While momentum investors look for stocks that are in favor and rising in price, contrarian investors don't mind buying stocks that are falling in price if the fundamentals are sound.

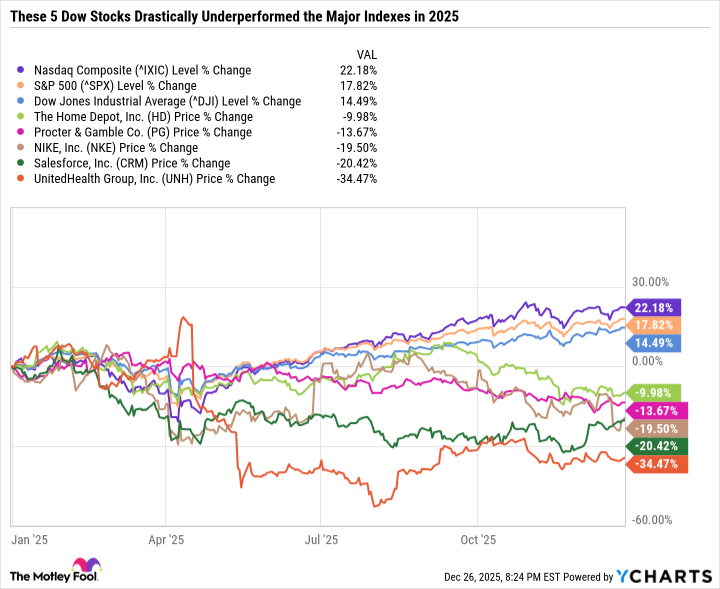

Despite a more than 14% year-to-date gain in the Dow Jones Industrial Average as of market close on Dec. 26, there are five Dow stocks that are down 10% or more in 2025: Home Depot (HD 0.65%), Procter & Gamble (PG 0.51%), Nike (NKE +4.18%), Salesforce (CRM 0.38%), and UnitedHealth Group (UNH 0.62%).

Here's why all five stocks could be great buys for value investors in 2026.

Image source: Getty Images.

1. Home Depot

Home Depot's earnings have been languishing due to a sluggish housing market and consumer spending pressures. Even though the stock market is hovering around all-time highs, consumer sentiment remains low due to factors such as higher living costs, inflation, tariffs, and trade policy.

Home Depot tends to perform better when consumers are feeling optimistic about the economy and can afford to spend on major home improvement projects.

Buying Home Depot stock when it's out of favor could be a great move for patient investors. The company has been investing heavily in long-term growth through acquisitions and new store openings. When the cycle shifts, Home Depot will be ready.

In the meantime, investors can scoop up shares for a reasonable 24.1 times forward earnings estimate and collect passive income from Home Depot's reliable dividend, which yields 2.7% at the time of this writing.

NYSE: HD

Key Data Points

2. Procter & Gamble

Consumers aren't just pulling back on discretionary goods and services like home improvement projects. The consumer staples sector is drastically underperforming the S&P 500 in 2025 -- down 0.4% compared to a 17.8% gain in the index. Even Costco Wholesale, a longtime sector outperformer, is on track to have its worst performance relative to the S&P 500 in decades.

Tariffs are complicating supply chains and putting pressure on margins. If household balance sheets were in better shape, consumer staples companies may have an easier time passing along those costs to customers. But that's far from the case.

Like the broader consumer staples sector, Procter & Gamble's stock price took a hit in 2025. But the household goods and personal products company has done a masterful job maintaining its high margins thanks to its highly diversified product mix, international exposure (which reduces its dependence on North America), elite supply chain, and marketing.

Procter & Gamble continues to grow its earnings, albeit at a slower pace than in previous years. But even mediocre earnings growth is relatively good compared to its peers. P&G also pays an incredibly reliable dividend, with 69 consecutive years of increasing the payout and a 2.9% dividend yield at the time of this writing.

NYSE: PG

Key Data Points

3. Nike

Nike shares got a boost in recent sessions as Nike board member and Apple's CEO, Tim Cook, nearly doubled his stake in Nike. But even with that boost, Nike is on track to lose value for the fourth consecutive year.

Nike has been hit hard by tariffs, which are heavily weighing on its gross margins. However, it has made significant strides in adapting its strategy to better incorporate its wholesale partners while maintaining a substantial direct-to-consumer presence.

Tariffs, a slowdown in China, and consumer spending pressures in North America have certainly been a thorn in Nike's side. But the bigger issue is innovation. Nike isn't as dominant as it used to be. Competition is fierce, and consumer preferences are changing.

Nike is returning to its roots by leaning into what has historically made its brand so effective, which is storytelling. To resonate with consumers, Nike must do more than simply place products on a shelf or have an easy-to-use digital platform. It must create footwear, apparel, and equipment that consumers around the world will choose over similarly priced products. Nike also needs to reduce its product markdowns and discounts to restore its margins.

With so much going wrong at Nike, some investors may prefer to wait for the company to demonstrate more concrete evidence of a turnaround. But for folks who believe in the staying power of the brand, Nike and its 2.7% dividend yield could be worth a closer look in 2026.

4. Salesforce

Former market darling Salesforce has undergone a considerable sell-off, along with its software-as-a-service (SaaS) peers, as investors question the role of software in the age of artificial intelligence (AI). The SaaS model relies on increasing the total number of users and revenue for each. But if AI-powered tools enable users to do more with less, an enterprise may need fewer subscriptions.

Salesforce is undergoing a period of change, but the company isn't crossing its fingers and hoping for a recovery. Salesforce is taking action by deploying data-powered AI agents that act as virtual assistants. Agentic AI speeds up workflows and boosts productivity. But the Agentforce pricing model can be costly because it is partially dependent on add-ons per user.

The good news for Salesforce is that it already has widespread adoption. So if Salesforce can improve its product to keep customers engaged, there's a good chance they would prefer sticking with its customer-relationship management platform rather than switching to an unfamiliar competitor. Salesforce also owns Slack, Tableau, and MuleSoft, positioning it as a leader in enterprise software across the entire value chain.

It's also worth mentioning that while Salesforce's growth has slowed, it is still growing and has high margins. The stock is dirt cheap, trading at just 22.6 times forward earnings. And to top it all off, Salesforce offers investors a modest dividend yield of 0.6%.

All told, Salesforce's risks are likely already priced into its valuation, making Salesforce a great buy for long-term investors.

NYSE: CRM

Key Data Points

5. UnitedHealth

The worst-performing Dow stock in 2025 is UnitedHealth, which has lost roughly a third of its value. The health insurance giant underestimated the impact of rising medical costs and the usage of Medicare Advantage plans. It also fell under a Department of Justice criminal investigation.

Similar to Nike, just about everything is going wrong for UnitedHealth all at once. So the simplest reason to be optimistic about the stock for 2026 and beyond is that the worst is likely over. After all, UnitedHealth is an industry leader that is heavily out of favor, but the business model has what it takes to recover.

Its UnitedHealthcare segment collects premiums on health insurance plans from Medicare and Medicaid beneficiaries, employers, and individuals. And its Optum segment offers health services. When UnitedHealth is at the top of its game, these two segments are a well-oiled machine that produces steady cash flow and supports a growing dividend.

UnitedHealth is increasing premiums to adjust for higher costs, which should help its results in the new year. At just 20.3 times forward earnings with a 2.7% dividend yield, UnitedHealth is a top pick for value investors in 2026.