The technology sector offers explosive long-term growth potential. Here's one strong piece of evidence for that claim: Over the past decade, the tech-heavy Nasdaq Composite has performed much better than the S&P 500 and the Dow Jones. Naturally, there are plenty of excellent tech stocks available.

Determining the best tech stock to own through 2035 will vary depending on each investor's preferences, risk tolerance, starting capital, and other factors. However, one of my favorites is none other than Google parent Alphabet (GOOG 0.73%) (GOOGL 0.79%).

Let's consider several reasons why.

Image source: Getty Images.

A leader in artificial intelligence

What trends will drive the tech sector forward in the next decade? The best candidate is arguably artificial intelligence (AI). Since the release of ChatGPT, AI has taken over the world. This isn't just some fleeting trend that will fade away in another year or two. Corporations are actively implementing AI in their day-to-day operations. Some are already seeing a material impact on their financial results. The companies at the forefront of this industry could reap immense financial benefits for themselves -- and their shareholders -- in the next decade.

Alphabet is establishing itself as a leader in this area. The company's latest GenAI chatbot, Gemini 3, was well received by the market as it is increasingly seen as a worthy competitor to OpenAI's ChatGPT.

NASDAQ: GOOGL

Key Data Points

Alphabet offers its Gemini models through its Google Cloud platform, in addition to subscriptions to the chatbot for individuals. There is fierce competition here, but Alphabet is faring relatively well -- and it could continue to do so.

Beyond that, Alphabet has also been successful at working AI into its products to protect its market share. The company's famous search engine now features AI overviews and an AI mode designed to retain search volume within its ecosystem, rather than losing it to ChatGPT. The result is that Alphabet's core advertising business remains strong.

Alphabet's revenue in the third quarter was $102.3 billion, 16% higher than the year-ago period. Advertising made up the bulk of total sales. And make no mistake: AI-powered initiatives throughout the company's products, as well as the AI-based services it offers through the cloud, will be powerful growth drivers for Alphabet through 2035.

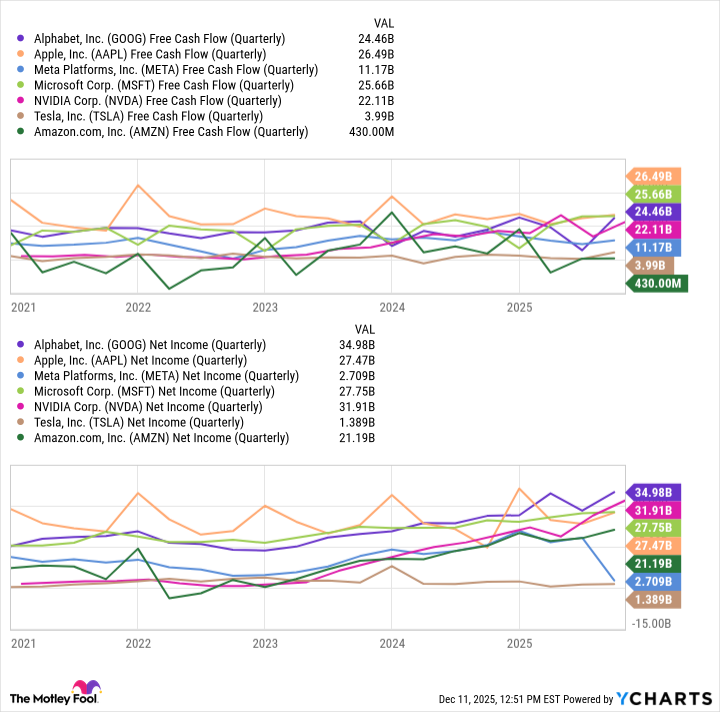

The most profitable among the "Magnificent Seven"

The "Magnificent Seven" is a group of tech -- or tech-adjacent -- companies, all of which are among the largest and most profitable in the world. Alphabet is part of this clique, and the Google parent has a claim to fame: As of the latest quarter, it generates higher profits than all its peers. True, the net income figure has some drawbacks, but when paired with free cash flow -- where Alphabet ranked third in this group as of the latest period -- we can have a far more accurate picture of a company's financial health.

GOOG Free Cash Flow (Quarterly) data by YCharts

Alphabet's strong standing among its peers in these departments means it has ample opportunities to reinvest in the business and pursue lucrative growth opportunities. That's what it is already doing with AI.

Alphabet also has less important segments that could make some progress in the next decade. That's the case with the company's autonomous vehicle segment, Waymo. Will this business meaningfully impact Alphabet's results by 2035? Maybe not. However, the point is that Alphabet's strong earnings and cash flow grant it significant financial flexibility, which could allow it to pounce on new profitable markets over the next decade.

Warren Buffett jumped on the bandwagon

Warren Buffett has historically been cautious about investing in tech companies. But some of his and his team's picks here have been winners. That's particularly the case with Apple, which has delivered amazing returns since Berkshire Hathaway first initiated a position back in 2016. The conglomerate recently acquired shares of Alphabet, making it its 11th-largest holding.

We don't know whether it was Buffett himself (who is about to retire) or one of his investing lieutenants who made the call. Whatever the case may be, Berkshire Hathaway has some of the most brilliant investing minds in the world and a long-term investment horizon. Perhaps we shouldn't expect Alphabet to perform well through 2035 solely because Buffett thinks it will, but the tech giant's underlying business, excellent financial results, economic moat stemming from its brand name, network effects, and high switching costs all make a strong case for the company.

All these reasons suggest that Alphabet has a strong chance of being one of the best tech stocks to hold over the next decade.