Describing the artificial intelligence (AI) revolution as the best investment opportunity of a generation isn't hyperbole -- this technology truly is game changing, capable of accomplishing things that were unthinkable just a few years back. There are few industries that AI can't help improve at least a little bit, if not a lot.

Investing in AI, however, isn't necessarily easy. There are an overwhelming number of companies in this business. Some will thrive. Others will end up floundering. But it's difficult (if not impossible) to distinguish which is which. In the meantime, worry of an AI bubble being popped makes it uncomfortable to wade into the industry's most obvious and popular picks like Nvidia or Palantir Technologies.

Fortunately, there's a simple, effective solution. An exchange-traded fund focused solely on artificial intelligence offers instant, diversified access to the entire industry. And one ETF in particular is arguably your best bet among these names. That's the Global X Artificial Intelligence & Technology ETF (AIQ +1.12%). Here's why.

Sidestepping the problem too many other ETFs face

It's certainly not the only artificial intelligence ETF to consider. The Roundhill Generative AI & Technology ETF and VistaShares Artificial Intelligence Supercycle ETF are viable options as well, as is the fairly new Dan Ives Wedbush AI Revolution ETF or the iShares Future AI and Tech ETF. And if you're a fan of the Global X family of funds, the Global X AI Semiconductor & Quantum ETF and the Global X Robotics & Artificial Intelligence ETF are worth a look.

NASDAQ: AIQ

Key Data Points

The Global X's Artificial Intelligence & Technology ETF doesn't hold any of the AI stocks you wouldn't also own through alternatives; like most other ETFs of this ilk, this AI exchange-traded funds owns familiar names including Alphabet, Broadcom, Nvidia, Palantir, Taiwan Semiconductor Manufacturing, and all the rest you'd expect it to.

Where AIQ stands out, rather, is in how it's assembled -- the Indxx Artificial Intelligence & Big Data index it's meant to mirror is far better balanced than the majority of your other options. First but not foremost, all of AIQ's holdings fall into one of two well-defined categories. The first of these is artificial intelligence developers and service providers. The second is AI hardware, including quantum computing platforms.

The index includes 60 handpicked stocks from the first group, and 25 stocks from the second category, with reasonable size minimums for both. While handpicking tickers contradicts the idea of index investing, when it comes to AI, a bit of handpicking may be the best way of getting started.

Image source: Getty Images.

That's not quite what makes the Global X Artificial Intelligence & Technology ETF such a savvy play, however. It's the weighting methodology. Companies with significant exposure to the artificial intelligence industry can't make up more than 3% of the index's total value, while companies with only modest exposure to the AI market can't make up more than 1% of the fund's total holdings. And the ETF's holdings are rebalanced semiannually, in cases where ordinary price changes might have skewed this allocation too far out of place.

This is a dramatically different weighting approach from other indexes and exchange-traded funds. For perspective, the Invesco QQQ Trust (and the Nasdaq-100 index it's based on) has a 9% Nvidia, 8% Apple, and 7% Microsoft weighting. This may be relatively close to these companies' proper market cap weightings, but it's not necessarily a balanced allocation that most investors would choose -- if they had the choice. Big gains that cause poorly balanced portfolios can leave you exposed to too much profit-taking risk.

A simple but brilliant solution

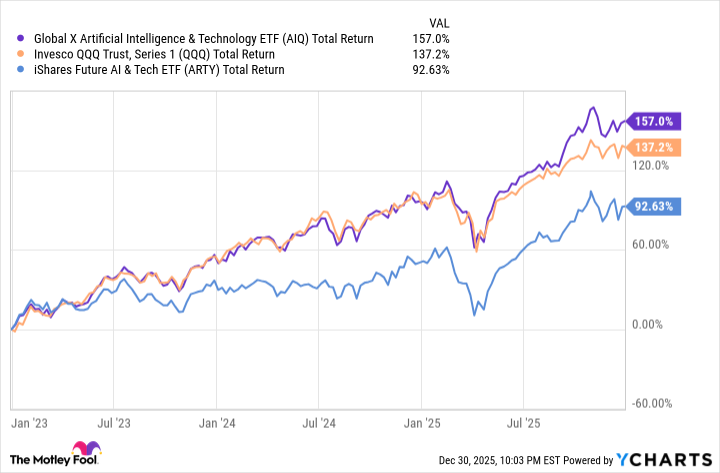

Now, much of the time since this ETF's mid-2018 launch, this allocation approach hasn't made much difference. And, some of the time, it's actually worked against AIQ (compared to similar technology funds). Enough of the time, however, it's helped more than it's hurt. It's been particularly advantageous since April's low, for instance, shortly before concerns about an artificial intelligence bubble first began quietly simmering.

AIQ Total Return Level data by YCharts

More than anything, though, holding the Global X Artificial Intelligence & Technology ETF allows you to invest in the entire artificial intelligence movement in a way that gives you easy, balanced exposure to all the names in the business that really matter. And it does so in an automatically balanced way that sidesteps one of the chief challenges of owning a large group of volatile stocks. That's the dangerous imbalance that develops when only a few stocks are driving most of its gains.

Just bear in mind that -- like almost all other exchange-traded funds -- this one is best seen and used as a long-term thematic investment. Global X will swap out any AI stocks as merited, so you'll ideally be holding the best of the best tickers in the artificial intelligence business. But you won't remain too overweighted for too long with high-performing tickers that are inviting a wave of profit-taking.