If you're starting out investing and have $1,000 or more to put to work, investing in some top growth stocks of market leaders can be a smart idea. Let's look at two great growth stocks to buy right now.

Alphabet

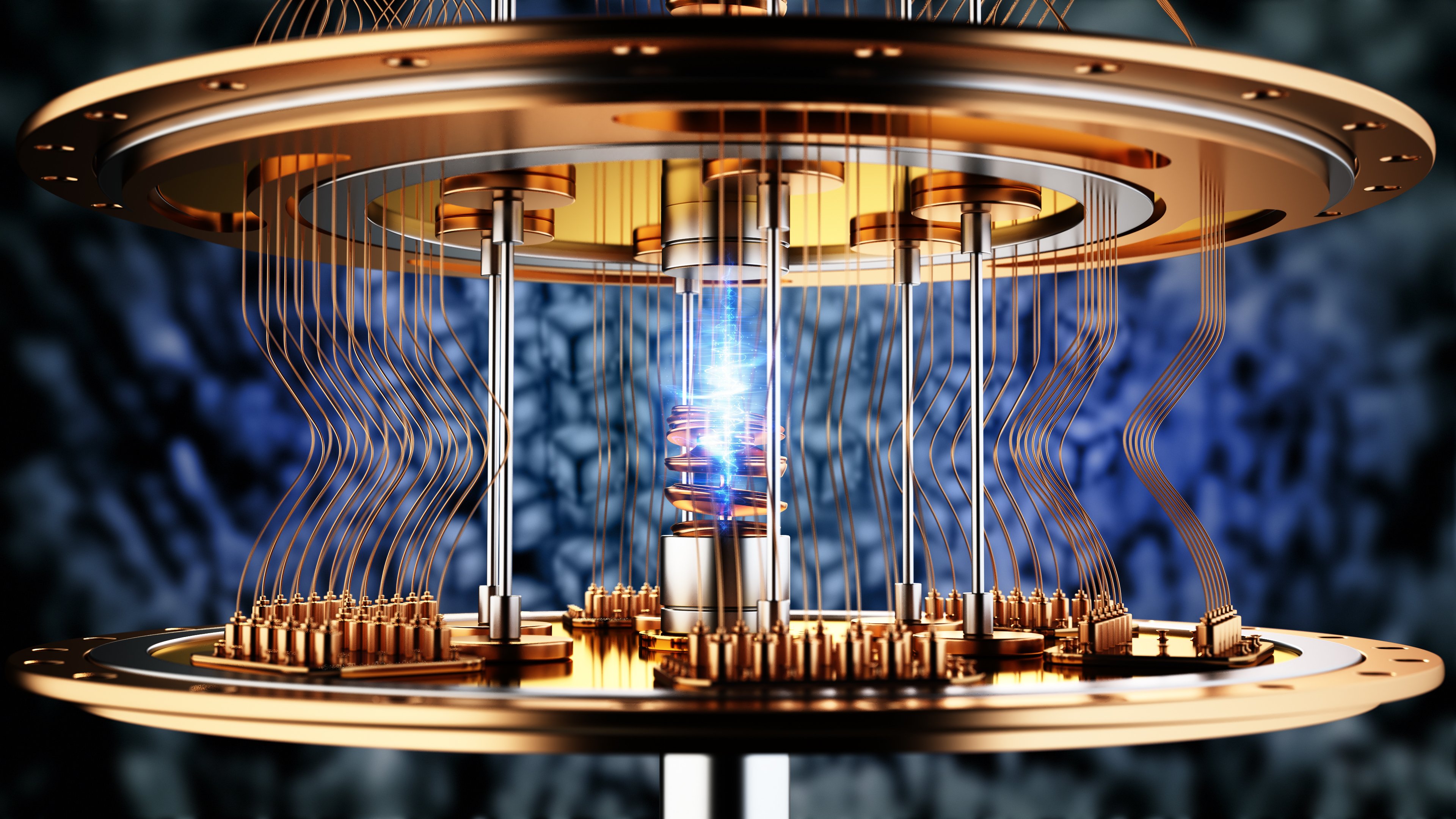

While Alphabet (GOOGL +2.37%) (GOOG +2.44%) is best known for its ubiquitous search engine, the company is a lot more than just Google Search. The company also owns YouTube, the world's largest streaming platform, while its cloud computing unit, Google Cloud, is its fastest-growing segment. Meanwhile, it is also the majority owner of robotaxi service Waymo, and it has developed its own chip for quantum computing.

Google Search is still its largest business, and the company created a wide moat through both distribution and its ad network. Alphabet owns both the market-share leading Chrome browser and Android operating system, which helps make Google search the default search engine on more than 70% of devices.

NASDAQ: GOOGL

Key Data Points

Meanwhile, a search revenue-sharing deal with Apple helps cover most of the rest, making Google the gateway to the internet for most people. At the same time, the company can better monetize search than anyone else through its vast ad network, which can equally serve everyone from large global clients to local mom-and-pops.

While artificial intelligence (AI) is changing the landscape, Alphabet has embraced the technology. It's created its own world-class large language model (LLM) in Gemini, which it is embedding throughout its products, including Google Search. New features like AI Mode and AI Overviews are helping drive queries and revenue, while its stand-alone Gemini app is also gaining a lot of traction. At the same time, Alphabet has also spent the past decade developing its own AI chips, which give it a cost advantage when training its AI models and running inference.

AI demand is also driving strong growth at Google Cloud, and the company is increasing its capital expenditure (capex) budget to try to keep up with demand. Its custom chips give it an advantage in this business, as well, lowering costs and giving it strong margins. Meanwhile, it has just started providing its custom chips to outside customers to run their AI workloads on its cloud network, with Anthropic placing a big order for next year.

As one of the leading AI companies in the world with multiple growth drivers, Alphabet is a top growth stock to invest in right now.

Image source: Getty Images.

Amazon

Amazon (AMZN +0.27%) is the market share leader in both e-commerce and cloud computing. While it's best known for its e-commerce operations, Amazon Web Services (AWS) is actually its largest segment by profitability.

Like Google Cloud, AWS has been seeing strong growth stemming from AI services and consumption, and the company is boosting its spending on data center infrastructure to increase capacity to meet surging demand. The company also has its own custom AI chips, which it used to build a data center for Anthropic.

It also recently signed a seven-year $38 billion deal with OpenAI to provide the AI model maker with compute power using Nvidia graphics processing units (GPUs). AWS revenue grew by 20% last quarter, but it should continue to accelerate in 2026.

NASDAQ: AMZN

Key Data Points

Meanwhile, the company is using AI and robotics in its e-commerce operations to drive efficiency and profits. Amazon is one of the leading robotics companies in the world, and it has more than 1 million robots in its fulfillment centers that are all coordinated by its DeepFleet AI model.

It's also using AI to optimize its logistics network by helping to determine the best routes delivery drivers should take and in which warehouses items should be stored to be the closest to last-mile delivery. This saves costs and increases delivery speeds.

Like Alphabet, Amazon has also become one of the world's largest digital advertising platforms through its sponsored ad business. It is using AI to help merchants create better ad campaigns and target users, and last quarter, its high gross margin ad revenue grew a robust 24%.

Amazon is seeing its e-commerce profits grow much quicker than its revenue, while its cloud computing revenue growth is starting to accelerate. This makes it a great time to buy shares in this market-leading company.