It's a new year, and all investors are trying to do the same thing: Find the best stocks to buy and hold in 2026. It's a tall task, considering there are thousands of stocks to choose from. That's why I like to narrow down the search by looking at sectors that were under pressure in 2025.

Investors often are wary of an entire sector of the stock market. When this happens, virtually every stock in the sector gets punished. This can result in a good company getting thrown out with the bathwater. And that's why I'm looking at financial technology (fintech) today.

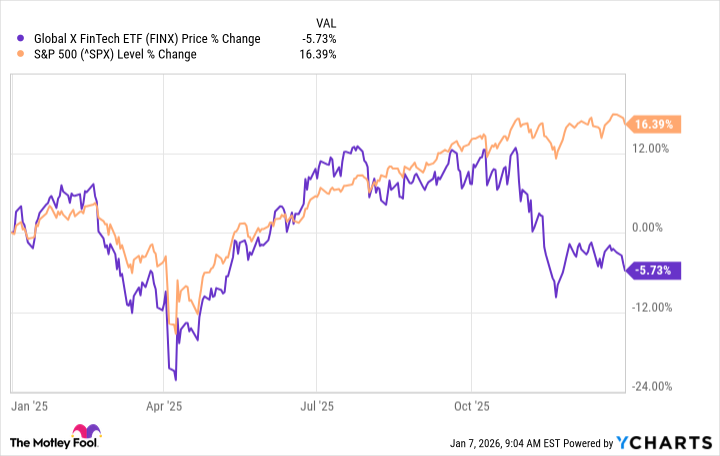

Fintech underperformed by a wide margin in 2025. To illustrate, consider the Global X FinTech ETF -- an exchange-traded fund (ETF) with a focus on fintech stocks -- compared with the S&P 500. As the chart below shows, this ETF posted a loss for the year, in contrast to the market's red-hot gains.

The fintech sector had a challenging year, making it likely that there's a good opportunity in this beaten-down industry. And I believe that Shift4 Payments (FOUR +1.20%) is one such stock.

How Shift4 makes money

Shift4 offers payment-processing hardware and software to hospitality venues, stadiums, restaurants, and more. This isn't exactly unique -- many players in the industry do this. But Shift4 has grown substantially by focusing on high-volume customers, such as the aforementioned stadiums.

Image source: Getty Images.

Few fintechs have grown as fast as Shift4 in recent years. During just the past five years, revenue has increased by nearly 400%. Granted, its high-volume customer base tends to have lower margins, but this focus helped the business scale up. Moreover, management relentlessly focuses on profitability -- specifically, free cash flow -- despite the margin headwind.

Chief Executive Officer Taylor Lauber said in his third-quarter letter to shareholders that Shift4 always prioritizes "where the next dollar is spent, and with urgency, as the free cash flow of the business improves each quarter."

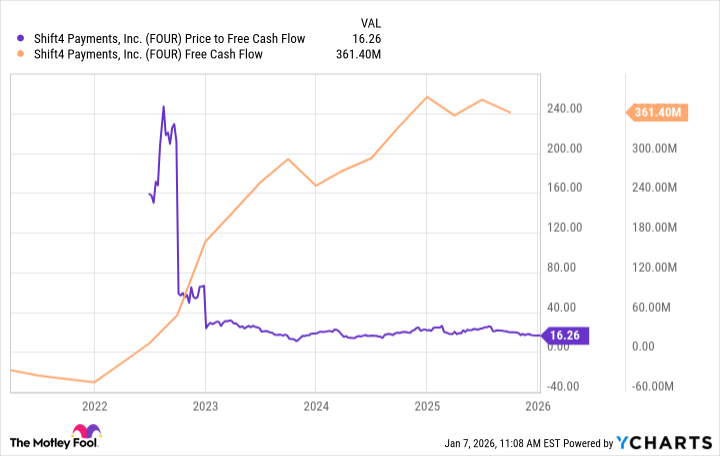

FOUR Price to Free Cash Flow; data by YCharts.

As the chart above shows, Shift4 has made consistent progress with its free cash flow, now generating more than $350 million annually. But its stock price has stagnated, meaning it now trades at a cheap price-to-free-cash-flow valuation of 16.

Why investors soured here

As of this writing, Shift4 stock is down 6% during the past five years, even though the S&P 500 is up 85% -- ouch! That's not what one would expect from a high-growth business.

NYSE: FOUR

Key Data Points

Investors have soured on the stock for a couple of reasons. First, they are concerned about the sector as a whole. Competition is fierce, making it difficult to achieve long-term competitive advantages. And the sector is facing disruption from cryptocurrency, a risk now made more acute with crypto-friendly legislators in office.

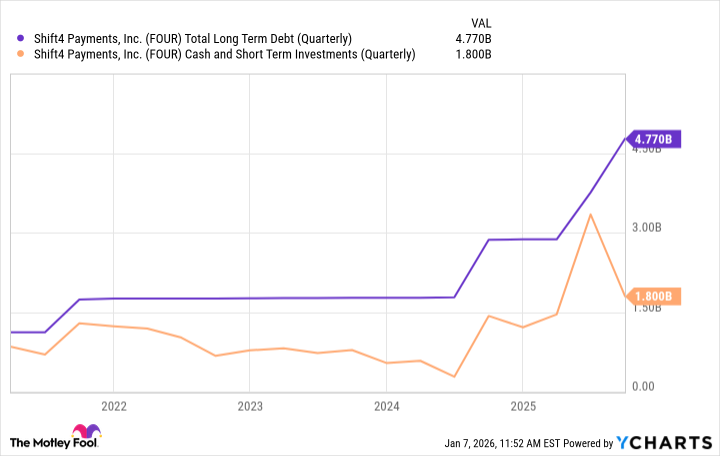

Second, Shift4 makes big acquisitions, leading to higher debt. In 2025, it acquired Global Blue, which handles tax refunds for overseas purchases, for $2.5 billion, a huge transaction considering the company's own market cap is less than $6 billion.

The end result is that its debt has increased significantly in recent years. And the company has a high level of debt compared to cash, as the chart below shows.

FOUR Total Long Term Debt (Quarterly); data by YCharts.

In no way is Shift4 in imminent danger, but its higher debt levels are concerning.

Why Shift4 stock could have big upside

Investors may be concerned with Shift4's debt, but management isn't. If it were concerned, it would likely focus some of that cash flow on reducing debt as quickly as possible. But management seems to be looking elsewhere.

At the end of the third quarter, management approved a $1 billion stock buyback program, and it's likely looking to make some big purchases quickly. On the quarterly earnings call, Lauber said he was "incredibly excited to be able to deploy capital into such an obvious opportunity."

In other words, Shift4 is authorized to reduce its share count by nearly 20%, and management may do so in short order. This signals that management is confident in the strength of its business and the sustainability of its debt.

However, the company is also likely confident that its stock price won't stay cheap for long. Right now, it is aiming for an adjusted free cash flow annual run rate of $1 billion by the end of 2027. This would signal free cash flow of at least $250 million in the fourth quarter of 2027.

Assuming Shift4 is on this path, its adjusted free cash flow would roughly double before the end of 2028. The valuation is already cheap. If it stays as cheap as it is now, the stock would double by 2028 as well. Aggressive share repurchases would only further boost its potential.

Shift4 stock was thrown out with the bathwater in 2025. But I doubt it will underperform for much longer as 2026 gets rolling.