Nu Holdings (NU +1.71%) is making waves in the fintech investment sector. Since the start of the year, the Latin American financial services company has surged 58%. The bank has done a stellar job of serving regions starved for quality, affordable banking services, leveraging its digital platform to connect with hundreds of millions of customers.

The company's stock performance reflects investor optimism about Nu's growth trajectory and future prospects. The bank has a large customer base to sell to and is targeting other markets ripe for disruption. Here are three reasons to invest in Nu Holdings today.

NYSE: NU

Key Data Points

1. Nu has seen tremendous growth in Brazil

For many years, Brazilian consumers faced a concentrated and predatory banking system dominated by just five banks. The situation was so severe that credit card interest rates reached 160%, and former finance minister Paulo Guedes described it as a "cartel."

Changes paved the way for Nu's neobank model. By operating a digital-only platform, Nu challenged the traditional banking model by offering free digital accounts and credit cards with no annual fees, attracting tens of millions of customers. Today, Nu serves more than 110 million customers in Brazil, or roughly 60% of the country's adult population.

Image source: Getty Images.

Nu currently holds multiple regulatory licenses, letting it offer products and services in payments, credit, financing, investments, and securities. However, Brazil has made regulatory changes restricting the use of the term "bank" by those without a banking license, so Nu is aiming to acquire a small bank in Brazil sometime next year.

Being a fully licensed bank provides legitimacy with consumers, especially in a market where trust in financial institutions is paramount. This license could also make it easier for Nu to access markets reserved for banks, thereby lowering its cost of capital.

2. It has a huge customer base to cross-sell to

Nu has a huge customer base of 127 million, and sees this as an opportunity to create value and cross-sell to those customers. It views this as a means to enhance the profitability and economics of its overall business. Nu offers a range of financial services, including lending, investments, and insurance. It also offers travel and cellular services, along with an integrated marketplace platform.

One way to assess how effective Nu is at cross-selling is to look at its average revenue per active customer (ARPAC). As customers adopt more of its products, the revenue per active user climbs. In the third quarter, Nu's ARPAC was $13.40, a 20% year-over-year increase on a foreign-exchange-neutral basis. For Nu's long-term customers who have been on the platform for eight years or more, the ARPAC was $27.30 as of the second quarter.

Nu's growing ARPAC demonstrates the long-term monetization potential as its customer base grows, matures, and adopts more of its products. This is a critical component that helps Nu grow efficiently and cost-effectively.

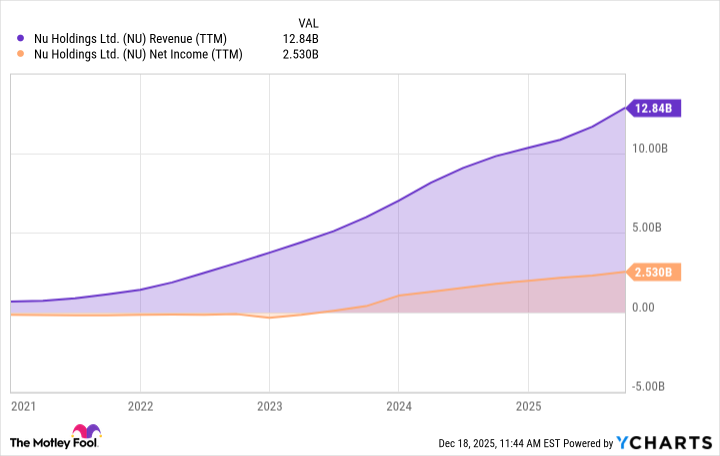

NU Revenue (TTM) data by YCharts.

3. Positive trends should fuel future growth

A positive trend for Nu is smartphone adoption, which is projected to reach 400 million users across Latin America. This digital-native population increasingly prefers mobile apps to physical bank branches, a trend Nu leverages through its low-cost, digital-first model.

Nu's growth in Brazil has been excellent, and the company has begun its expansion into Mexico and Colombia. These are two of the largest regions in Latin America, with significant numbers of unbanked or underbanked consumers. In Mexico, Nu has over 13 million customers, representing about 14% of the country's adult population. It is also approaching nearly 4 million customers in Colombia.

Nu Mexico has been approved to convert into a bank in Mexico and is currently completing the final steps. It previously operated as a Popular Financial Society (SOFIPO). Once fully authorized as a bank, it will be able to offer a broader product portfolio, including payroll accounts. It will also increase its deposit insurance coverage by 16-fold, allowing Nu to attract high-net-worth individuals.

But that's not all. In September, Nu Holdings applied to the Office of the Comptroller of the Currency for a charter to establish a de novo national bank in the U.S. The charter would let the company offer a range of products, including deposit accounts, credit cards, loans, and potentially digital asset custody, under a single federal regulator.

Nu has demonstrated excellent growth across Brazil and is making strides in Mexico and Colombia. The company is effectively leveraging its scale and cross-selling to drive efficient growth. If you're looking for an attractively priced growth stock, Nu Holdings, trading at 20 times next year's earnings, appears to be an excellent buy today.