Oklo (OKLO 7.46%) was a market darling of 2025. And, so far, the stock's incredible run has extended into the new year. As of Jan. 8, the stock is up almost 30% year to date, with a year-over-year gain of about 265%. For those who have watched this nuclear stock skyrocket from the sidelines, the question naturally becomes: Is it too late? Has all the good news been baked into the price?

NYSE: OKLO

Key Data Points

Oklo's 200% run: Room for more, or time to cool?

Oklo is an advanced nuclear start-up aiming to develop small fast-spectrum reactors with complementary fuel recycling capabilities. Oklo plans to own and operate these powerhouses. It would sell the electricity they generate to customers under long-term power purchase agreements (PPAs), which would provide it with recurring revenue.

Image source: Oklo.

In addition to power generation, Oklo is expanding into radioisotope production. Oklo recently signed an agreement with the Department of Energy to support the build-out of a radioisotope pilot facility through Oklo's Atomic Alchemy subsidiary.

That said, Oklo has not secured a design license from the Nuclear Regulatory Commission (NRC), nor has it built or operated a full-scale Aurora powerhouse yet. And while it's been progressing through the NRC's process, there's always the risk that its reactors won't deliver as expected in the real world.

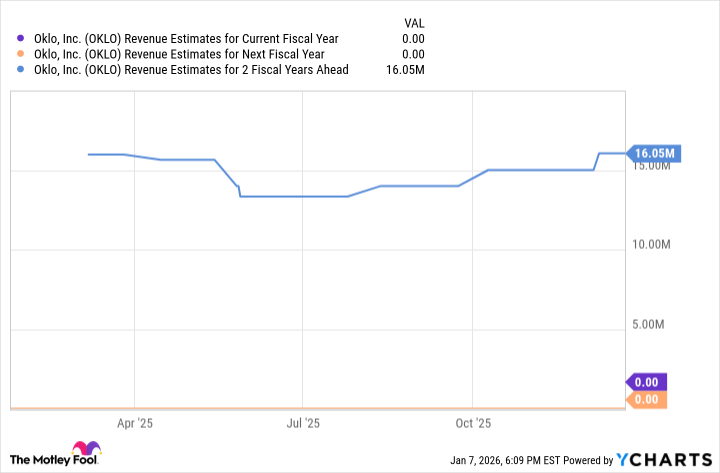

Valuation-wise, the stock looks pricey. It has a market cap of about $15 billion, despite generating no revenue today. Even with its radioisotopic arm underway, it could take several years before significant sales are made.

OKLO Revenue Estimates for Current Fiscal Year data by YCharts

Whether it's too late to buy the stock depends on how long you're willing to stay invested. For the near term, durable upside could be limited by the unproven fundamentals of Oklo's business. Zoom out five or 10 years, however, and the company -- assuming it gets NRC approval -- could still have plenty upside ahead.

For cautious investors who believe a lot of good news is already baked into Oklo's price, a nuclear energy exchange-traded fund (ETF) could be another way to gain exposure to this growing industry.