It's no secret that artificial intelligence (AI) has been the main theme fueling the action on Wall Street over the last few years. Specifically, the levels of demand for high-performance GPUs, networking equipment, and data centers have dominated the bulk of the AI narrative to date.

But what about monetization? Assessing which companies -- other than Nvidia (NVDA +0.02%) -- are truly generating measurable AI-driven growth can be challenging.

In my view, AI-focused investors should keep Meta Platforms (META 0.74%) on their radar in 2026. While its megacap peers are receiving the lion's share of the attention, the social media leader could be on the cusp of becoming AI's next big contributor.

Image source: Getty Images.

Meta's AI revenue is leaving the competition in the dust

Meta owns and operates four massive social media platforms -- Facebook, Messenger, Instagram, and WhatsApp. Across its "family of apps," the company serves 3.5 billion daily active users, on average. So it's not surprising that advertisers are eager to get in front of Meta's massive audience.

During the third quarter, Meta generated $51.2 billion in revenue, $50 billion of which came from its advertising segment. This represented 26% growth year over year. While that's impressive, it was not enough to get Wall Street excited.

Where things get interesting is how Meta is maintaining its growth profile. Within its AI division, Meta introduced a product called Advantage+, a suite of machine learning tools that helps advertisers improve their targeted campaigns.

On the company's third-quarter earnings call, CFO Susan Li told investors that Advantage+ is now operating at a $60 billion annual revenue run rate. That was nearly a threefold increase from the first quarter.

Beth Kindig, lead tech analyst at the I/O Fund, drew an interesting parallel between Meta's growth and that of OpenAI. ChatGPT was released to the public in November 2022, just over three years ago. According to numerous media outlets, OpenAI is expected to achieve a $20 billion revenue run rate in 2025. During this same period, Meta grew its AI ads business from essentially nothing to $60 billion -- 3 times more than OpenAI.

Taking this one step further, Kindig wrote that "it would require a step-up from 175% growth YoY to 460% year-over-year for Microsoft to match Meta's AI revenue."

Against this backdrop, Kindig posits that Meta has quietly become the second-largest AI monetizer next to Nvidia.

NASDAQ: META

Key Data Points

Cash flow could be modest in 2026

While Kindig's analysis is interesting, investors shouldn't get too hung up on the hierarchy of AI-related sales. The more important takeaway from her analysis is that Meta's top-line growth appears muted compared to the accelerating sales growth of its emerging AI products.

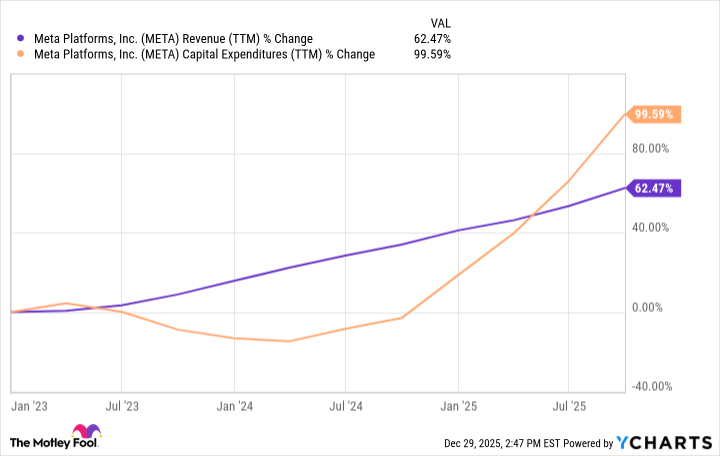

META Revenue (TTM) data by YCharts.

As I alluded to earlier, most of the chatter surrounding AI over the last few years has been about spending. Perhaps no other company is under more scrutiny in this regard than Meta.

Its capital expenditures are far outpacing the rate at which its revenue is increasing. In the long run, this is unsustainable.

It's no wonder investors became spooked after Meta's management said that its capex would be "notably larger" in 2026. The combination of aggressive spending and a new revenue stream that has not yet matured will almost certainly hinder Meta's ability to generate excess cash flow in 2026.

Is Meta stock a good buy right now?

While I agree with Kindig in the sense that most investors are probably overlooking the magnitude and potential of Meta's new AI ads business, prudent investors aren't going to jump into the stock based on one metric.

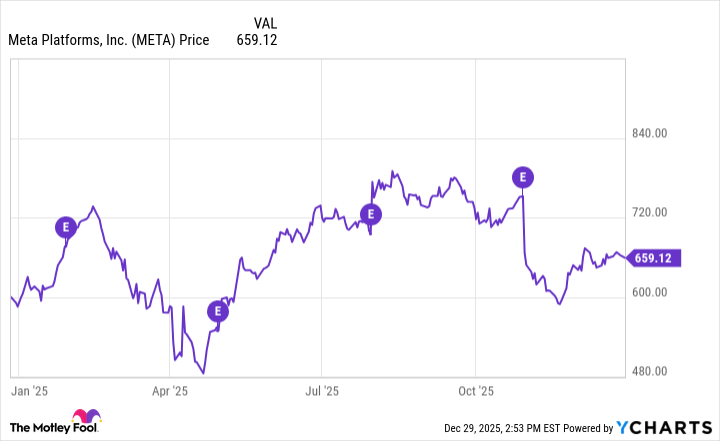

Over the last year, Meta's stock has traversed a number of peaks and valleys. The pronounced sell-offs were in large part influenced by investors' wariness about the company's spending.

Given its achievements so far and the trajectory of Advantage+, I'm personally cautiously optimistic about its prospects. However, it still has a lot to prove against Amazon, Alphabet, and others.

For these reasons, smart investors should be on the lookout for specific updates regarding Advantage+ and Meta's other AI ambitions. If these products continue to blossom and position the company to grow faster than its current spending trajectory in the long run, I would take advantage of any selling pressure and buy the dip in the new year.