BigBear.ai (BBAI 1.05%) is a popular artificial intelligence (AI) stock despite its small size. BigBear.ai has a market cap of less than $3 billion, which is why investors are so excited about it. The number of opportunities to invest in small-cap artificial intelligence stocks is fairly limited, boosting the popularity of the few that are available.

BigBear.ai is no exception, and many investors are wondering if the stock could double in 2026. I think that's wishful thinking, and investors must have a solid case for it to double, because hoping it will double isn't an investment strategy. So, does BigBear.ai have the potential to double? Let's find out.

Image source: Getty Images.

BigBear.ai recently closed on a smart acquisition

BigBear.ai is focused on providing government and government-adjacent clients with custom AI solutions. Its biggest contract is with the U.S. Army, and it's providing them with its Global Force Information Management-Objective Environment (GFIM-OE) system. This software will harness AI capabilities to ensure that the military is "properly manned, equipped, trained, and resourced" for whatever mission is at hand. That's a very specific contract, and there aren't many other repeat customers that can use this software.

NYSE: BBAI

Key Data Points

Another area where it has made a name for itself is airport security. Its facial recognition software can speed up international traveler processing, but once again, it's limited in other uses.

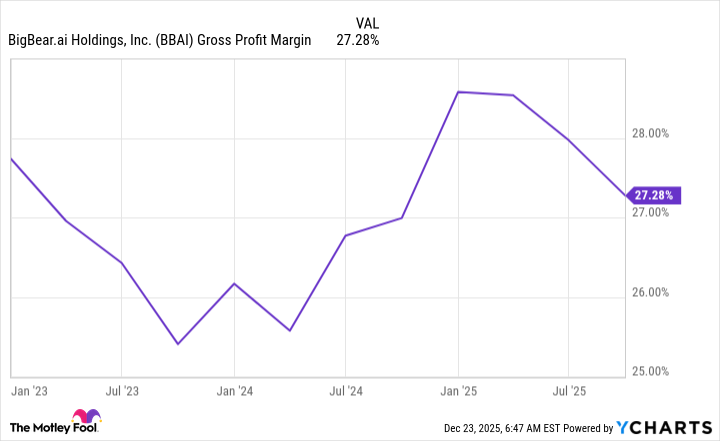

This makes BigBear.ai more of a consulting software company rather than a platform software company, as it's making custom software for each of its clients rather than offering a wide-use platform clients can build upon. This shows up in BigBear.ai's gross margin, as it's far lower than most of its software peers.

BBAI Gross Profit Margin data by YCharts

Most platform software companies have about an 80% gross margin, which gives them a far greater potential to produce strong profit margins later on. This is one ding on BigBear.ai's potential, but it recently made a smart move that could redeem itself.

In Q3, it announced the acquisitions of Ask Sage, a generative AI platform that's tailored toward national security or other high-security areas. This is a smart move by BigBear.ai, as it gives it a platform to offer clients rather than just building one solution. It has an annual recurring revenue of about $25 million, making it a decent chunk of BigBear.ai's business moving forward, as it generated just shy of $145 million over the past 12 months.

However, revenue growth highlights another problem with BigBear.ai's stock.

BigBear.ai's revenue growth is negative

Right now is among the best times to be an AI company. AI software should be practically selling itself due to the huge demand to implement cutting-edge technologies. However, BigBear.ai hasn't realized that growth. In fact, its revenue decreased 20% year over year in Q3 2025.

That's a huge red flag for investors. If BigBear.ai cannot meaningfully grow revenue during the biggest AI boom we've seen, what makes you think that it can grow in the future? While it's doing the right thing by acquiring Ask Sage, it may be too little, too late.

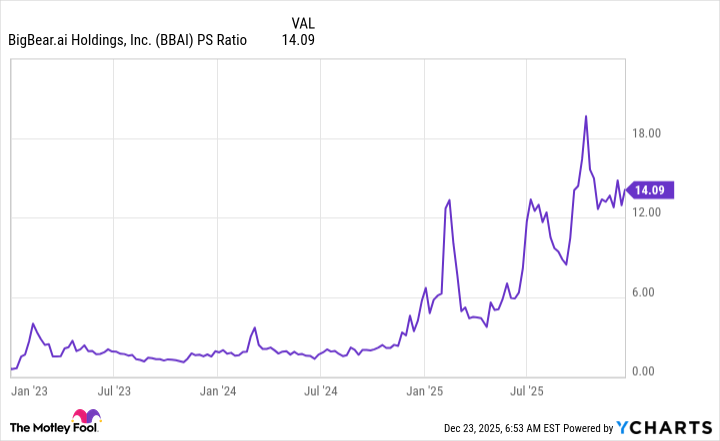

To top things off, BigBear.ai's stock isn't cheap.

BBAI PS Ratio data by YCharts

The stock trades for 14 times sales, which may seem somewhat cheap for an AI software stock. However, investors must realize that the typical 10 to 20 times sales valuation for software stocks requires an 80% gross margin. Spotify, another software company that has a low gross margin (32% over the past 12 months), trades for about 6 times sales.

That's a good example of where BigBear.ai should probably be valued, and with its negative revenue growth, limited current business, and expensive price tag, I'd say BigBear.ai is more likely to fall in 2026 than it is to double.