Nebius Group (NBIS 5.33%) has made investors significantly richer in the past year. An investment of just $100 in shares of this neocloud company is now worth just over $266.

The 166% gains that Nebius achieved during this period have been fueled by the growing demand for artificial intelligence (AI) computing power in data centers. It's in the business of setting up dedicated AI data centers equipped with powerful graphics processing units (GPUs) from Nvidia, as well as server processors from AMD and Intel, to deliver high-performance computing.

But can the company sustain its red-hot rally in the coming year, especially considering concerns about the heavy spending on AI infrastructure? Let's find out.

Image source: Getty Images.

Nebius' business model should supercharge its growth next year

Nebius rents out its computing power to customers that require it to run AI workloads, store AI-related data in the cloud, train large language models (LLMs), develop custom AI solutions, and execute AI inference solutions. More importantly, the company goes beyond just providing the hardware. It is a full-stack AI company offering managed software services that enable customers to build and fine-tune models and inference applications.

NASDAQ: NBIS

Key Data Points

As such, it is in a position to capitalize on two key aspects of the AI market.

First, hyperscalers and AI companies are seeking to acquire computing power to run AI workloads in the cloud. There is a deficit in available AI computing power, which is why major cloud computing companies aren't able to fulfill their contracts. As a result, the contractual backlogs of these companies have skyrocketed.

Second, an increasing number of businesses, governments, and AI companies are likely to develop and deploy AI applications, both for their in-house use and for customers. That's because the technology is driving productivity gains for companies adopting it. Market research firm IDC estimates that each $1 spent on AI in 2030 could generate $4.60 in value.

This should pave the way for Nebius to keep growing at a blistering pace in the coming year, given the full-stack nature of its services. Its revenue in the first nine months of 2025 shot up by 437% to $302 million. Moreover, Nebius also reduced its adjusted net loss by 61% during this period to $170 million.

Management expects to achieve annualized run-rate revenue of $7 billion to $9 billion by the end of 2026. It calculates this metric by multiplying the revenue in the final month of the quarter by 12. This means sales in December 2026 could be as high as $750 million. That's significantly higher than what the company has generated so far in 2025.

For comparison, Nebius is expected to close 2025 with $556 million in revenue, up by 374% from last year. Analysts expect an acceleration in its top-line growth to $3.3 billion in 2026.

Nebius' revenue, therefore, could jump sixfold next year. This ambitious target seems achievable because the company has landed a couple of huge contracts from Meta Platforms and Microsoft that are likely to supercharge its growth in 2026. These two companies alone have created a revenue backlog of more than $20 billion for the company.

As a result, Nebius now plans to increase its connected data center capacity to a range of 800 megawatts (MW) to 1 gigawatt by the end of 2026. That would be a major increase over the 220 MW of connected power that it's projecting by the end of 2025. This major capacity expansion should support the incredible revenue growth that analysts are expecting from the company next year.

But will this blistering growth be enough to send the stock higher?

Investors may be worried about one thing

The stock's stunning rally in the past year is the reason it's now trading at a costly 65 times sales. That's way higher than the U.S. technology sector's average price-to-sales ratio (P/S) of 9.

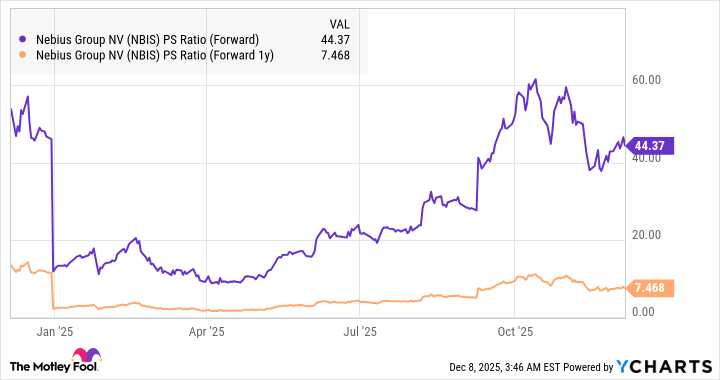

But then, Nebius' red-hot growth, which is set to get better next year, justifies its valuation. In fact, the company's forward sales multiples are significantly lower due to the huge growth that it is expected to deliver.

NBIS PS Ratio (Forward) data by YCharts.

Even if Nebius trades at a significantly discounted 10 times sales (almost in line with the tech sector's average) next year and delivers $3.3 billion in revenue, its market cap could hit $33 billion. That points toward potential gains of 33% from current levels. However, this AI stock could deliver more than that since it is likely to enjoy a premium valuation due to its huge backlog, which could help it beat Wall Street's revenue expectations for 2026.