Many investors were shocked when Nvidia became the first company to achieve a $4 trillion market cap. The competition for the world's largest market cap was long a contest between Apple and Microsoft, so to see Nvidia emerge out of nowhere likely came as a surprise.

Now, the question is, which company is the next to achieve a $4 trillion market cap? Today, Apple has already achieved that, but instead of Microsoft (which previously reached that point before retreating), I believe another emerging company will be the next one to reach this milestone. Here's why.

Image source: Alphabet.

The next $4 trillion company

Today, the stock most likely to reach $4 trillion and stay above that point is Alphabet (GOOGL 0.07%) (GOOG 0.04%). Currently, its market cap is at $3.7 trillion, surpassing Microsoft's current $3.5 trillion market cap.

That choice may come as a surprise to some investors. As recently as spring 2025, the Google parent's market cap was under $2 trillion.

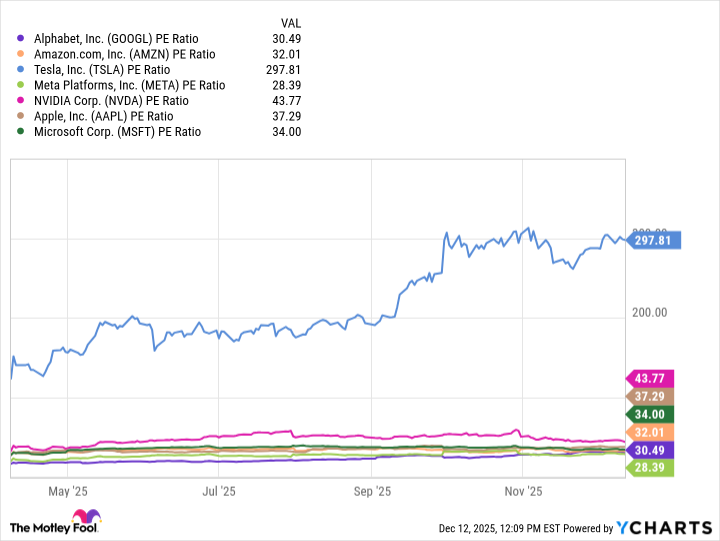

Data by YCharts.

Alphabet stock had long been smaller than many of its "Magnificent Seven" peers, as the rise of ChatGPT weighed on the stock. When GPT-4 came out in 2023, investors soured on Google Search, and its market share had fallen below 90% for the first time in decades.

At that point, not only did ChatGPT offer more thorough and concise results, but it bypassed the advertising ecosystem that had long served as the primary source of the Google parent's revenue.

The company released Google Gemini later that year. Still, Gemini did not initially stand out from the likes of Claude, Grok, Copilot, and numerous other AI platforms trying to unseat ChatGPT.

Also, investors should remember that Alphabet has long worked to reduce its dependence on advertising for revenue. In recent years, Google Cloud has claimed an increasing share of the revenue. Still, even though Alphabet was an early pioneer in artificial intelligence (AI), these efforts did not seem to impress investors.

What changed?

However, Alphabet has long benefited from a massive level of liquidity and considerable free cash flows. In late 2024, it pledged to spend $75 billion on capital expenditures (capex) in 2025, later raising that to the $91 billion-$93 billion range.

Much of that spending has gone into improving legacy products. Search now incorporates AI-driven results, and Google Cloud offers upgraded infrastructure, multimodality AI models, and new tools for developers. Additionally, AI should help to make Waymo a source of revenue as it seeks to compete in the autonomous driving space.

Nonetheless, it seems to be the release of Gemini 3 in November that has captured the most attention recently. With improved reasoning, coding, and multimodal understanding, some analysts claim it is "better than ChatGPT."

With that, the stock is up more than 60% over the last year, and more than 110% from its April low. Not surprisingly, almost half of that increase has occurred since October.

NASDAQ: GOOGL

Key Data Points

Moreover, despite these gains, it is the second-cheapest Magnificent Seven stock. Its P/E ratio of around 30 is undercut only by Meta Platforms, a stock trading at 28 times earnings. That comparative discount could give investors all the more reason to continue buying stock in the Google parent.

Data by YCharts.

Alphabet at $4 trillion (and beyond)

Between the relatively low valuation and the newfound success of Gemini 3, Alphabet appears likely to reach $4 trillion next.

Ultimately, investors like winners in cutting-edge technologies, and amid Alphabet's massive investments, having Gemini 3 perceived as "better than ChatGPT" positions Alphabet stock for higher moves.

Additionally, the AI pioneer is aggressively applying the technology to Google Cloud, and its efforts with Waymo could begin to bear fruit soon. As investors notice the stock as undervalued relative to peers, it continues to benefit from numerous tailwinds.

Amid such successes, Alphabet may not only reach $4 trillion, but could challenge Apple and Nvidia for the world's largest market cap.