With another year in the books, investors have every reason to smile. In 2025, the iconic Dow Jones Industrial Average, broad-based S&P 500, and innovation-inspired Nasdaq Composite all roared to several record-closing highs. It was a reminder of just how much of a wealth-creating machine Wall Street can be.

But the stock market is also unpredictable. Regardless of whether the bull market enters its fourth year or gives way to a bear market, the following 10 magnificent stocks are well-positioned to make you richer in 2026.

Image source: Getty Images.

1. Visa

The first amazing stock that has a history of delivering positive returns for investors is payment-facilitating behemoth Visa (V +0.70%). Shares of Visa have climbed in 13 of the last 15 years. Including dividends, its only two declines were 0.3% and 3.3%, respectively, in 2021 and 2022. Comparatively, 12 of the last 15 years have produced double-digit gains for Visa's shareholders.

Visa's outperformance reflects its close-knit ties to the U.S. and global economy. With the exception of a two-month recession during the COVID-19 pandemic, the U.S. economy has been expanding since mid-2009. A growing economy incentivizes consumers and businesses to spend, which in turn facilitates the fee-based payment revenue that drives Visa's profits and share price higher.

At the same time, Visa avoids the pitfalls that occasionally sink lenders. By strictly focusing on payment facilitation and avoiding lending, Visa isn't required to set aside capital for loan losses. In other words, when short-lived economic contractions do occur, Visa typically bounces back faster than other financial stocks.

NASDAQ: TTD

Key Data Points

2. The Trade Desk

Next up is a phenomenal business that appears poised for a bounce-back year: adtech stock The Trade Desk (TTD 7.47%). Although tariffs have adversely impacted ad spending for some of the company's core customers, midterm elections should offset some of this burden in 2026 and potentially lead to some attractive year-over-year comps.

Despite volatility in The Trade Desk's stock, its Unified ID 2.0 (UID2) technology is gaining momentum as a replacement for third-party tracking cookies. The more businesses utilize UID2, the more likely it is that The Trade Desk will maintain or grow its pricing power in the digital advertising space and sustain a double-digit sales growth rate.

There's also a value proposition that, frankly, has never previously existed with The Trade Desk. While investors had been piling in with the expectation of 20% to 40% annual sales growth and a nosebleed forward price-to-earnings (P/E) ratio, investors can buy shares today for 18 times forward-year earnings, with a mid-to-high teens annual sales growth rate. That's a bargain!

Image source: Getty Images.

3. Meta Platforms

Although the stock market enters 2026 at a historically expensive valuation multiple, the one member of the "Magnificent Seven" that remains fundamentally attractive is social media titan Meta Platforms (META +2.10%).

Meta is the parent company of several popular social media destinations, including Facebook, WhatsApp, Instagram, Threads, and Facebook Messenger. In September, its family of apps attracted an average of 3.54 billion people each day. With no other social media company coming remotely close to luring this many eyeballs on a daily basis, Meta enjoys exceptional (and steady) ad-pricing power.

Furthermore, Meta is allowing its clients access to generative artificial intelligence (AI) solutions, enabling them to tailor their messages to users. This should enhance click-through rates, bolster its ad-pricing power, and make its forward P/E ratio of 22 all the more attractive.

NYSE: UNH

Key Data Points

4. UnitedHealth Group

Health insurance and healthcare services conglomerate UnitedHealth Group (UNH 1.14%) had an abysmal 2025, which was marred by higher-than-anticipated Medicare Advantage expenses and multiple downward revisions to its profit outlook. But over the last 26 years, UnitedHealth stock has risen in 22 of them, including dividends paid.

The key to UnitedHealth Group's turnaround is the steps it's taken to ensure that 2025 was an anomaly. Specifically, the company is exiting unprofitable Medicare Advantage markets and won't be shy about increasing healthcare premiums. Since higher costs are inevitable for insurers, they typically boast strong premium pricing power.

UnitedHealth Group's Optum subsidiary should be expected to bounce back in 2026, as well. This segment, which provides everything from pharmacy drug delivery to the software used by medical companies, has historically delivered superior operating margins to UnitedHealth's insurance segment. If Optum's operating margin rebounds to near 7% this year, UnitedHealth stock could easily be one of the Dow's top performers.

