One of the hottest themes within the greater artificial intelligence (AI) landscape is quantum computing. In 2025, shares of quantum AI pure plays D-Wave Quantum and Rigetti Computing have soared by 232% and 78%, respectively. In addition, the largest pure-play, IonQ, has gained a respectable 27% on the year.

One quantum computing stock that hasn't fared as well as its peers is the aptly named Quantum Computing Inc. (QUBT +4.34%). With shares down 23% this year and nearly 50% below all-time highs, could Quantum Computing stock be poised for a comeback in 2026?

NASDAQ: QUBT

Key Data Points

Why is Quantum Computing Inc. stock selling off?

If you take a look at Quantum Computing's investor presentation, you'd think the company is up to something big. According to management, the total addressable market (TAM) for the company's specific area of quantum computing -- photonic integrated circuits -- could be worth $66 billion by 2032.

Moreover, the company believes its technology has applications across several critical industries including healthcare, financial services, defense, supply chains, energy management, and autonomous vehicles. With such ubiquitous use cases, perhaps this is why the likes of NASA, Accenture, BMW, and Big Four accounting firm EY have partnered with Quantum Computing.

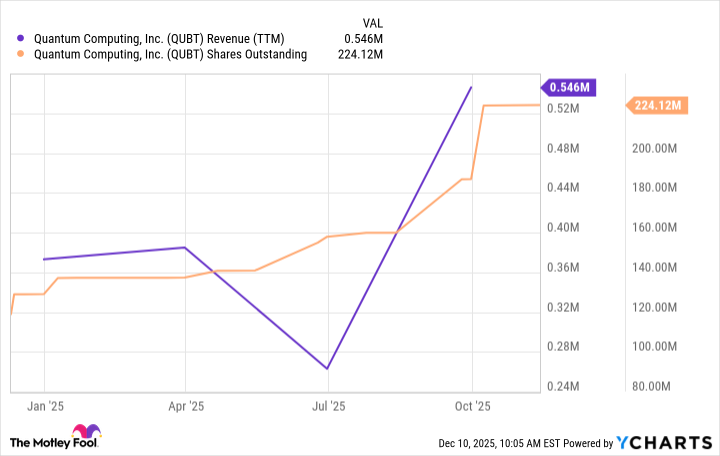

While these details are nice to read about it, I think the sell-off in Quantum Computing stock can be summed up in one picture:

QUBT Revenue (TTM) data by YCharts

Over the past year, Quantum Computing has only generated about $500,000 in revenue. Meanwhile, the company's outstanding share count has almost doubled.

Despite its best marketing efforts, Quantum Computing has virtually no real business traction at the enterprise level. Given its nominal sales base, the company has been forced to issue stock in order to raise capital and continue funding its product roadmap.

In the long run, this type of strategy is unsustainable. Given the sell-off in Quantum Computing stock, I think investors are becoming tired of the dilution and increasingly demanding that growth comes from commercial adoption of the company's supposed revolutionary technology.

Image source: Getty Images.

Is Quantum Computing stock a buy?

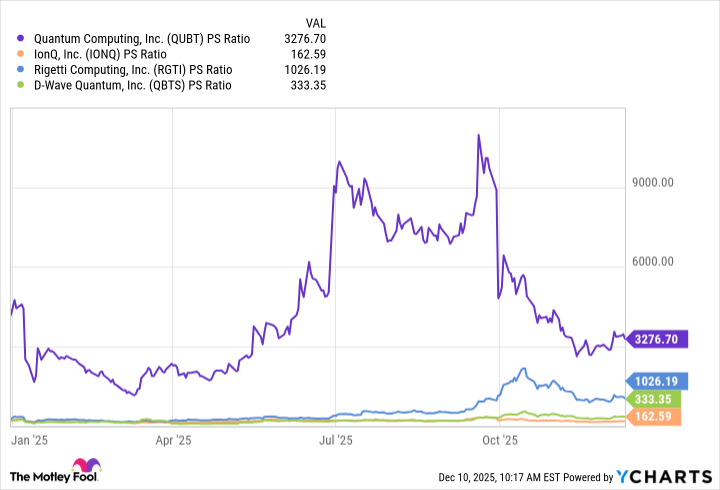

With shares plummeting relative to its peers, some investors may fall for the idea that now is a good time to buy the dip in Quantum Computing stock. After all, shares are "just" $12. Smart investors understand that looking at a stock price in isolation reveals little about a company's underlying valuation, though.

Even with the sell-off, Quantum Computing boasts a market capitalization of $2.8 billion. This represents an unjustifiably high price-to-sales (P/S) ratio of nearly 3,300. In fact, Quantum Computing trades at the biggest premium among its cohorts, and yet the company is the smallest in terms of revenue.

QUBT PS Ratio data by YCharts

Buying shares of Quantum Computing now because you think the stock is cheap would be falling for a value trap.

Could a rebound be in store for Quantum Computing stock?

To me, owning Quantum Computing stock is too speculative. Should shares experience a rebound, my suspicion is that these movements would be driven more by narratives and headlines rather than any concrete progress from Quantum Computing's business itself. As such, any increases in the stock price would likely feature fleeting momentum and could plummet once again.

I see Quantum Computing as a meme stock that was once favored by day traders. Ultimately, I think shares of Quantum Computing are headed for further selling pressure and should be avoided by prudent investors.

By contrast, investors with a long-term time horizon who are interested in the quantum AI opportunity are looking elsewhere, Amazon, Alphabet, Microsoft, International Business Machines, and Nvidia being top options.

Unlike the pure plays, big tech presents investors with some exposure to the quantum computing movement while also addressing other established fields in the AI market, too. This level of diversification allows investors to benefit from the upside of quantum computing while also gaining exposure to other durable AI opportunities as well.