The hot field of artificial intelligence (AI) has boosted the fortunes of many businesses. Perhaps the most famous example is semiconductor chip leader Nvidia. It's a great AI company to invest in, but far from the only one.

Another compelling AI stock to consider is Taiwan Semiconductor Manufacturing (TSM +0.22%), commonly referred to as TSMC. Nvidia is one of its customers, as is major Nvidia competitor AMD.

Many reasons make TSMC a top AI stock to buy now. Here's a look at some of them to explain why it's a worthwhile investment.

Image source: Getty Images.

TSMC's AI-fueled success

TSMC plays a critical role in the AI industry. It manufactures the advanced semiconductor chips sold by Nvidia and AMD, and is the world's leading foundry in this area.

As a result, TSMC's sales are soaring. In the third quarter, the company reported revenue of 989.9 billion New Taiwan dollars ($33.1 billion), an impressive 30% year-over-year increase. This contributed to 39% year-over-year growth in diluted earnings per share (EPS) to 17.44 New Taiwan dollars ($2.92).

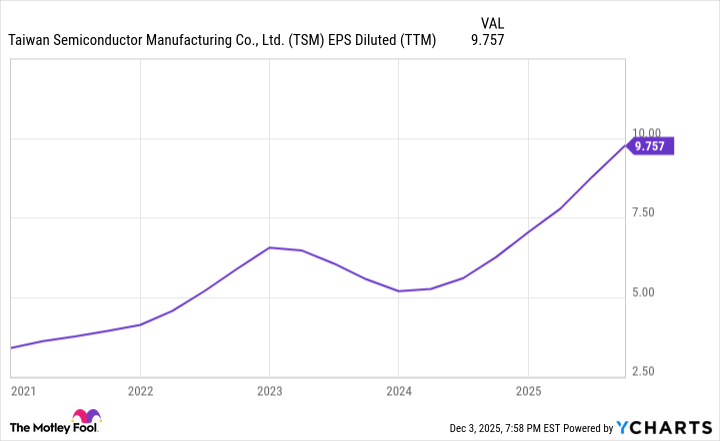

In fact, with the advent of AI, shareholders have been rewarded by TSMC's rising EPS over the past few years.

Data by YCharts.

Given its AI chip manufacturing leadership, TSMC is well-positioned to see continued growth. The customer demand is such that the company is building three new foundries in the U.S., as well as packaging and R&D facilities, totaling a $165 billion investment.

NYSE: TSM

Key Data Points

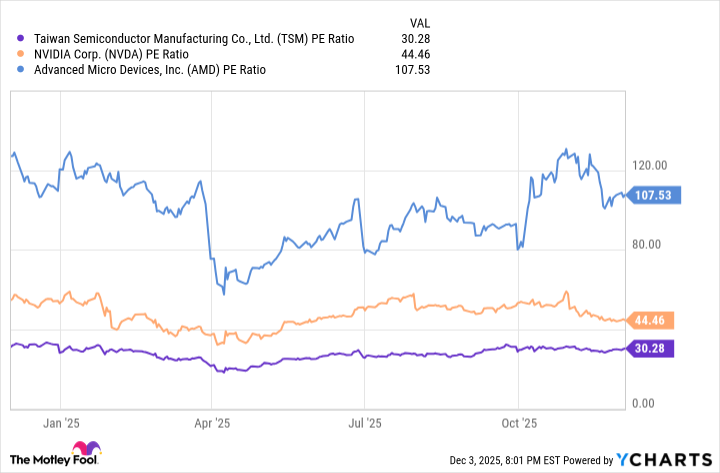

TSMC stock is a buy now because of its share price valuation. Its price-to-earnings (P/E) ratio is notably lower than both Nvidia and AMD.

Data by YCharts.

This indicates TSMC shares possess an attractive valuation compared to its prominent AI peers. It's also far more reasonable than rival Intel, which has a P/E multiple exceeding 4,000.

Combined with growing sales, EPS, and ongoing business expansion, TSMC looks like a great AI investment for the long term.