For decades, Walmart (WMT +1.47%) has been a retail staple, with more than 10,000 stores across 19 countries. While retail remains its bread and butter, it's approaching the industry from a more modern direction, and it's been paying off for its business and stock.

Through Dec. 14, Walmart's stock is up more than 29%, outperforming the S&P 500 and putting the company on a path to join the trillion-dollar market cap club.

At the time of this writing, Walmart's market cap is $930 billion. To hit the trillion-dollar mark in 2026, its stock would need to grow by around 7.5%. If it's able to accomplish this (and the current trillion-dollar companies remain), it would be the 12th trillion-dollar public company, and only the third non-tech company.

Image source: Getty Images.

Going beyond just brick-and-mortar sales

Walmart became a household name through its brick-and-mortar retail stores, but the company is expanding well beyond that. After losing the initial e-commerce battle to Amazon, Walmart has begun closing the gap.

Amazon's e-commerce business took off because of the delivery convenience it provided through Amazon Prime. Order today, and you can expect a package at your doorstep within two days.

Walmart is mastering the same approach, but it has one thing working in its favor that Amazon doesn't: Walmart can use its thousands of stores as de facto delivery hubs, whereas Amazon has to rely on its regional fulfillment centers.

This allows Walmart to make same-day delivery in many cases and gives consumers a reason to choose it over Amazon. This may not matter for some orders, but for things like groceries, Walmart's speed can make a world of difference, especially in rural areas.

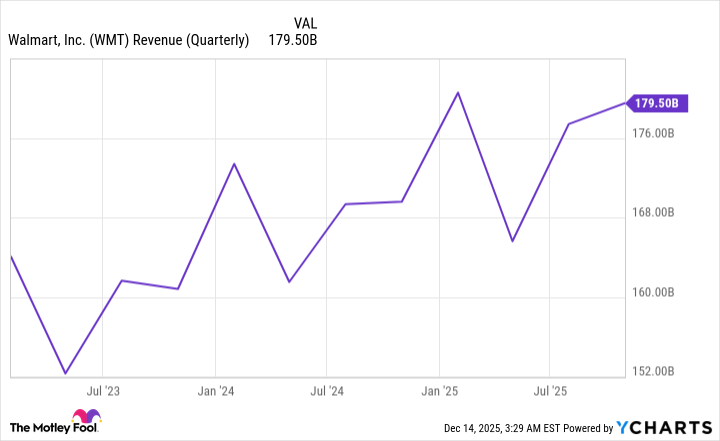

In its fiscal third quarter, Walmart's U.S. and global e-commerce revenue grew 28% and 27%, respectively, outpacing its total revenue growth (5.8%).

WMT Revenue (Quarterly) data by YCharts.

Advertising is bringing Walmart higher margins

The margins in retail are notoriously low, especially for Walmart, which generally prioritizes volume and low prices over higher margins. Selling $100 worth of goods may only bring a few dollars of profit in many cases. However, the company has been expanding its footprint in a much higher-margin business: advertising.

Walmart Connect is its advertising business, and it has been picking up steam. In the company's fiscal third quarter (ended Oct. 31), its global advertising grew 53%, while Walmart Connect in the U.S. grew 33%.

NASDAQ: WMT

Key Data Points

Advertising is a high-margin business because once the infrastructure is in place, it costs virtually nothing to sell and display another ad. And with the millions of people who shop at Walmart -- whether in person or online -- it has plenty of data to help advertisers with targeted campaigns.

In 2026, I expect Walmart's advertising revenue to continue to grow impressively. Its appeal should continue to increase, making it a go-to for advertisers looking for more eyes.

A dividend that you can count on

A Dividend King is a company that has increased its dividend annually for at least 50 consecutive years, and with 52 consecutive years of increases, it's a club that Walmart is proud to be a member of. The stock has had an impressive five-year run: up 138% compared to the S&P 500's 86% gains. But its dividend has long been a major selling point for investors looking for consistent income.

Its current quarterly payout is $0.235, with a yield just around 0.80%, so it's not a stock you come to for life-changing money. However, if you want reliability and consistency, Walmart's dividend provides that. You never have to second-guess it.

Walmart's stock doesn't come cheap

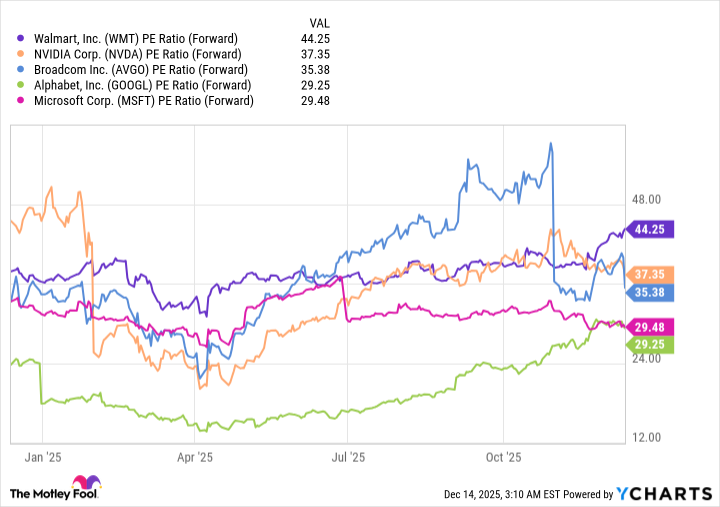

One thing working against Walmart is that its stock is priced fairly expensively by most standards. Its forward price-to-earnings ratio (P/E) is around 44.2, which is more than tech companies like Nvidia, Microsoft, Broadcom, and Alphabet.

WMT PE Ratio (Forward), data by YCharts.

This high forward P/E ratio is an indication that Walmart is no longer being priced like a legacy retailer; it's being priced like a high-growth tech stock. It still has what it takes to hit the trillion-dollar mark in 2026, but a high valuation leaves less room for error in most cases. That said, 7.5% gains through 2026 should be in Walmart's plans.