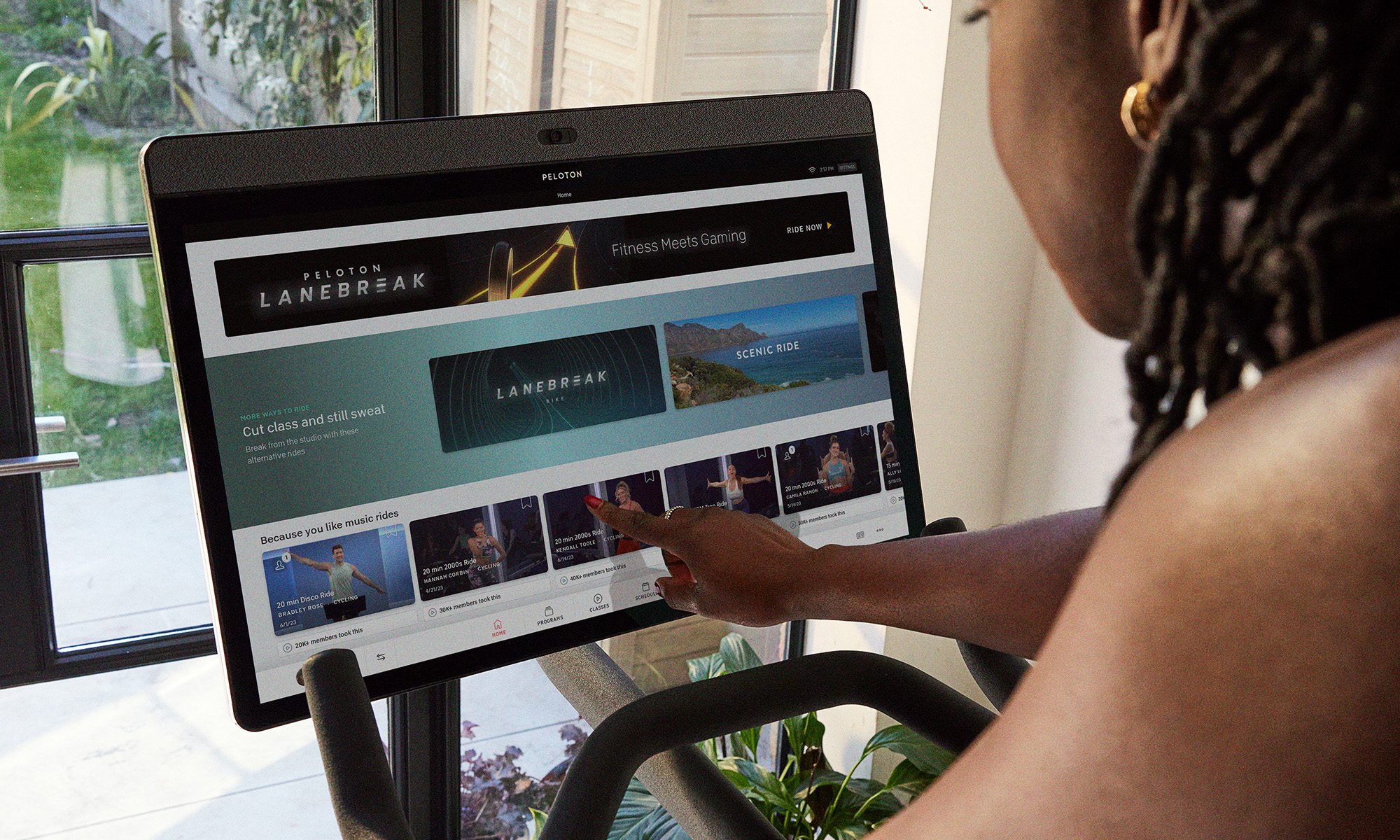

Image source: Peloton.

There's seemingly no true fix for Peloton's problems

Peloton's biggest issue is that it grew too fast and overestimated how much people loved its equipment and services, rather than being almost forced to embrace them because going to the gym wasn't an option at the time. There's a social aspect to the gym that simply can't be replicated at home, and after being on lockdown for so long, it was obviously something people missed.

NASDAQ: PTON

Key Data Points

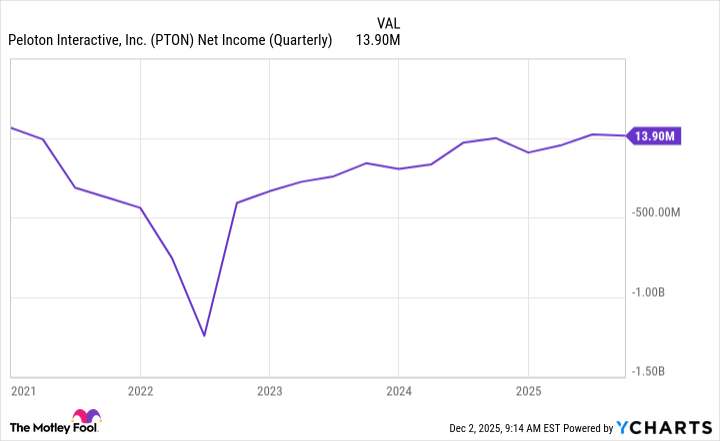

Peloton has tried numerous moves to drive demand back up. It has embraced partnerships, made a $420 million acquisition, tried offering rental services instead of only selling equipment, and is on its third CEO since going public just six years ago. The business shows slight signs of improvement (its net income was $14 million in its latest quarter), but it has a long way to go and hasn't moved the needle much on its stock price.

PTON Net Income (Quarterly) data by YCharts

Your money is better off invested elsewhere

Peloton seems to be stuck in a phase of let's just try this and see if it works, which isn't always bad when the subject is a company's side project or small experimental bet. However, that's a huge red flag when it's the company's core business model.

I haven't personally sold my Peloton shares because I eventually plan to use my losses for tax loss harvesting purposes, but it's a stock I wouldn't recommend to someone, especially considering the company doesn't seem to have a viable direction investors can rely on and get excited about.