For most investors interested in growth opportunities, their mind goes to tech stocks. Given how the tech sector has performed over the last decade or so, it's easy to see why this is the case. Overall, it has outperformed all of the other major sectors of the U.S. economy.

Hitting it big on an individual tech stock can get you life-changing money, but it doesn't take that to make good money from the tech sector. Many tech-focused exchange-traded funds (ETFs) can also be lucrative choices, with much less risk.

As we head into 2026, there's one ETF that seems like a good choice, while there's one in particular I would avoid right now.

Image source: Getty Images.

The tech ETF to embrace going into 2026

The Invesco Nasdaq 100 ETF (QQQM +0.32%) is a relatively new ETF (launched in 2020) that tracks the Nasdaq-100 index. The Nasdaq-100 contains the 100 largest non-financial stocks on the Nasdaq stock exchange and is essentially a subset of the much broader Nasdaq Composite.

QQQM is essentially the same as its predecessor, the Invesco QQQ Trust ETF (QQQ +0.32%), but a key difference is that QQQM's expense ratio is 0.15% compared to QQQ's 0.20%. The differences seem slight on paper, but if you're a long-term investor, it could easily add up to hundreds or thousands in differences in fees paid, depending on your investment amounts and returns.

NASDAQ: QQQM

Key Data Points

Since the Nasdaq-100 contains companies from other sectors, QQQM isn't a pure-play tech ETF. However, the tech sector is by far the most represented, accounting for 65% of the ETF. The top five sectors are rounded out with consumer discretionary (17.6%), healthcare (4.9%), telecommunications (3.5%), and industrials (3.2%).

When you invest in QQQM, you know you're getting exposure to some of the top tech companies in the world (though it only contains U.S. companies), spanning many different industries. You get exposure to key AI hardware players in Nvidia and Broadcom; cloud computing giants in Amazon, Microsoft, and Alphabet; a consumer hardware king in Apple; and emerging software companies like Palantir Technologies, Shopify, CrowdStrike, and plenty of others.

In many cases, these companies have their hands in many different tech industries, so you know you're covering a lot of ground with a single investment. You get tech giants to lead the way, while hedging with other sectors in case the tech sector experiences a hiccup along the way (which isn't far-fetched).

The tech ETF I'm avoiding right now

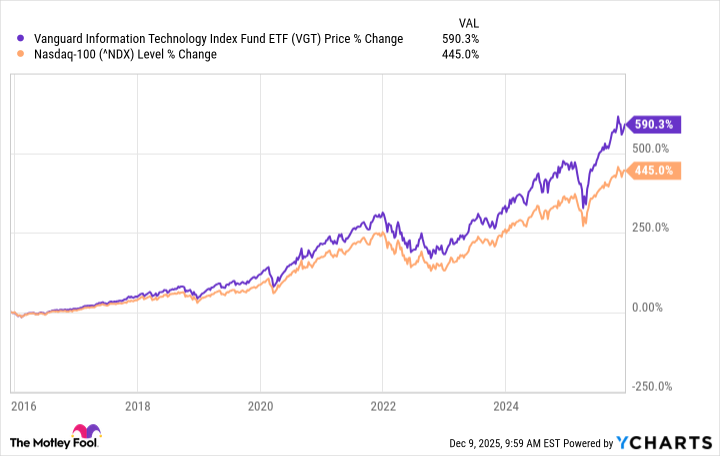

The Vanguard Information Technology (VGT +0.10%) has produced some great returns over the past decade. In fact, it has outperformed the Nasdaq-100 during that time. I'll be the first to admit it's a good ETF that holds some top-tier companies.

Unfortunately, the problem with VGT is its concentration in three stocks: Nvidia, Apple, and Microsoft. Together, they account for over 45% of VGT, comprising 18.2%, 14.3%, and 12.9%, respectively.

To be fair, the high concentration is why it has produced strong returns in recent years; however, expecting those returns to continue is essentially betting on those three companies maintaining their winning streak. Of course, they can, but if I'm investing in a tech ETF, I would want my investment to be spread across a broader part of the tech spectrum. Which brings us to the next reason I'm avoiding VGT heading into 2026.

VGT only holds companies in the information technology (tech) sector, which means it excludes some key tech companies that are categorized differently because of how the stock market officially defines them. Most notably, VGT doesn't include Amazon (consumer discretionary sector), Alphabet (communication services sector), or Meta Platforms (communication services sector).

Going into the new year, those are undoubtedly companies I'd want in an ETF I invest in to gain exposure to the tech world. They may technically belong in those other sectors, but it's hard to suggest that they are not tech companies.