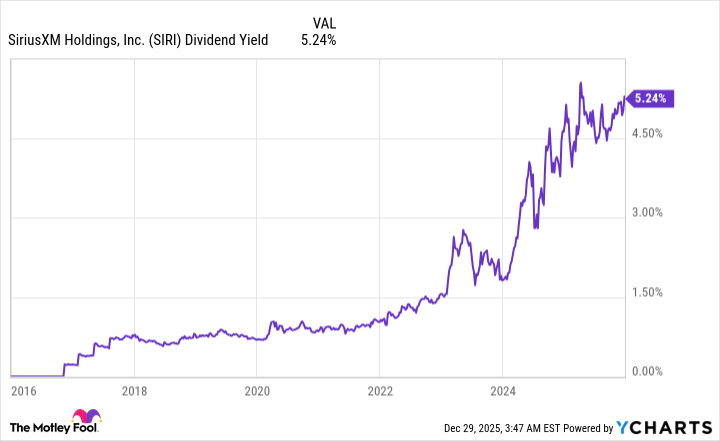

Sirius XM's dividend yield is more than four times higher than the yield of the S&P 500. SIRI Dividend Yield data by YCharts.

5. Sirius XM Holdings

A fifth magnificent stock that can make you richer in 2026 is one of Wall Street's few legal monopolies, satellite-radio operator Sirius XM Holdings (SIRI 0.20%). Sirius XM strikes the perfect balance of value and income amid a historically pricey stock market.

What separates Sirius XM from a long list of terrestrial and online radio companies is its revenue mix. Whereas traditional radio operators rely almost exclusively on advertising for their sales, Sirius XM generates more than three-quarters of its net revenue from subscriptions. Individuals subscribed to its services are less likely to cancel than businesses are to meaningfully reduce their marketing budgets during periods of economic turbulence. This means Sirius XM's operating cash flow is more predictable than its peers.

Sirius XM also enters the year with a forward P/E ratio of less than 7! This is near its all-time low as a public company of 31 years, and represents a 46% discount to its average forward P/E multiple over the trailing five-year period. Sirius XM's 5.2% yield lays a solid foundation beneath its historically cheap shares.

Image source: Getty Images.

6. BioMarin Pharmaceutical

Keeping with the theme of value in a very pricey stock market, drug developer BioMarin Pharmaceutical (BMRN +1.01%) checks all the right boxes for patient investors.

While successful novel drug developers are a rarity in their own right, what makes BioMarin special is its focus on ultrarare-disease therapies. Its superstar drug is Voxzogo, which treats achondroplasia in children. Voxzogo's double-digit sales growth, fueled by growing global demand, label expansion opportunities, and strong pricing power, has it on track to (likely) top $1 billion in full-year sales this year.

At the same time that Voxzogo is spreading its wings, BioMarin is reining in costs and looking to divest Roctavian, its one-time gene therapy for adults with severe hemophilia A. BioMarin's heightened operating focus has the company on track to deliver mid-to-high single-digit sales growth in 2026 and more than $5 in earnings per share (EPS). A forward P/E of 11 for an ultrarare-disease company with rapidly expanding operating cash flow is a bargain that investors shouldn't pass up.

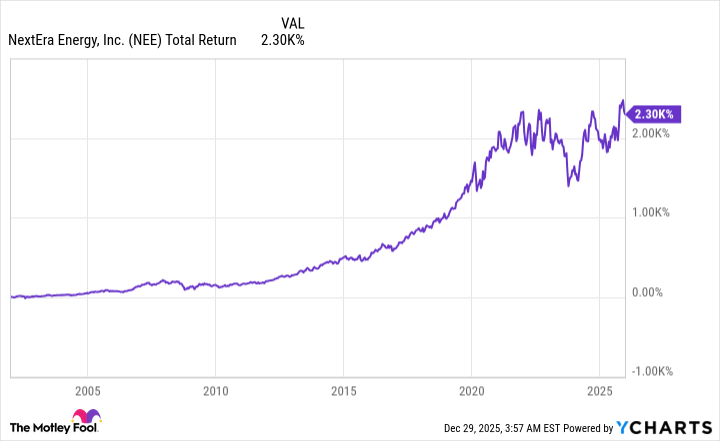

Including dividends, NextEra Energy has only had three down years since the beginning of 2002. NEE Total Return Level data by YCharts.

7. NextEra Energy

Another industry leader with a history of delivering positive total returns to its shareholders is the United States' largest electric utility by market cap, NextEra Energy (NEE +0.78%). Including dividends, NextEra has generated a positive return for its investors in 21 of the last 24 years.

