When it comes to investing, one of the most important things someone can do is start. I often hear people say that they don't start because they feel they don't have enough money to make any meaningful investments, but that couldn't be further from the truth.

Any money invested is meaningful, regardless of how little it may seem. Whether it's $5, $20, or $50, beginning to invest is a way to not only put yourself in a position to grow that money but also to get used to the inner workings of the stock market.

And despite how confusing the market may seem, it can be quite simple. Many people have built wealth solely with exchange-traded funds (ETFs). These allow you to invest in dozens, hundreds, and sometimes thousands of companies at once, simplifying the process and removing the need to research individual companies.

Image source: Getty Images.

Lean into the power of dividends

If you're looking to start building wealth and have $50, my recommendation is a dividend ETF. If it works out (which it usually does over the long term), a dividend ETF gives you a double bonus: stock price appreciation and consistent payouts. And if it doesn't work out and the ETF hits a period of struggles, you still have the dividend payouts to help pad some of the paper losses.

Along with a dividend ETF, investors should strongly consider using their brokerage platform's dividend reinvestment plan (DRIP). Your brokerage platform takes the dividends you're paid and automatically uses them to buy more shares of whatever stock or ETF paid them.

For example, if you invest $50 in an ETF with a 3% yield, you could expect to receive $1.50 annually, or $0.375 quarterly, in dividends. With a DRIP, instead of receiving the $0.375 in cash each quarter, it would buy $0.375 more of that specific ETF.

In most cases, the cash payouts you receive from dividend ETFs won't move the needle until you have accumulated a good amount of shares. That's why focusing on using dividend payouts to acquire more shares can be more impactful in the long term.

What dividend ETF should you consider?

There's no shortage of dividend ETFs. Some focus on companies with high dividend yields, while others seek out dividend appreciation. And some ETFs look at how long a company has been paying dividends. For someone just starting, a great go-to option is the Schwab U.S. Dividend Equity ETF (SCHD +0.18%).

NYSEMKT: SCHD

Key Data Points

This ETF requires that companies have at least 10 years of dividend payouts and healthy financials, so when you invest in it, you know you're getting high-quality companies. Its criteria do a lot of the vetting for you, making your job much easier. All you need to do is invest consistently (ideally) and let time and dividend reinvestment lead to compound earnings.

Compounding occurs when the money you make from investments begins to make money on itself. It's a lucrative cycle that can take relatively small sums and turn them into much larger amounts, which is why using a DRIP can be so efficient at building wealth. It speeds up the process.

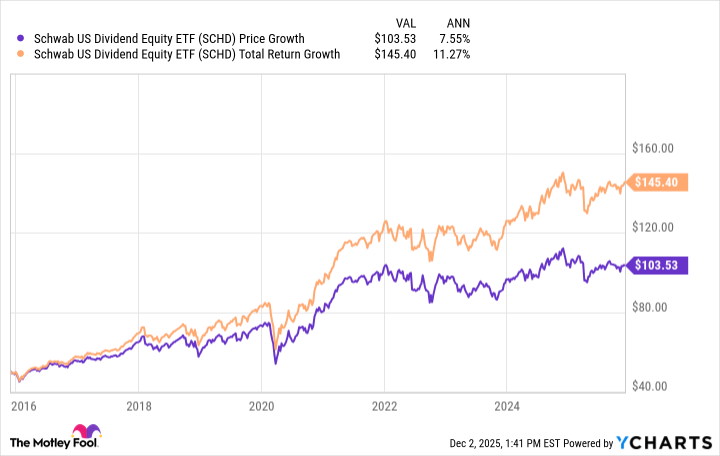

For many dividend ETFs, the payouts account for a good portion of their total returns. Let's take the Schwab U.S. Dividend Equity ETF, for example. Over the past decade, its share price is up 107%, meaning a $50 investment then would be worth $103.50 now. However, when you account for dividends, the returns over that span jump to 190%, making a $50 investment worth $145.

These dollar amounts may seem small, but you have to start somewhere. As you continue to add to your investments and let time and compounding work their magic, you'll likely be surprised at just how effective this can be. It's a much better alternative than having cash that you don't need for emergencies sitting around and losing purchasing power to inflation.