Throughout the artificial intelligence (AI) revolution, investors have primarily turned to companies that develop semiconductors, data centers, and cloud computing software for growth opportunities.

But as most investors still chase GPUs and infrastructure, a new pocket of the digital realm is beginning to show its potential: quantum computing. While tech megacaps such as Microsoft, Amazon, Alphabet, and Nvidia are also exploring quantum computing, it's the pure-play stocks in the space that have witnessed the most action -- in particular, IonQ, Rigetti Computing, and D-Wave Quantum (QBTS 6.72%).

D-Wave's approach to building quantum computers is unusual, but it has potential. Could investors be overlooking the next big thing in the tech space?

NYSE: QBTS

Key Data Points

What makes D-Wave Quantum different from the competition?

It's important for investors to first understand that quantum computing does not yet have meaningful commercial applications. Rather, the technology is heavily funded by research and development budgets and remains primarily an exploratory pursuit used in niche services.

Moreover, while the underlying principles that allow the tech to work are the same, there is no one-size-fits-all approach to building quantum computing architectures. For instance, IonQ uses a trapped ion qubit system, while Rigetti is using superconducting qubits.

D-Wave, on the other hand, uses an approach called quantum annealing. As the company's website explains: "Quantum annealers are quantum computers that you initialize in a low-energy state and gradually introduce the parameters of a problem you wish to solve. The slow change makes it likely that the system ends in a low-energy state of the problem, which corresponds to an optimal solution." So it may not produce the very best answer, but it will produce one of them.

Unlike those of its peers, D-Wave's quantum computers are less purpose-built, and should be best suited to optimization-based applications across supply chains, manufacturing, and logistics. This means that they could be useful in areas such as workforce and production scheduling, resource optimization, cargo loading, and logistics routing.

Image source: Getty Images.

What are the biggest risks to an investment in D-Wave Quantum?

One of the biggest risks surrounding an investment in D-Wave is the company's underlying approach. If quantum annealing proves less useful at scale than rival gate-based hardware designs, then D-Wave will likely achieve less commercial adoption.

However, the more obvious risk is the sustainability of its financial profile.

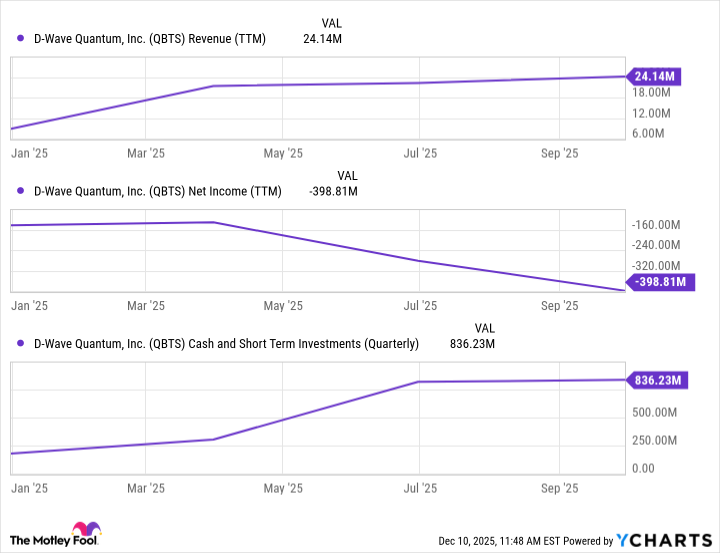

QBTS Revenue (TTM) data by YCharts.

While the company has found a bit of traction in terms of revenue, it's absolutely hemorrhaging cash. What some may find a bit confusing at first is that a company with only $24 million in sales and nearly $400 million in annual losses boasts nearly $1 billion in cash on its balance sheet. How is this possible?

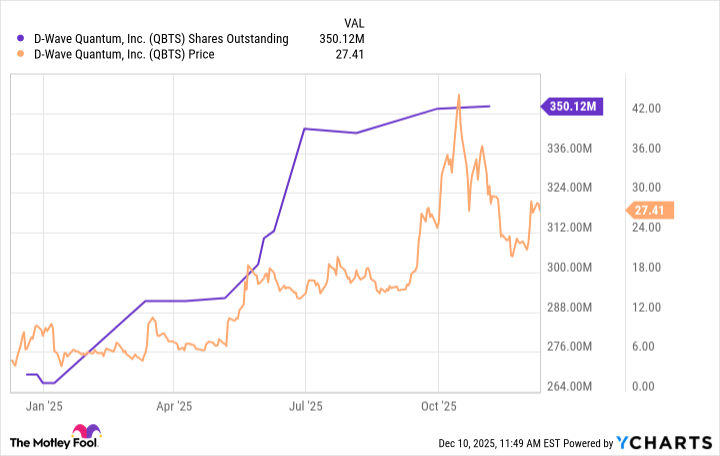

The answer is simple: Over the last year, D-Wave has taken advantage of its outsized share price momentum and repeatedly issued new stock at premium valuations to raise cash. The company's outstanding share count has ballooned, meaningfully diluting shareholders.

QBTS Shares Outstanding data by YCharts.

Should you invest in D-Wave Quantum stock?

D-Wave's current price-to-sales ratio of 331 is well above what investors witnessed among tech stocks even during the peak euphoria of the dot-com bubble. And as is well known, many early darlings of the internet were not able to sustain their frothy valuations when the exuberance evaporated, and their stock prices cratered. Given these dynamics and the patterns of history, I think quantum computing stocks -- including D-Wave -- are headed for an epic bubble-busting event in the near future.

Furthermore, even as the company was issuing stock at premium valuations throughout 2025, several members of D-Wave's leadership team and board of directors were cashing out and selling shares. To me, this is a potential signal that management may not be fully confident in the company's long-term trajectory.

While D-Wave's specific approach to building quantum AI applications could be underappreciated, with the stock trading at a massively speculative premium, it's hard to say that the stock has been glossed over.

D-Wave is a speculative stock that would be best avoided by the average retail investor. Leave the attempts to ride its share price momentum to risk-seeking day traders.