This consistency is born from the predictability of NextEra's operating model. Specifically, demand for electricity remains relatively stable from one year to the next. Moreover, the prohibitive costs of installing the necessary infrastructure mean utilities often act as monopolies or duopolies in the areas they serve. NextEra Energy's cash flow tends to be highly predictable and transparent when looking out one or more years.

Additionally, no utility generates more capacity from wind or solar than NextEra Energy. While investments in these renewable energy sources haven't been cheap, they've notably reduced electricity generation costs and allowed NextEra to average high-single-digit EPS growth. Its forward P/E of 20 represents a 13% discount to its average forward P/E over the last five years.

Image source: Getty Images.

8. Okta

An eighth exceptional stock that can help investors' portfolios grow in 2026 is AI- and machine learning-driven cybersecurity solutions provider Okta (OKTA +0.47%).

The leading reason to own shares of Okta is that it provides a basic need service. Regardless of how well or poorly the stock market and/or U.S. economy are performing, hackers don't take a vacation from trying to steal and access sensitive data. The demand for third-party identity verification solutions is only expected to grow over time, which plays right into Okta's wheelhouse.

The other selling point of Okta is that its key performance indicators point to sustained double-digit growth. Its subscription backlog, known as its remaining performance obligations, increased to nearly $4.3 billion by the end of October (up 17% from the previous year). Further, its gross margin has jumped to more than 77% through the first nine months of fiscal 2026, reflecting the juicy margins associated with cloud-based software.

NASDAQ: YORW

Key Data Points

9. York Water

This is the perfect time to mention that sensational stocks come in all sizes. While it's easy to invest in brand-name businesses that have consistently delivered for investors, overlooking small-cap gems like water utility York Water (YORW +0.18%) would be a mistake.

The reason 2026 could be a huge year for York Water is related to a filing for a proposed rate increase with the Pennsylvania Public Utility Commission (PPUC). York is a regulated utility, which means it needs the approval of the PPUC before it can increase rates on its customers. If approved, it would represent an annual revenue increase of approximately 32% from reported sales in 2024. That's not chump change, and it would likely result in a substantial uptick in full-year EPS.

York Water is also arguably Wall Street's greatest dividend stock. While it doesn't offer the highest yield and hasn't raised its dividend every year, it has been paying a dividend for 209 consecutive years! The predictability of its operating model, coupled with a steady diet of bolt-on acquisitions, makes York a rock-solid investment.

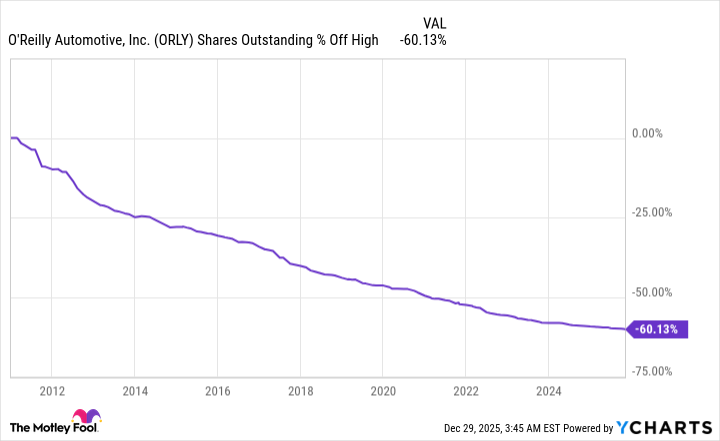

O'Reilly Automotive offers one of Wall Street's premier share-repurchase programs. ORLY Shares Outstanding data by YCharts.

10. O'Reilly Automotive

The 10th and final magnificent stock that can make you richer in the new year is auto parts chain O'Reilly Automotive (ORLY +1.02%). Shares of O'Reilly have advanced in 21 of the last 23 years.

Macro themes should continue working in O'Reilly's favor. According to a May 2025 report from S&P Global Mobility, the average age of cars and light trucks on U.S. roadways rose to an all-time high of 12.8 years. Consumers and businesses hanging onto their vehicles longer than ever before suggest that O'Reilly and its peers will be relied upon to provide the parts and accessories needed to keep these cars and light trucks in tip-top shape.

But what truly sets O'Reilly Automotive apart is its share-repurchase program. Since initiating a buyback program in 2011, the company has spent nearly $27 billion to retire 60% of its outstanding shares. This is having an undeniably positive impact on its EPS over time, which should make its shares more attractive to value-seeking investors.