Once upon a time, Netflix (NFLX +0.40%) shifted into second gear. The company dominated video rentals by then, essentially driving incumbents such as Blockbuster and Movie Gallery out of business. Digital video streams had been a free bonus for Netflix subscribers since 2007, but it was time to convert that free feature into a separate moneymaking business.

With 14 years of hindsight, it's easy to say that the streaming focus was the right idea. Netflix is a global media giant today, powered by an almost perfectly global digital video service. But this future wasn't obvious in 2011, and Netflix's management sure didn't handle the strategy switch perfectly. The Qwikster debacle drove share prices as much as 59% lower in less than three months.

If you had the foresight to buy more Netflix stock in that deep dip, you'd have some massive gains by now. The handful of shares I added at the end of October are up by 7,836% as of Dec. 11, 2025. It's a shame I didn't have $13,000 of investable cash to spare at the time -- that would have been worth more than a million dollars by now.

So, Netflix has a history of game-changing price gains. However, past returns don't say anything about future prospects. Can Netflix's stock still set you up for life if you invest, say, $13,000 in December 2025?

NASDAQ: NFLX

Key Data Points

A $34 trillion Netflix is not the plan here

First of all, it's unreasonable to expect Netflix to keep up its world-class growth for another decade and a half. My opportunistic buy in the Qwikster dip has seen a compound annual growth rate (CAGR) of 36.6% for 14 years. Repeating that performance would give Netflix a $34 trillion market cap by the year 2039.

The figure should be adjusted for inflation, stock dilution, moon phases, and so on, but that's still an outrageous target. A $13,000 Netflix investment today won't be worth $1,000,000 in 14 years. Honestly, you need lottery tickets and a date with Lady Luck to make a million that fast.

From scrappy disruptor to global profit engine

That being said, I see great value in Netflix right now.

This company was a very different beast in 2011. Streaming media was a new idea, at least in terms of business-driving operations. Smartphones and broadband internet connections were nowhere near as readily available as they are now.

Today, Netflix sits on a global distribution platform, a deep content library, and a proven playbook for turning engagement into cash. It generates billions in free cash flow, has shifted from "growth at any cost" to disciplined, profitable expansion. The company still commands only a single-digit percentage share of TV viewing time even in its most mature markets, according to Nielsen data cited in October's Q3 report.

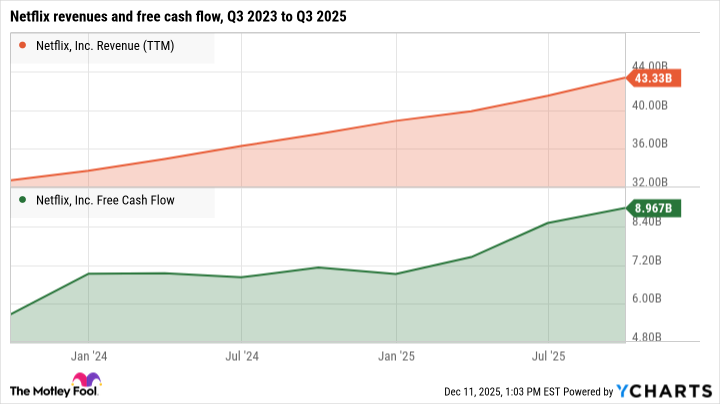

I mean, have you seen Netflix's revenue and cash flow trends in the last two years? Here you go:

NFLX Revenue (TTM) data by YCharts. TTM = trailing 12 months.

Sales are up by 32% over this two-year period, while free cash flows rose by 58%. Both figures are all-time highs. Netflix is a cash machine these days -- a sharp shift from its former focus on pure subscriber growth.

How Netflix could still help you reach $1 million in 30 years

I haven't even talked about the levers Netflix can pull to keep the growth story going. From video games and live sports coverage to culture-changing hits and real-world entertainment hubs, the company is getting busy with new ideas.

The hypergrowth days may be over. Still, Netflix should outperform the broader stock market in this new era of profitable entertainment sector dominance. Let's set a modestly market-beating target. Over the last 10 years, the S&P 500 (^GSPC 0.43%) delivered a CAGR of 14.9% (total returns, accounting for dividend payouts).

Imagine a sustained 16% growth rate for your $13,000 Netflix investment, barely ahead of the S&P 500. At that pace, you'll have $1.12 million in 30 years.

Image source: Netflix.

Mind you, my time machine is in for repairs again. The Warner Bros. Discovery buyout shenanigans fried my last flux capacitor. So, these are estimates, not rock-solid facts. Netflix could outperform my targets, speeding up your travel to a million dollars. Or it could fall short, slowing you down or making you settle for "only" half a million in 2055 at a 13% CAGR.

Either way, I'm confident that Netflix has lots of growth ahead, with or without Warner's assets. And the stock is down 21% in the last three months, despite rock-solid sales growth and even stronger cash profits. Including a healthy dose of Netflix stock in a diversified portfolio can indeed set you up for life, with reasonable expectations and a few decades' worth of patience.