The artificial intelligence (AI) revolution has transformed companies in just about every major sector of the economy. In the technology industry, no company has benefited more from the rise of AI than Nvidia (NVDA 0.28%).

What was once a niche semiconductor business designing parallel processors to enhance video game graphics has become the backbone hardware provider for generative AI workloads. Over the last three years, Nvidia's market value has gone parabolic -- increasing from about $350 billion when ChatGPT was launched to $4.5 trillion today, making it the most valuable company in the world.

While Nvidia remains king of the AI chip realm, some on Wall Street are leery about the prospects that it will be able to keep its rally going. Rising competition for its graphics processing units (GPUs) has some investors worried that its sales growth could be about to plateau.

According to Wall Street, however, Broadcom (AVGO +1.30%) might now be the best AI chip stock on the market. Among the 48 sell-side analysts who cover Broadcom, 46 of them have a rating of buy or equivalent on the stock. Only two rate it a hold, and zero think now is the time to sell. So what's driving this near-unanimous bullish outlook on Broadcom?

NASDAQ: AVGO

Key Data Points

Why does Wall Street love Broadcom so much?

When investors hear about the increasing levels of capital expenditures going into AI infrastructure, it's natural that many would think Nvidia and Advanced Micro Devices will be the biggest beneficiaries of that spending.

Indeed, the GPU vendors have benefited -- and will continue to benefit -- from accelerating data center buildouts featuring ever-larger chip clusters. Behind the scenes, however, Broadcom may be more optimally positioned than its chip counterparts.

As the power required to train and inference ever more complex AI models rises and as the workloads involved scale, Broadcom stands to win whether these clusters are powered by Nvidia's Blackwell and Rubin GPU architectures, AMD's MI300 accelerators, or the custom silicon designs of cloud hyperscalers like Amazon Web Services, Microsoft Azure, or Google Cloud Platform.

In other words, Broadcom is not a cyclical semiconductor business. Instead, the company is more of a royalty play on broader AI infrastructure spending patterns -- witnessing incremental demand for each dollar spent on new GPU architecture releases and chip upgrade cycles.

Against this backdrop, Broadcom should be seen as a pick-and-shovel player fueling the AI infrastructure era thanks to its dense lineup of networking tools, including switches and interconnects, as well as its role in helping design custom application-specific integrated circuits (ASICs) for hyperscalers such as Alphabet, Meta Platforms, ByteDance, and OpenAI.

Image source: Getty Images.

Should you buy the dip in Broadcom stock?

Since Broadcom reported its fiscal fourth-quarter earnings on Dec. 11, its shares have retreated by roughly 13%. I do not see this as a reason for investors to run for the hills.

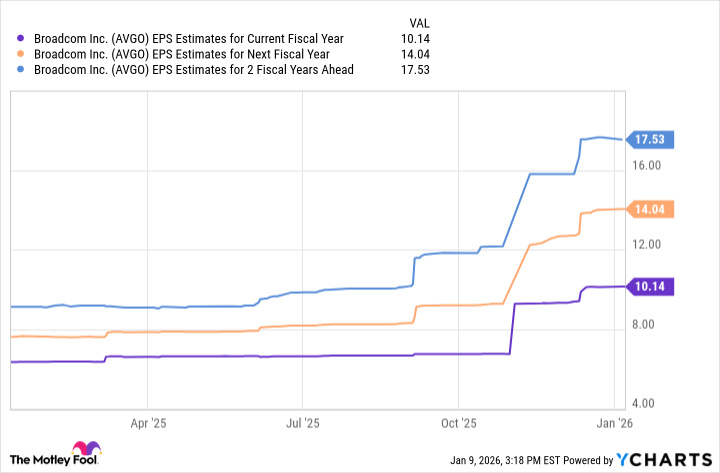

While Broadcom's forward price-to-earnings (P/E) multiple of 34 may appear expensive at first glance, there's more to uncover.

AVGO EPS Estimates for Current Fiscal Year data by YCharts.

While the stock has dropped in the past month, Wall Street's expectations have not. According to consensus estimates, Broadcom is expected to consistently grow its earnings per share (EPS) over the next two fiscal years. By fiscal 2028, Wall Street is forecasting Broadcom's EPS to rise by nearly 70% compared to fiscal 2026's expectations.

Should Broadcom meet or exceed those forecasts, investor sentiment should shift to the upside. If its forward P/E were to return to its peak levels in the mid-50s, the stock could be headed well north of $900 (based on 2028 EPS estimates).

Here's the big picture: Broadcom's sell-off wasn't a warning that growth is plateauing or that demand for AI infrastructure is decelerating. What's happening is quite the opposite, and Wall Street's optimistic outlook reflects these dynamics.

Over the next couple of years, I think Broadcom will experience a meaningful valuation expansion, making now an opportune time to buy the dip and prepare to hold the stock for the long run.