Palantir Technologies (PLTR 5.56%), the data analytics company revolutionizing both government and commercial businesses with its powerful artificial intelligence (AI)-powered insights, reached all-time highs multiple times in 2025. It was another very good year for the company, which now sports a market capitalization of roughly $440 billion.

But as AI companies saw some downward pressure in the fourth quarter, Palantir's stock suffered as well. Shares are trading about 10% below their all-time highs, and Palantir heads into 2026 with muted momentum.

Should investors give Palantir another look in advance of the fourth-quarter and full-year earnings report, which is likely to drop in early February? Or is the bloom starting to fade from Palantir stock?

Image source: Getty Images.

What makes Palantir unique?

Palantir embraces being different -- the company promotes that it was created more than two decades ago because it identified software platforms that it said were too rigid and difficult to maintain or improve. "We saw a need for a different kind of technology," management says on its website.

Palantir's solution is its innovative platforms that draw in information from thousands of data points simultaneously. It has integrated artificial intelligence into its Foundry and Gotham platforms, and uses AI agents to automate decisions, analyze situations, and suggest solutions.

The Foundry platform is designed for commercial clients, helping them to make decisions, simplify workflows, automate processes, and manage supply chains. The Gotham platform is primarily used for government work, including by military units and intelligence agencies, to provide real-time tactical information.

NASDAQ: PLTR

Key Data Points

Both platforms are integrated with Palantir's Artificial Intelligence Platform (AIP), which allows users to quickly build workflows and perform actions with minimal training -- allowing new customers to adapt to the platform quickly.

All that gives Palantir a key advantage over contractors such as BigBear.ai, which creates custom software solutions for its government clients. Because Palantir's platform is more adaptable, Palantir is able to sign up new clients much faster than BigBear.ai -- and bring in more revenue.

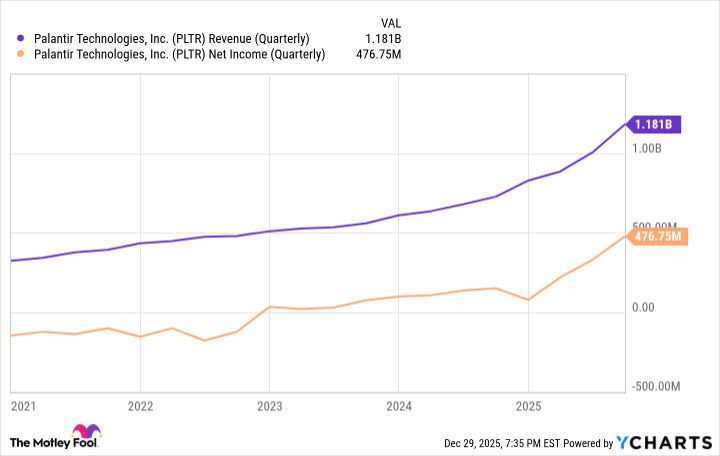

Palantir's revenue is soaring

Palantir's business model has allowed it to scale exceptionally fast -- particularly after it launched the AIP platform in April 2023. Since then, the company's quarterly revenue more than doubled to $1.18 billion, and it started turning a quarterly profit for the first time.

PLTR Revenue (Quarterly) data by YCharts

Third-quarter revenue was up 63% from a year ago, and net income of $476 million translates to a 40% profit margin.

More tellingly, Palantir is signing on average more than one deal per day that's valued at more than $1 million. In the third quarter, it brought in 204 such deals, with 91 of them valued at least $5 million and 53 valued at least $10 million.

U.S. government revenue remains the largest component of Palantir's business, accounting for $486 million in revenue during the quarter, a 52% increase from the same period last year. But the commercial business is growing even faster, with U.S. commercial revenue of $397 million, up 121% from the previous year.

The downside -- if you can call it that -- to Palantir's rapid growth is that its valuation is completely unsustainable. Palantir's forward price-to-earnings ratio of 254 and the forward price-to-sales ratio of 99 have been steadily increasing during 2025. There are plenty of Palantir bears who would argue Palantir is a dangerous stock for investors because it appears destined for a correction.

Why I still like Palantir today

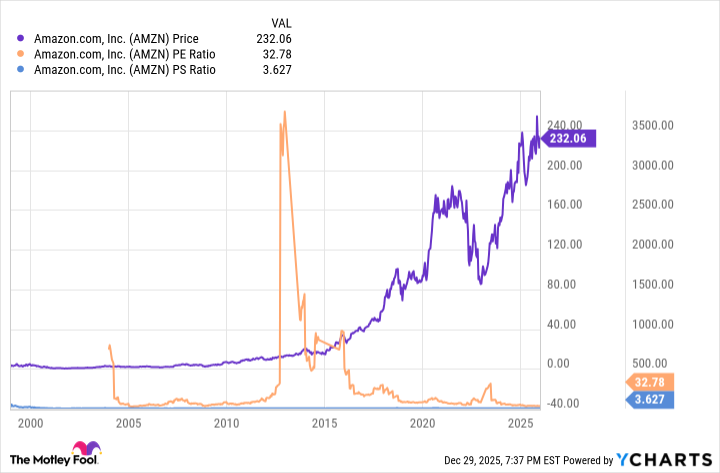

I remember when Amazon (AMZN 1.93%) was much like Palantir. More than a decade ago, Amazon had a P/E of more than 240, and analysts at the time predicted the stock's demise.

But it never happened -- sure, Amazon had its losing streaks, such as during the COVID-19 pandemic, but in general, the stock market misjudged Amazon because it didn't yet understand the vast potential of the e-commerce giant. And since then, Amazon's stock has continued to climb, and the P/E ratio stabilized.

I believe that Palantir is experiencing the same phenomenon. Its AIP platform is a true game changer that has allowed Palantir to quickly bring AI-powered insights to hundreds of companies. And I think that's just beginning.

When Palantir next files its earnings report, I expect the stock to take another leap higher and for the company's rapid growth to continue. That's why Palantir stock is still a buy for me, even though it's 10% off its all-time highs. It won't be down for long.