Exchange-traded funds (ETFs) can be incredibly powerful investments for building long-term wealth. The right ETF can diversify your portfolio, limit risk, and even generate a source of passive income.

As we head into 2026, now is a smart time to consider expanding your portfolio. Whether you're nervous about potential market volatility or simply want a few surefire investments that are very likely to perform well over time, these three Vanguard funds can be fantastic buys right now.

Image source: Getty Images.

1. Vanguard S&P 500 ETF

A staple in many investors' portfolios, the Vanguard S&P 500 ETF (VOO 0.02%) is one of the most popular ETFs for a reason. It tracks the S&P 500 index (^GSPC 0.01%), containing around 500 stocks from the largest and most established U.S. companies.

The S&P 500 ETF is a smart choice for investors looking to mitigate risk, as the index itself is all but guaranteed to survive periods of volatility. In fact, analysis from Crestmont Research found that throughout the S&P 500's history, there has never been a 20-year period in which the index experienced negative total returns.

To be clear, this doesn't mean an S&P 500 ETF won't experience ups and downs in the short term. But given a decade or two, it's incredibly likely to recover from even severe recessions or bear markets.

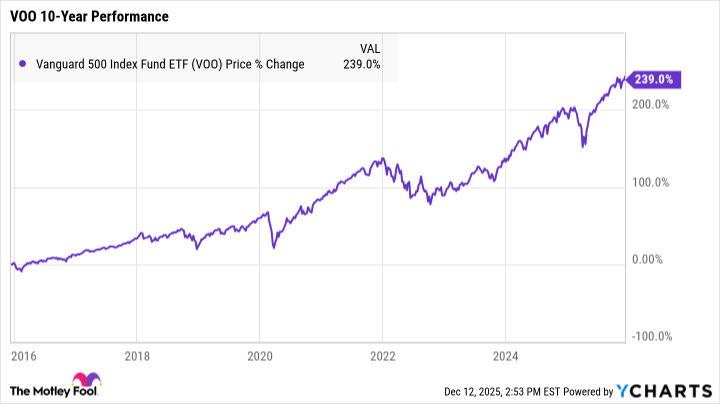

Over the last 10 years alone, the Vanguard S&P 500 ETF has earned total returns of 239%, as of this writing. If you'd invested $5,000 a decade ago, you'd have close to $17,000 by today -- more than tripling your money with next to no effort on your part.

2. Vanguard Total Stock Market ETF

If you're looking for the relative safety of an S&P 500 ETF but with even more diversification, the Vanguard Total Stock Market ETF (VTI 0.06%) may be a good choice. This ETF aims to encompass the stock market as a whole, with 3,531 stocks from corporations of all sizes across every industry. By owning just one share of this ETF, you're essentially buying a slice of the entire stock market with a single investment.

Like the S&P 500 ETF, a primary advantage of this fund is its ability to recover from market turbulence. The market as a whole has a perfect record of recovering from downturns, and that's unlikely to change anytime soon. In the event of a particularly severe recession, it could take years for the market to fully recover. But chances are good that it will bounce back eventually.

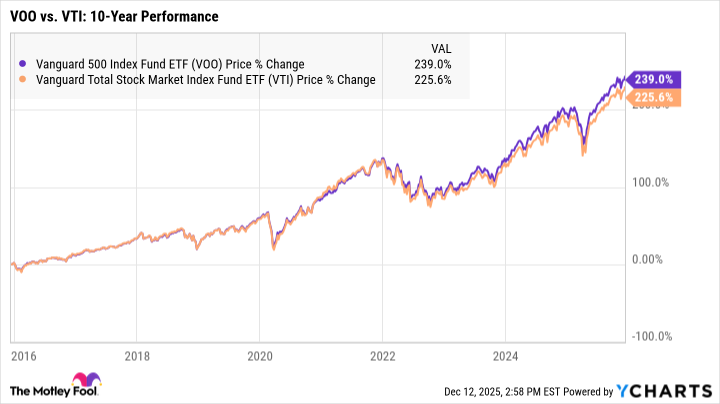

The Total Stock Market ETF has slightly underperformed the S&P 500 ETF over the last decade, with the biggest gap in performance over the last couple of years. That makes sense considering large stocks like Nvidia and Apple have been thriving throughout 2025. Because the S&P 500 contains only large-cap stocks, its narrower focus has enabled it to capitalize on those gains.

The Total Stock Market ETF's exposure to small-cap and mid-cap stocks can still give it an advantage in some cases, though. Typically, smaller corporations have more room for growth. If any of those smaller stocks experience explosive gains, this ETF could benefit from it.

3. Vanguard High Dividend Yield ETF

Investing in a dividend-paying ETF, like the Vanguard High Dividend Yield ETF (VYM +0.06%), can not only help you build wealth but also generate a substantial source of passive income over time. This ETF contains 566 stocks from companies with high dividend yields. It pays out quarterly dividends, and its most recent distribution was around $0.84 per share. While that may not seem like much, it adds up over time -- especially if you're consistently buying more shares.

Also, by reinvesting your dividends, it's easier to grow your passive income. The more you reinvest, the more shares you'll own. And the more shares you own, the more you'll receive in dividends and the more you can reinvest. Over time, it creates a snowball effect that could help you earn thousands of dollars per year in passive income.

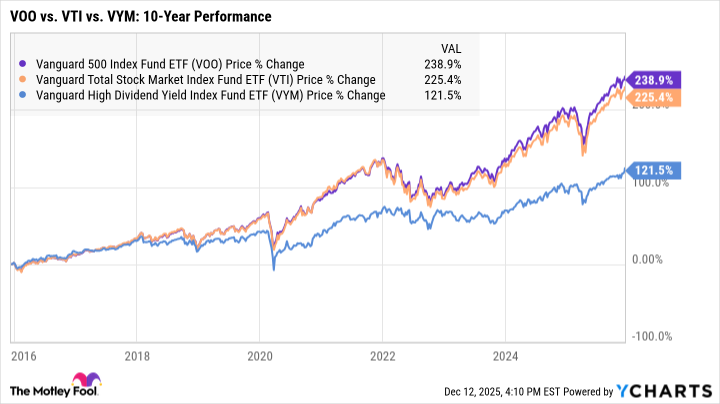

The Vanguard High Dividend Yield ETF has underperformed both the S&P 500 ETF and Total Stock Market ETF over the last decade. Again, though, its strength is its high dividend yield, not necessarily its returns. That dividend income can provide some cushion if your portfolio is hit during a market downturn.

ETFs can be fantastic low-maintenance investments for long-term investors. Over decades, the right fund can not only protect your finances but also help you build life-changing wealth.